Back with a vengeance: Mid-income condo market regains dominance

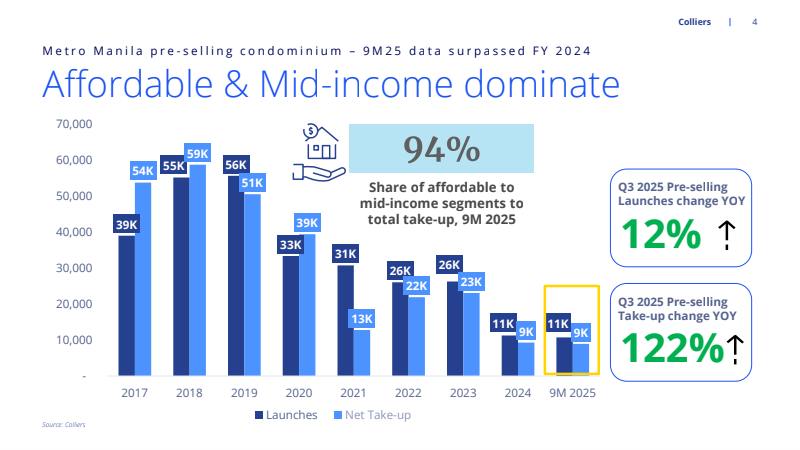

The Metro Manila pre-selling condominium market has pulled a surprise, recording an increase in net take up for two consecutive quarters.

The continued decline in back outs also indicates that the decent net demand in Q2 was not a blip, and that buyers are responding positively to the attractive ready-for-occupancy (RFO) promos and discounts being extended by property firms.

Interestingly, the affordable to mid-income price segments (P2.5 million to P12 million per unit) accounted for more than 90 percent of net take up in the first nine months of 2025.

It’s important to note that this affordable to mid-income sweet spot is starting to rebound as this is the price range that greatly appeals among Filipinos working abroad and local employees. These segments also accounted for about 80 percent of condominium completion in Metro Manila from 2016 to 2024.

Demand is finally catching up with supply.

Opportunities in Metro Manila peripheries

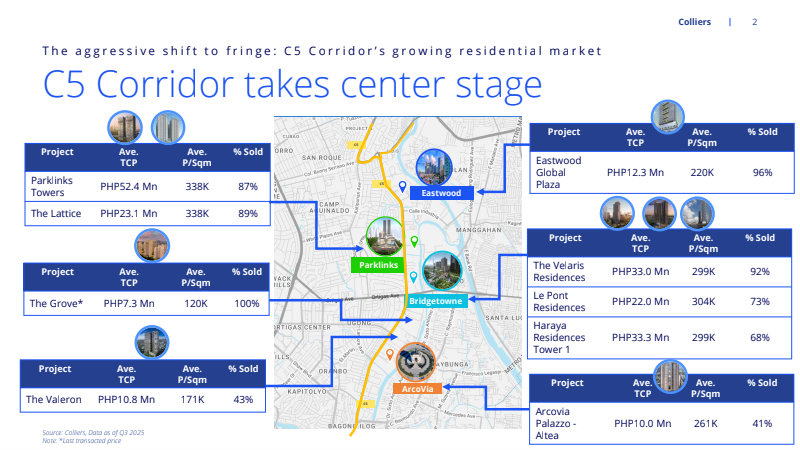

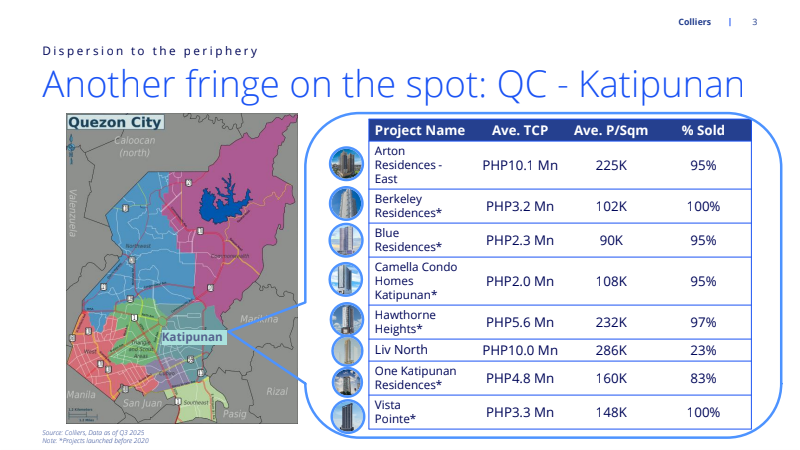

The lack of developable land and soaring prices in central business districts (CBDs) are driving more developers and investors to consider condominium projects in Metro Manila fringe areas.

Results from our Residential Survey showed that respondents are considering to buy condominium units in the fringe areas of Makati, Quezon City, and Pasig.

Colliers’ Q3 2025 data showed that condominium projects in the C5 corridor are doing well, with projects priced from P10 million to P63 million enjoying take-ups of between 40 percent and 100 percent.

Meanwhile, condominium projects in the Katipunan, Quezon City are priced from P2 million to P11 million, with average take-up of 85 percent—an impressive performance amid the stifled demand in certain Metro Manila locations.

Exploration of new sites for horizontal projects

The strong appetite for lot-only units outside the capital region has been enticing more developers to launch horizontal projects in Metro Manila. A couple of national developers have already introduced new lot-only developments in the metro this year.

The challenge for developers now is to look for an ideal location big enough for these lot-only developments, where competitive prices can still be imposed.

RFO promos and discounts

Developers remain aggressive in offering attractive and innovative promos, especially for projects that have substantial unsold RFO stock.

Select developers are offering up to 60 percent discount on total contract prices (TCPs) for spot cash payments as well as free parking slots along with the condominium unit.

One developer allows renters to move in to a fully furnished RFO unit within 90 days upon reservation for only 5 percent spot down payment. Rent-to-own schemes are common in the market, without hefty cash out and enabling the renter to eventually become the owner.

Another property firm allows end-users to lease a unit for up to 36 months. At the end of the lease term, at least 60 percent of the total lease payment will be deducted to the purchase price if the renter decides to buy the unit.

Colliers believes that these promos should be highlighted especially for a client base still wary of elevated mortgage rates and hefty spot cash payments.

The sustainability of these promos will be a concern moving forward, so firms need to come up with offerings that are flexible and innovative.

A much awaited comeback

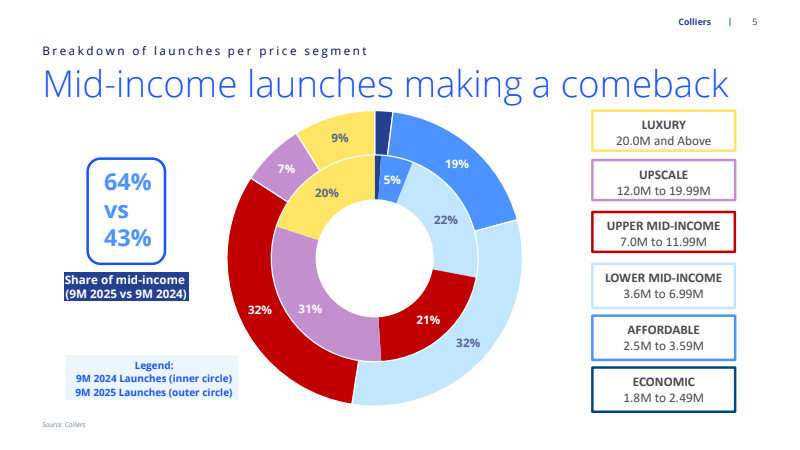

The mid-income segment (P3.6 million to P12 million) dominated total condominium launches in Metro Manila in the first nine months, accounting for nearly two thirds of units launched during the period.

This is in contrast to the trend which we observed last year, wherein upscale to luxury projects (P12 million and above) covered nearly half of condominium launches in the capital region.

Colliers believes that property firms should remain cautious with their new launches and carefully assess the types of mid-income units that continue to perform well in the market. For instance, units near university areas are recording strong take-up as they cater to a niche market.

The mid-income condominium market, which suffered substantially following the exodus of Philippine offshore gaming operators (POGOs), is finally starting to turn a corner.

The strong take-up for mid-income condominium units in the first nine month should significantly help lift the Metro Manila residential market. This impressive data only proves that developers’ RFO promos in Metro Manila are working.

The fourth quarter of each year is traditionally a strong period and this should enable the condominium market to post a strong finish in 2025.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.