Bridging gaps for sustained property growth

The Philippine property market is cyclical in nature. We believe that faster economic growth moving forward will be beneficial for the property market, especially for the residential segment.

Last year, the economy grew 4.4 percent, lower than the government’s target of 5.5 percent to 6.5 percent. Excluding the contraction in 2020 during the pandemic, this is the lowest annual growth since 2011.

Colliers Philippines believes that steady economic expansion is essential for the country to generate decent jobs and ensure growth in individual incomes. Improving workers’ purchasing power is crucial in fueling residential demand.

What’s also important to note is the fact that Filipinos working abroad continue to support residential demand nationwide. As more remittances flow into the Philippines, Colliers is optimistic that the money will be instrumental in fueling residential demand.

Sizable new supply in MM post POGO

For 2026, Colliers Philippines expects the delivery of 13,000 new units in Metro Manila, up 74 percent year-on-year (YOY).

The C5 corridor will likely account for a third of the new units to be turned over during the period. By end 2026, we also expect the Bay Area to outpace Fort Bonifacio as the largest residential hub in Metro Manila.

Colliers projects slower completion beyond 2026, partly due to tempered condominium launches in Metro Manila’s central business districts (CBDs) for the past three to four years. From 2026 to 2028, we project the average annual delivery of 7,000 units, down from the 14,000 yearly average from 2017 to 2019, a period positively influenced by demand from Philippine offshore gaming operators (POGOs).

New premium condos across the metro

For the next 12 to 24 months, Colliers sees the completion of premium residential condominiums under the luxury (P20 million to P100 million) and ultra luxury (P100 million and above) segments.

In 2026, among the luxury projects likely to be turned over include Aurelia Residences in Fort Bonifacio, and Alveo Land’s Parkford Suites in Makati CBD. In 2027, more premium condominiums are expected to be delivered including The Estate Makati and the Fuyu Tower of The Seasons Residences in Fort Bonifacio.

These projects are priced from P27 million to about P160 million per unit, with take-ups ranging between 30 percent and 100 percent. Colliers believes that these premium luxury condominium projects should help redefine the Metro Manila residential market.

The share of luxury to ultra luxury units to total condominium turn over in Metro Manila will increase from 22 percent this year to 62 percent in 2027. This indicates sustained supply and demand for premium projects in Metro Manila beyond 2026.

MM remaining inventory life (RIL) improving

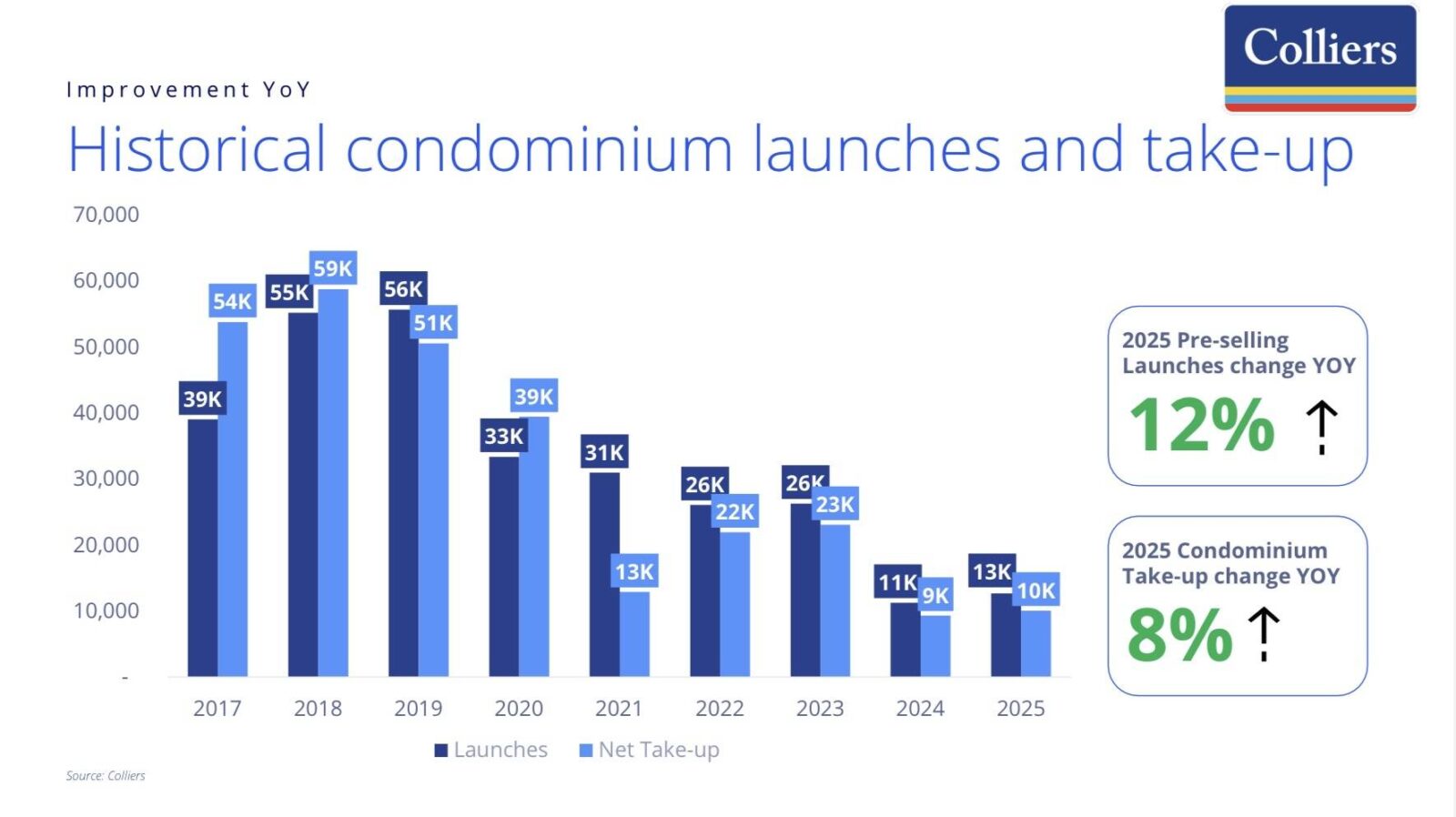

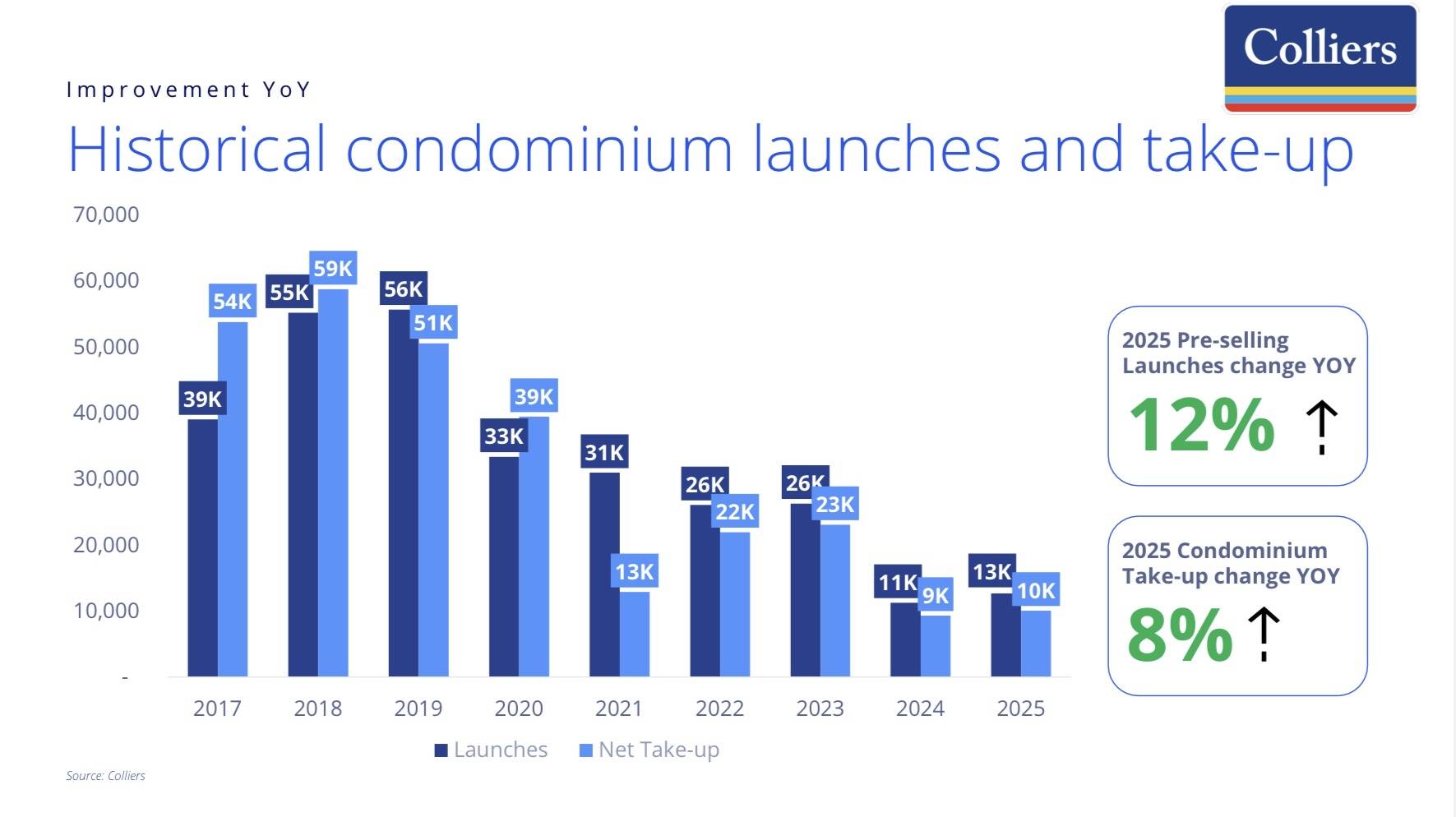

Colliers recorded the launch of 12,700 condominium units in the Metro Manila pre-selling market in 2025, up 12 percent YOY. Meanwhile, net condominium take-up reached 10,100 units in 2025, up 8 percent from 9,300 units a year ago.

Of the 10,100 units sold during the period, about 40 percent are ready-for-occupancy (RFO) units while 60 percent are pre-selling or projects that are still under construction.

Among the locations with the highest RFO take-up include Pasig City, Manila, Cubao–New Manila, Parañaque, and Pioneer. Meanwhile, submarkets such as Manila, Alabang-Las Piñas, Quezon City, Makati fringe, and C5 corridor accounted for majority of pre-selling take-up in 2025.

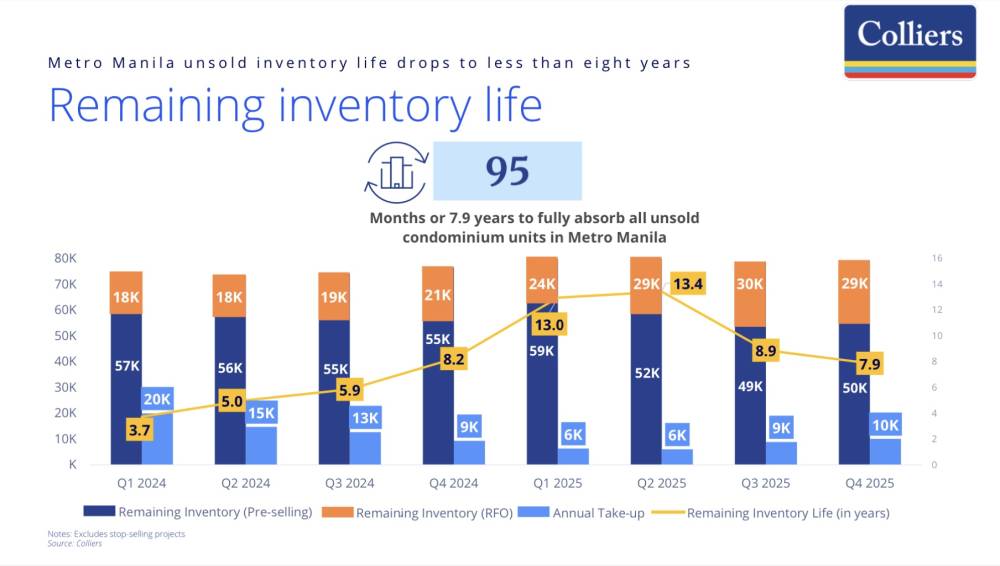

Colliers data showed that as of end Q4 2025, it will take nearly eight years to sell out all condominium units in Metro Manila, an improvement from a peak of 13.4 years recorded in Q2 2025.

We attribute the shorter inventory life to the tempered condominium launches as well as innovative RFO promos extended by developers to their clients. These include hefty discounts for spot cash payments, rent-to-own schemes, extended downpayment terms, and free parking, among others.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.