2024 a year of recovery for PH real estate

The Philippine real estate industry remains volatile and the slower-than-expected recovery can be attributed to three main factors: the lingering impact of the pandemic on commercial office, retail and residential markets; the higher-for-longer inflation and interest rates and the continuing geopolitical conflicts in Ukraine and the Middle East that have resulted in global uncertainties that have impacted global economic recovery.

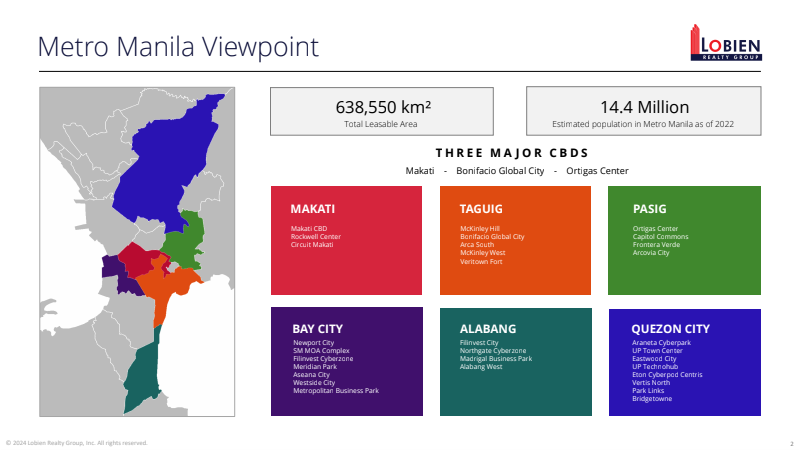

The pandemic has opened mixed and work-from-home arrangements that have affected office space demand and commercial and residential take up in Metro Manila.

Office vacancies

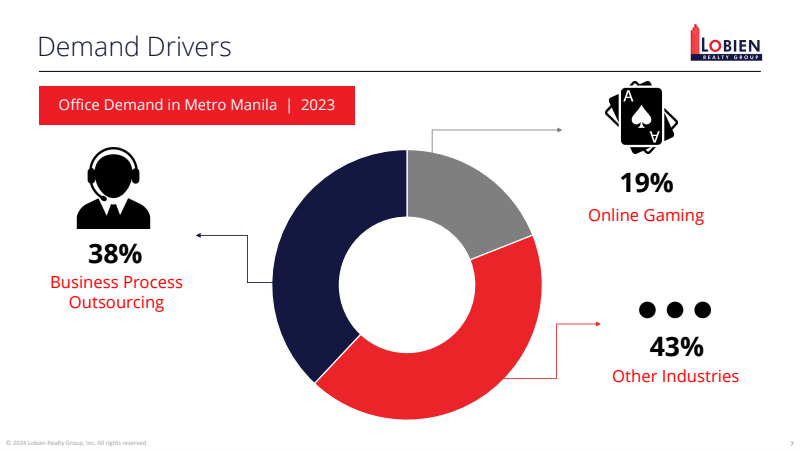

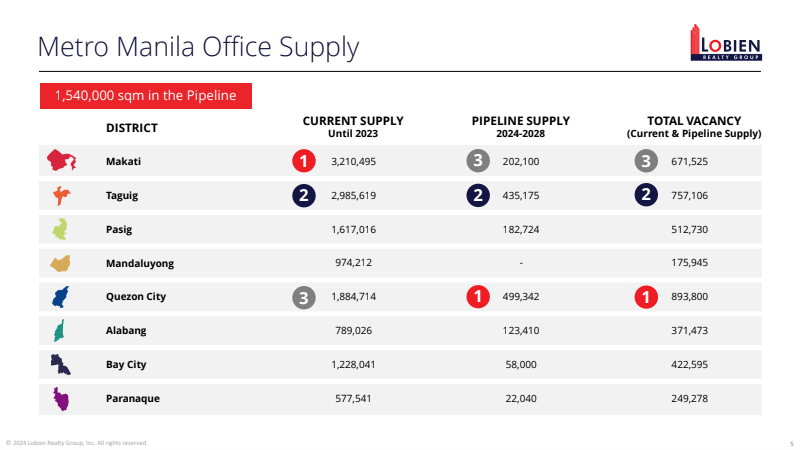

Office vacancy rates had inched higher to 20 percent in Q1 2024, although leased rates have significantly improved year-on-year for the same period—25 percent in Q1 2024 versus 4 percent in Q1 2023. The increase can be attributed to new supply in the market, pushing total available supply to 660,000 sqm versus 360,000 sqm in the same period last year.

However, average rent has remained at P1,100 per sqm level, which underscores the resiliency of the market even in the face of muted demand.

Provincial office markets have a higher vacancy rate at 28 percent, with total available supply of 230,000 sqm, while average rent being maintained at P600 per sqm level.

The high vacancy rates have also affected the retail and residential sectors, particularly the condominium units, as shown by a -14.5 percent decrease quarter-on-quarter and -0.3 percent year-on-year, based on the Bangko Sentral ng Pilipinas (BSP) Residential Real Estate Prices Index as of Q4 2023.

However, single detached/attached houses and townhouses grew in NCR and in the provinces (except for duplex, which registered a correction in Q4 2023), which bodes well for the residential sector.

Impact of inflation

Although the 2024 year-to-date inflation of 3.1 percent is well within the 2 to 4 percent government target, the continuing impact of El Niño has affected supply-demand imbalances of rice, which can have a negative impact on inflation for the rest of the year.

This, in turn, will have an impact on interest rates, which directly impact the real estate industry as well. At the moment, the BSP has maintained a more prudent monetary policy stance by keeping interest rates high, retaining key policy rate at 6.5 percent. For comparison, policy rate was at 4 percent in 2019 (pre-pandemic).

Finally, the ongoing geopolitical conflicts in Ukraine and the Middle East will create some issues in the supply chain, which will also impact inflation and, consequently, interest rates.

Hence, overall, the headwinds for the country’s real estate industry remain.

Good year ahead

However, economically, the Philippines is poised for another good year, with 2024 GDP growth being pegged at 5.8 percent by the World Bank, the fastest in Southeast Asia.

International tourist arrivals hit 5.4 million in 2023 and the number is expected to reach pre-pandemic levels of 8 million in 2024, resulting in P700 billion in tourism receipts. Remittances by overseas Filipino workers (OFW) also hit an all-time high in 2023 at $37.2 billion, growing 3 percent from 2022, and a modest growth is again expected in 2024. These tailwinds are expected to help the country’s real estate market.

Bright spots in real estate

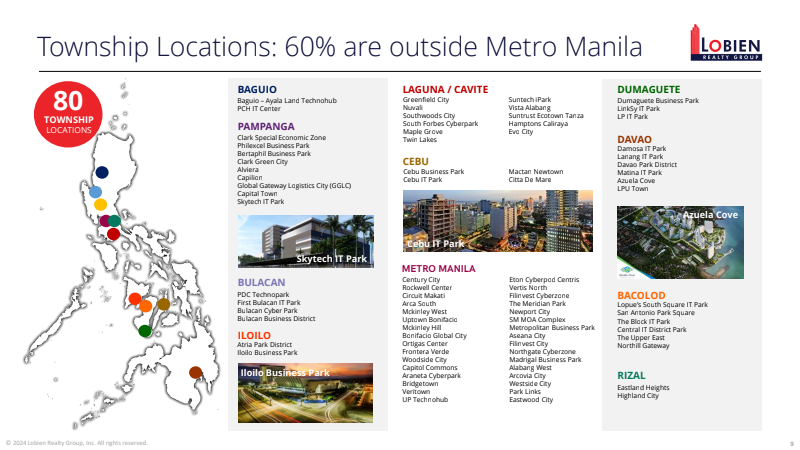

Also, one of the bright spots in the real estate industry is the continuing build-up of townships or mixed-use developments, where 40 percent of these developments are in Metro Manila and 60 percent in the provinces.

Townships, especially those outside Metro Manila, are expected to counter the mixed/work-from-home office arrangements as employees can now report to their offices located at a convenient distance with no issues on traffic and additional costs.

Further, townships are expected to sustain retail and residential demand due to the structural arrangement of a masterplanned community that combines office, leisure, retail and even academic places, which are all intended to benefit the locators. The issue of labor supply for business process outsourcing (BPO) companies is also addressed by townships that are in the provinces.

Sustainable locations

Major developers have likewise identified several key areas outside Metro Manila where such township developments can be sustainable, such as Cebu, Clark, Bacolod and Davao.

Alviera in Porac, Pampanga deserves additional mention as it is not in the next wave areas identified by the BPO industry but poses a lot of promise because of its proximity to Clark. Plus, Ayala Land is known to have a high success rate in township developments.

We expect the trend of building sustainable and dynamic townships outside Metro Manila by major developers to continue as a response to the postpandemic office and labor challenges.

In conclusion, despite the postpandemic work-related changes, economic headwinds and geo-political shocks, the Philippine real estate industry is poised to post another year of recovery in 2024.

The author is the chief executive officer of Lobien Realty Group Inc., a full service real estate consultancy and property investments strategy firm.