Cebu property sustains vibrancy

Cebu remains a major option for national players planning to capture demand outside Metro Manila and, at the same time, corner the growing demand for high-end residential projects, condotels and leisure-oriented developments.

In our view, the market for upscale and luxury residential units in Cebu is likely to expand so developers should further assess buyers’ appetite for these units with the right price points and ideal amenities.

Outside of the more established Cebu IT and Cebu Business Parks, we are starting to see greater interest in locations like Mandaue and Mactan. The latter is definitely an enclave for the more expensive leisure-centric developments, while the former is gradually being recognized for its upscale condominium units that are posting strong sales velocities.

Banking on the allure of leisure

In our view, demand for leisure-oriented properties will partly be sustained by the recovery of leisure and travel sector. Aside from local investors, the demand for these residential projects is also likely to come from foreigners.

Colliers believes that Cebu is likely to corner demand for such developments as it is among the most visited in the country and is one of the most viable investment options for affluent buyers looking for options outside Metro Manila.

Given the Department of Tourism’s bullish projections, we are optimistic that greater arrivals and tourism spending will be beneficial to developers with leisure-oriented developments. This, of course, will be complemented by improving infrastructure connectivity across the country.

Affordable and lower mid-income segments still dominate

In H1 2025, Colliers recorded the take-up of 1,900 condominium units in Cebu. The affordable to lower mid-income projects (P2.5 million to P7 million), accounted for more than 70 percent of total condominium units sold in the pre-selling market during the year.

In our view, the demand for these segments is partly sustained by investors who plan to rent out their units to outsourcing employees. These segments should also receive sustained demand from local investors as well as Filipinos working abroad looking for viable investment options.

The affordable to mid-income segments dominated the take-up for house-and-lot (H&L) projects in Cebu as well, accounting for nearly 70 percent of horizontal units sold in H1 2025. In our opinion, take-up for these units is supported by remittance-receiving households, especially as Cebu is part of Central Visayas Region, one of the top sources of deployed overseas Filipino workers (OFWs) in 2023.

Cebu condominium supply to grow beyond 2025

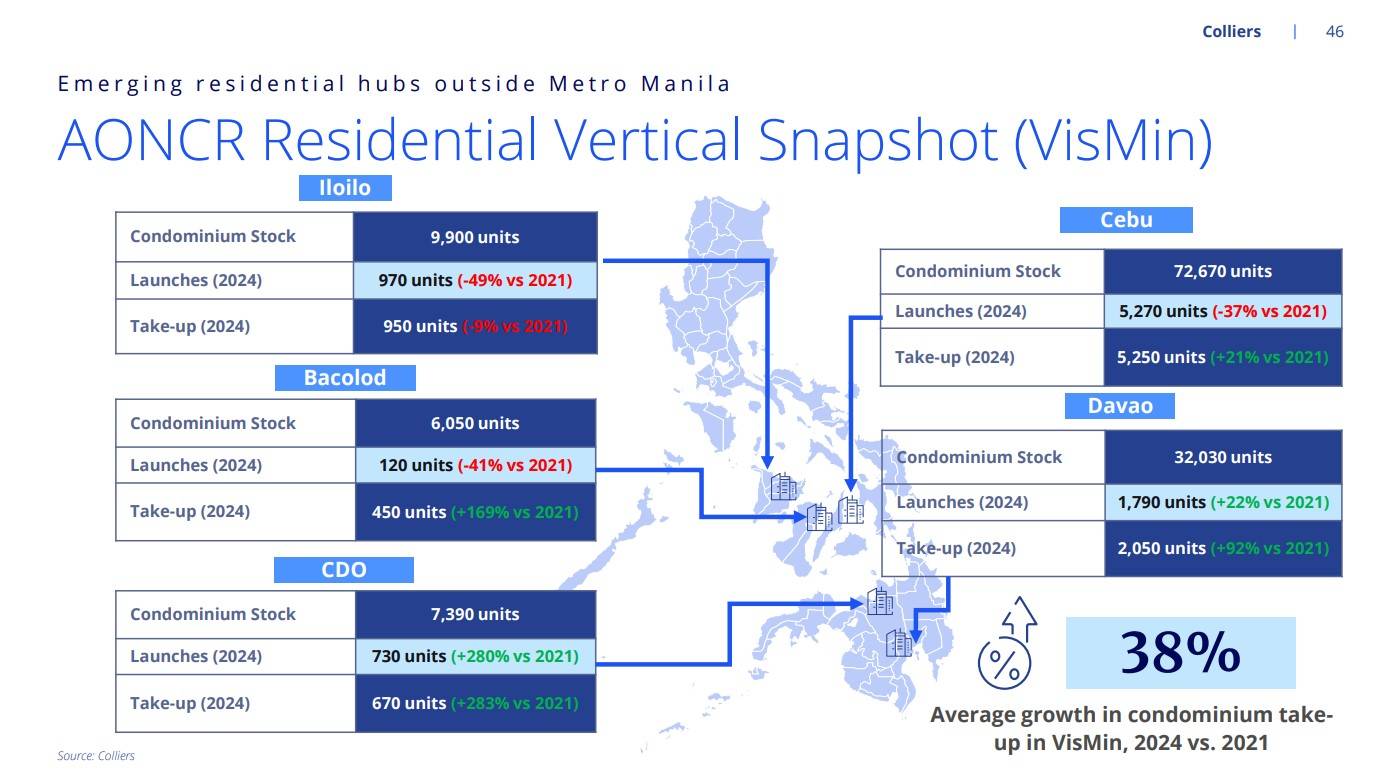

Colliers recorded the completion of 5,800 new condominium units in Cebu in 2024.

We see substantial completion across Metro Cebu from 2025 to 2028. By 2027, Colliers expects Cebu’s condominium stock to reach 102,500 units with the average annual completion of 8,300 new units from 2025 to 2028.

Interesting prospects for Cebu property—from commercial to residential, and vertical to horizontal.

In our view, the market for upscale and luxury residential units in Cebu is likely to expand so developers should further assess buyers’ appetite for these units with the right price points and ideal amenities

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.