99-Year Land Lease Law promises stability for foreign investors in PH real estate

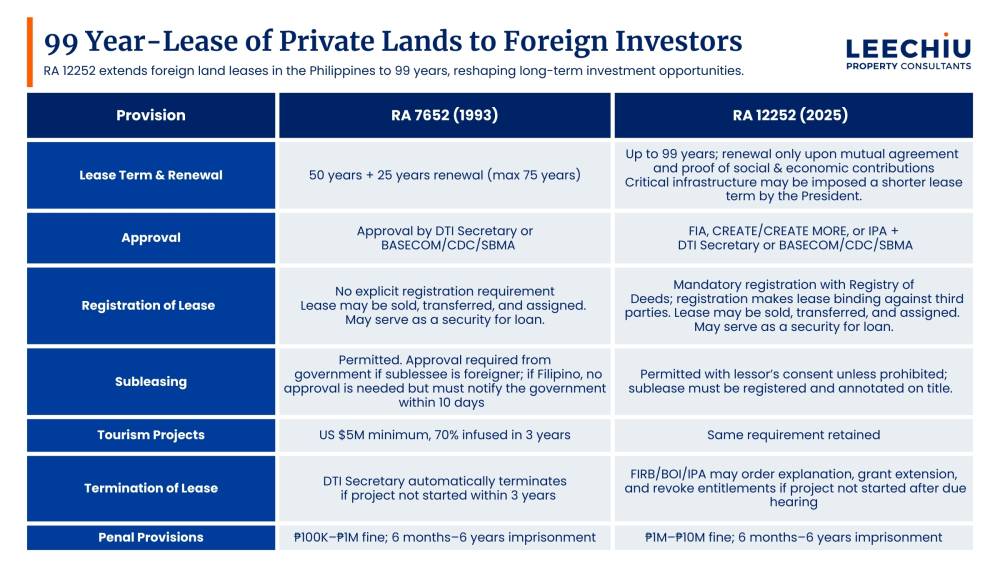

The Philippines has historically been one of Asia’s more restrictive real estate markets for foreigners, limiting ownership to condominiums and capping land leases at 50 years, with a single 25-year renewal.

Now, a pivotal change signals a more welcoming future for foreign capital.

With the signing of Republic Act No. 12252 on September 3, foreign investors may now lease land in the Philippines for a straight 99-year term–a foundational reform expected to transform the country’s property and investment landscape.

A competitive edge

Short lease horizons have long been a major roadblock for foreign investors.

Large-scale developments often take decades to plan, build, and recoup investments, but the previous 50+25 framework constrained timelines and discouraged capital inflows due to the critical flaw of uncertainty associated with the ambiguous 25-year renewal.

By extending leases to 99 years, the Philippines now offers investors a near-freehold level of security. This stability increases the confidence of lenders and banks, making backers more willing to finance large-scale projects.

Critically, it turns what was once seen as a simple leasehold into a bankable, collateralizable asset, unlocking project financing that was previously difficult to access.

This balance avoids the risks of outright foreign land ownership, which could drive up prices and make properties less affordable for locals, while still giving institutional investors the stability needed for long-term commitments.

Unlocking tourism, township projects

Tourism is one of the sectors poised to benefit most.

In January 2025, international tourism receipts surged 71 percent year-on-year to $1.1 billion, highlighting the sector’s strong recovery. Analysts project that tourism could account for as much as 20 percent of the country’s gross domestic product (GDP) in the coming years, provided there is sustained investment in large-scale resorts and hospitality estates.

With 99-year leases, foreign developers now have the long-term security to build investment-grade hospitality assets that can span generations.

Townships and mixed-use developments also stand to gain. These projects often require long gestation periods and extensive infrastructure, which were difficult to justify under shorter lease terms.

The reform now opens the door for global developers to commit to projects that integrate residential, commercial, and recreational spaces on a scale previously seen only in freehold developments.

Industrial and infrastructure potential

The new lease law could also accelerate investment in industrial parks, logistics hubs, and digital infrastructure.

Data centers, airports, and large-scale transport facilities demand heavy upfront capital and decades-long operating horizons. By extending lease periods, the Philippines provides the certainty needed for foreign developers to secure financing and pursue projects critical to national competitiveness.

Regional comparison

The reform is a competitive necessity to place the Philippines on par with regional peers. Singapore, Hong Kong, and the Maldives already offer 99-year leases, helping them attract global giants such as Blackstone and CapitaLand.

Despite its strong market fundamentals–a population of 116.7 million people and a median age of just 26–the Philippines has historically struggled to compete for the same tier of long-term institutional capital.

This policy change is a strategic and timely move to address this gap. While overall net foreign direct investments (FDIs) into the country has recently seen a decline, the real estate sector has remained a key draw for capital, attracting P10.79 billion in approved foreign investments in the first quarter of 2025 alone.

The extended leasehold is designed to leverage this proven appeal, positioning the Philippines to finally capture the large-scale, long-term investments enjoyed by its regional peers.

A win-win arrangement

Supporters of the measure describe it as a “win-win.”

Foreign investors gain the time and security to execute their vision and recover investments, while Filipino landowners retain ultimate freehold ownership, allowing them to monetize their land via long-term partnerships without relinquishing their core asset.

Once reverted, properties can be redeveloped, re-leased, or integrated into new projects, ensuring long-term benefits for both sides.

A step toward competitiveness

By extending lease terms, the Philippines is signaling a stronger commitment to compete for global capital. The law is expected to attract deeper investments in tourism, real estate, and infrastructure—projects that generate jobs, transfer knowledge, and build lasting value.

For investors, it opens the door to bigger and bolder projects. For Filipinos, it promises growth anchored in long-term partnerships, with land ownership ultimately preserved.

The author is manager of Investment Sales at Leechiu Property Consultants