A ‘fast and furious rally’ in PH real estate seen in the next several years

The Philippine real estate industry is well-positioned to gather more momentum for further recovery in 2025.

The country’s gross domestic product (GDP) in the first quarter of the year stood at 5.4 percent, while inflation cooled to 2.2 percent, which is in the lower end of Bangko Sentral ng Pilipinas’ (BSP) target inflation band of 2 to 4 percent.

And as of June 2025, the policy interest rate was reduced by 50 basis points, to 5.25 percent from 5.75 percent at the start of the year. Another reduction is expected this year due to low inflation and further economic growth.

Resilient office space market

Right before the pandemic, GDP growth averaged 5.957 percent from 2009 to 2019, while average policy interest rate was 3.775 percent.

During this period, the office space market registered significant growth, with rental rates doubling to P1,160 per sqm in 2019 from P503 per sqm in 2009. The vacancy rate was also at an optimum of 5.5 percent.

From 2020 to 2024 however, average GDP growth halved to 2.998 percent, policy interest rate increased to 4.35 percent, and vacancy rate tripled to 15.3 percent. Rental rates have also decreased by 18 percent to P950 per sqm.

The slower-than-expected recovery can be attributed to a challenging environment caused by the lingering effects of the pandemic on the economy and the physical work setup; unstable global growth; uncertainty in trade policy, particularly the impact of the United States’ reciprocal tariffs; geopolitical tensions in Asia and Middle East; and the full exit of Philippine offshore gaming operators (POGOs), which left more than 1.5 million sqm of office spaces vacant based on Lobien Realty Group’s estimates.

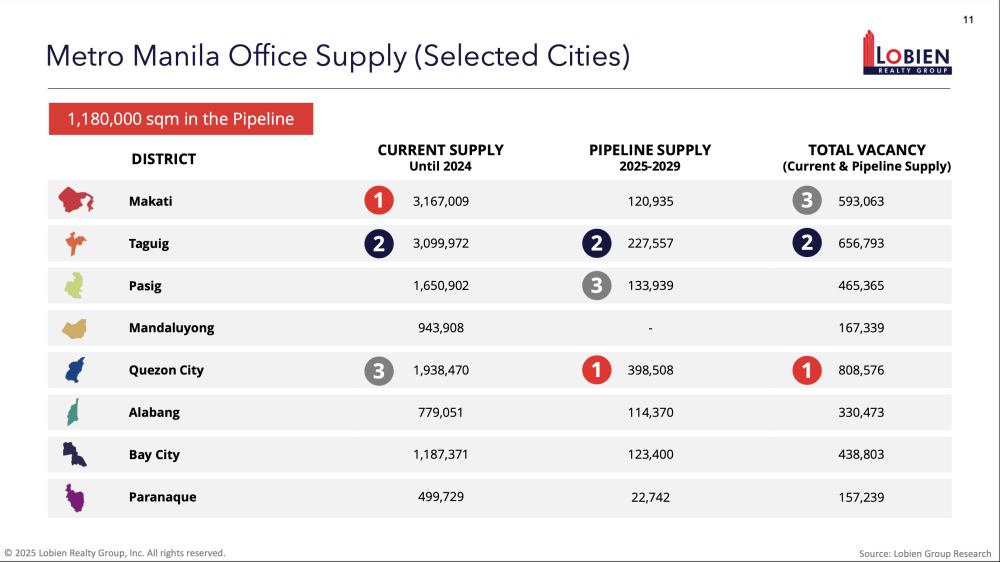

Currently, landlords have significantly cut the pipeline supply, except in key central business districts such as Makati, Bonifacio Global City, Pasig, and Quezon City, totaling 880,000 sqm for the next five years.

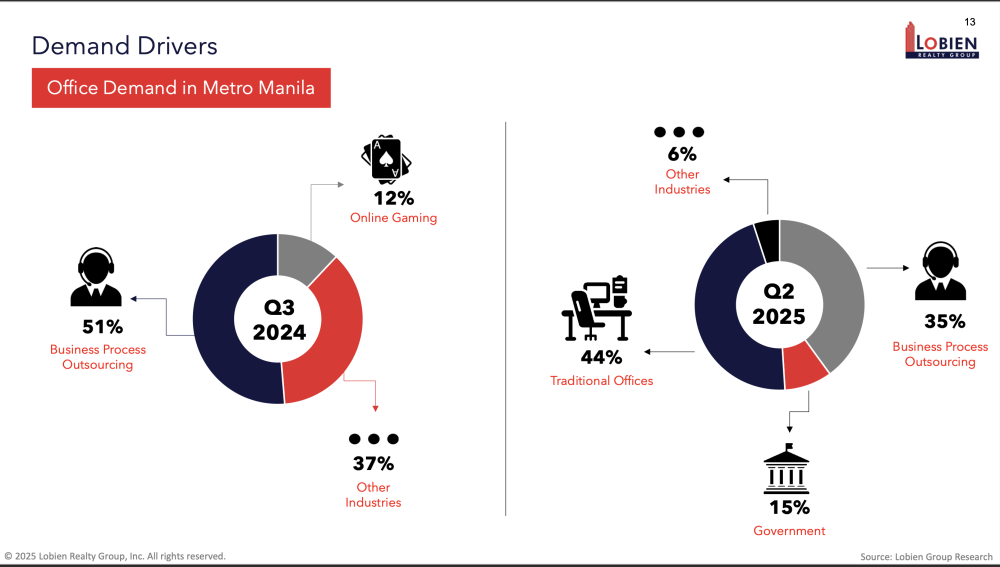

The resiliency in the office market can be attributed to the durability of the IT-BPM industry, which had been adding more than 100,000 FTEs annually, even during the pandemic. It is well-positioned to hit 2.3 million FTEs by end of 2028, which translates to an additional office requirement of 2 million sqm.

Flexible offices or co-working spaces continue to grow and are currently occupying 300,000 sqm. Government agencies have become one of the major drivers of office demand, generating 15 percent of the annual demand.

Residential market

In the residential market, buyers and investors see major opportunities despite the high interest environment.

The BSP reported that, as of Q1 2025, residential prices grew 7.6 percent YOY, led by the 10.6 percent growth in condominium prices. In terms of location, residential loans are mostly granted in Calabarzon, NCR and Central Luzon.

In the condominium market, a logical adjustment to demand is already evident, as shown by the marked decrease in new supply in the NCR. This is due to the existing stock of over 160,000 condominium units.

Developers have also focused their activities on overseas Filipino workers (OFWs), whose remittances have been growing steadily at 3 percent a year to $38.3 billion in 2024. International road shows are being done in the United States (which accounts for 40.6 percent of the total OFW remittances), United Kingdom, and the United Arab Emirates.

Townships and provincial offices

Townships are concentrated in the NCR (40 percent) but are also strategically developed in growth corridors like Pampanga, Laguna, Cavite, Cebu, and Davao. Townships are key to creating critical mass for the residential, office and commercial space sub-markets.

Provincial office space vacancy rate remains elevated at 30 percent and year-on-year figures remain the same in terms of leased rates (7 percent) and average rent (at around P550 per sqm).

Some softening in rental rates can be expected to aggressively push excess supply, especially in Cebu, Iloilo, and Pampanga. Key infrastructure developments, especially those connected to the Luzon Spine Expressway Network, are expected to further spur the growth of township developments.

Industrial as a bright spot

The industrial market has been a bright spot in Philippine real estate, and is expected to have a compound annual growth rate of 5.42 percent over the next decade. This is underpinned by strong e-commerce growth, increase in foreign direct investments, infrastructure projects, and urbanization trends.

Continued expansion of warehousing activities in Calabarzon, Central Luzon, Central Visayas and Davao is expected.

Key takeaway

Amid a challenging environment, it has been observed that the real estate industry behaves in a cyclical manner and a contraction usually follows an expansionary and hyper-growth phase (2009 to 2019).

Currently, the country’s real estate market is in a recovery phase, and considering the positive economic indicators, especially the impending reductions in benchmark interest rates, we can expect a fast and furious rally in the next several years.

The author is the chief executive officer of Lobien Realty Group