A race to innovate and differentiate

Developing masterplanned communities has become a vital part of property firms’ development strategy.

The lack of masterplanning in Metro Manila compelled many of them to take the lead in establishing integrated communities.

However, the massive developments in the past couple of decades have resulted in a scarcity of developable land, prompting property firms to look at other viable growth corridors that have solid consumer base with constantly rising purchasing power.

Among the regions preferred by developers is the Cavite-Laguna-Batangas (Calaba) corridor. This area is part of the Southern Tagalog Region, which expanded by 7.8 percent in 2022, faster than the national economic growth of 7.6 percent.

Home to some of the biggest industrial locators in the country, this region has been getting support from the completion of crucial infrastructure including the Metro Manila subway, NLEx-SLEx Connector Road, LRT-1 Cavite extension, Cavite-Laguna Expressway (Calax), among others.

These public projects are essential in promoting Southern Luzon’s attractiveness for property projects, including well-designed masterplanned communities.

Strategic land-banking

Property firms continue to aggressively pursue land banking and develop more masterplanned communities outside Metro Manila, due not only to the scarcity of developable land, but also to improved infrastructure connectivity and the growing appetite for condominium projects and office towers outside the capital.

Property firms can command premium pricing for residential projects in masterplanned projects while office developers are able to capture demand from emerging outsourcing destinations outside Metro Manila.

In our view, the government’s plan to allocate about 5 to 6 percent of the country’s economic output on infrastructure will do wonders for the Philippine property sector. The Calaba corridor will hugely benefit as several big-ticket public projects are due to be completed in the next three to six years.

More vertical projects in the south

Colliers is seeing the development of more condominium projects in the South, especially Cavite and Laguna.

In our view Cavite will become more viable for more vertical residential projects, with the rising affluence of its residents, influx of more foreign investors, as well as aggressive development of more property firms trying to capture the rising interest from residential and commercial locators.

Preference for integrated communities

At Colliers Philippines, we pose survey questions to our webinar participants. During these quarterly briefings, we would get between 300 and 400 respondents from the property sector. Our respondents include property analysts, brokers, investors, end-users, and other property stakeholders.

What’s interesting is that our respondents’ responses reflected the growing demand for masterplanned projects. This only means that the appetite for integrated communities, townships or estates is here to stay. But just like other property segments, property firms need to innovate and renovate with their offerings to stand out in a fiercely competitive Philippine market.

Proximity is key

In another Colliers survey we asked our respondents for their topmost consideration when buying a condominium unit in a central business district (CBD).

About 62 percent of respondents chose proximity to offices, malls, and other amenities as their chief consideration—highlighting the growing preference for convenience and accessibility.

Meanwhile, 16 percent chose the live-work-play-shop lifestyle, 13 percent prioritized design and layout, and 8 percent considered availability of dedicated workstations as well as flexible and open spaces.

Colliers recommends that developers continue highlighting the advantages of living within business districts and integrated communities, and to consider improving amenities and facilities in their projects to meet constantly changing buyer preferences.

Green and sustainable features

In another poll, we asked respondents about the importance of green and sustainable features when purchasing a residential unit.

More than 90 percent of our respondents believe that such features are important, but to varying degrees. Forty percent believe that sustainable features are important but are not a deciding factor, while 17 percent said these are critical and must be present. Forty one percent believe that sustainable features are nice to have but not a requirement.

Colliers believes that the popularity of sustainable features is indicative of shifts in buyers’ preferences.

In our view, more developers should continue integrating these features into their developments to gradually capture investor and end-user demand, and to differentiate their projects in the market. These include natural lighting, optimized air quality, and rainwater catchment facilities.

We also encourage developers to adopt sustainable features with the inclusion of open green spaces such as vertical gardens in their upcoming projects.

Developers may also explore green building certifications such as Leadership in Energy and Environmental Design (LEED) or Building for Ecologically Responsive Design Excellence (Berde) for their projects.

Colliers believes that adopting green and sustainable features will play a crucial role in future-proofing residential projects under a newer and better normal.

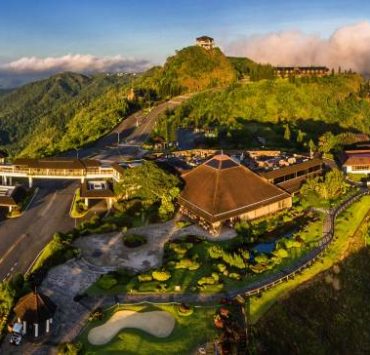

Golf communities as crucial differentiators

Colliers has been seeing an aggressive push from developers to differentiate.

Some are integrating active lifestyle amenities while others are offering large conference halls and retail centers.

As developers want to stand out, we see further differentiation in the market. Hence, we see the offering of golf courses within or near residential enclaves.

Colliers believes that this is a differentiator that captures interest from businessmen and golf enthusiasts. Residential communities near or within golf communities also benefit from the price appreciation potential brought by these amenities.

Sustained demand

The demand for live-work-play-shop concept is definitely here to stay. End-users and investors will continue to look for convenience and this preference will only the drive demand for integrated communities across the Philippines especially in key growth areas outside the capital including the Cavite-Laguna-Batangas economic corridor.

As property firms scramble to corner the pent up demand for townships, expect more aggressive and proactive differentiation and innovation from Philippine property firms moving forward.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.