Achieving your dream home with Pag-IBIG

Owning a home is everybody’s dream and life goal. It offers security and stability unlike anything, yet it comes with great responsibility and planning. With the right information, mindset, and discipline, your dream home can soon be yours.

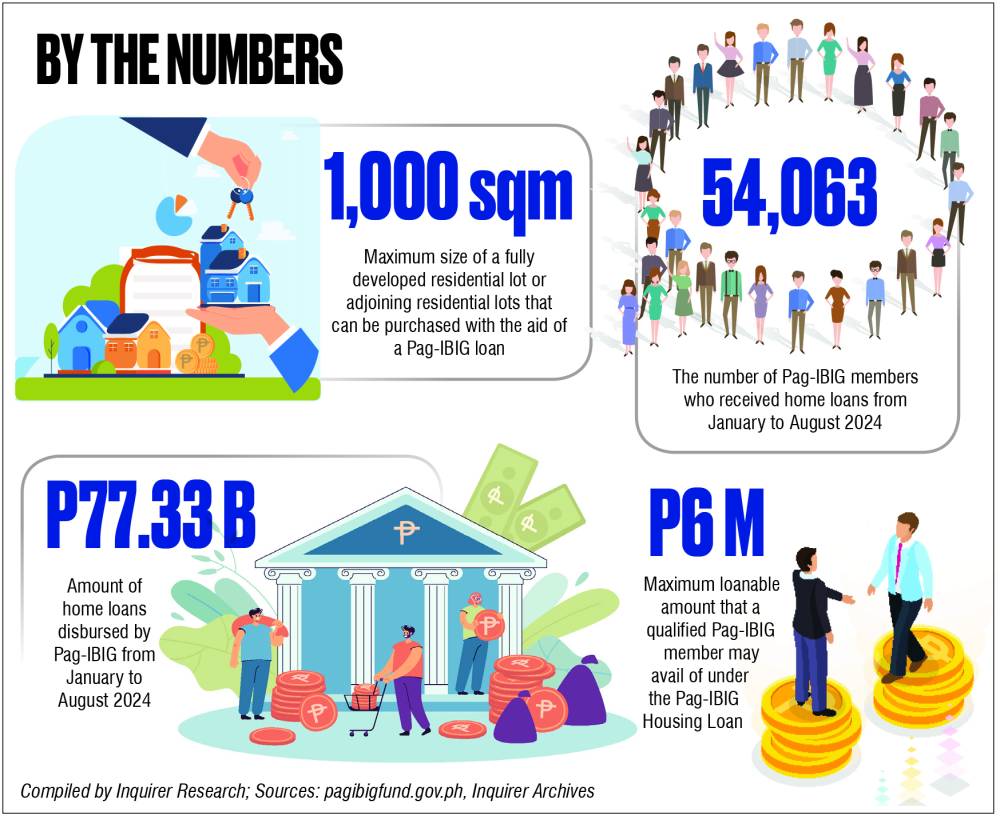

One of the major steps to achieving this dream is to plan your budget. Fortunately, Pag-IBIG Fund Housing Loan allows you to borrow up to P6 million with low rates and friendly terms.

Pag-IBIG Housing Loan

What can you do with a Pag-IBIG Housing Loan? You may use the loan to purchase any or a combination of the following: a fully developed residential lot or adjoining residential lots not exceeding 1,000 sqm, a residential house and lot, a townhouse, or a condominium unit (pre-owned or brand-new, mortgaged with Pag-IBIG Fund, or adjoining).

It can also be used to finance home improvements, construction or completion of a residential unit or lot owned by the borrower or a relative of the borrower; or refinance an existing house loan, subject to terms.

Eligibility

Before proceeding with the application process, ensure that you are an active member of Pag-IBIG with at least 24 months worth of savings (lump sum payment is allowed); not older than 65 years old at the date of loan application; not older than 70 years old at the date of loan maturity; have legal capacity to acquire and encumber real property; and have no Pag-IBIG housing loan foreclosed, canceled, bought back, or voluntarily surrendered.

Additionally, you must have a satisfactory background, credit and employment, and business checks. If you have an existing Pag-IBIG Housing account or short-term loan (STL), you need to make sure that your payments are up to date.

Requirements

If eligible, you may start preparing the following requirements including two copies of the application form with recent ID photo of borrower or co-borrower; proof of income (either for locally employed, self-employed, or overseas workers); photocopy of valid ID (back to back) of principal borrower and spouse; certified true copy of the latest Transfer Certificate of Title; photocopy of updated Tax Declaration (house and lot) and Real Estate Tax Receipt; and vicinity map or sketch map leading to the property subject of the loan.

These documents may be submitted to any Pag-IBIG Housing Business Center or Pag-IBIG Fund branch near you. You can also opt to process your application via Virtual Pag-IBIG.

The amount of loan that may be given to applicants will be based on the borrower’s actual needs and capacity to pay, among others.

Post approval requirements

Once submitted and approved, you will receive your Notice of Approval and Letter of Guarantee. You will be given 90 calendar days to complete and satisfy the requirements stated in your Notice of Approval. This includes, among others, the transfer of title and annotation of mortgage.

Upon submission of the post-approval requirements, you can expect to receive the proceeds of your loans within 10 working days. Pag-IBIG will coordinate with you on how your loan shall be released safely and conveniently.

Pay your loan

After successfully applying for and receiving your housing loan, you can start paying it exactly one month after its release date. You may do this via Virtual Pag-IBIG, at any Pag-IBIG Fund branch near you, or through its accredited collection partners or its online payment channels (both for local and overseas remittances).

If employed, you may also pay your loan through a collection servicing arrangement with your employer, who will then remit your monthly payments to Pag-IBIG Fund.

Other convenient payment arrangements include issuance of postdated checks and auto-debit arrangements with a Pag-IBIG Fund partner bank.

Sources: Inquirer Archives, pagibigfund.gov.ph