Collier’s Review: Dissecting the resilience of Metro Manila’s luxury condo market

The demand for Metro Manila’s luxury condominium market is roaring back.

Despite economic disruptions in 2020 and 2021, the segment that covers condominium units priced at P20 million and up exhibited resilience. Affluent investors continue to acquire these higher-priced residential units as they bank on these projects’ price appreciation potential. These upscale, luxury, and ultra luxury condominium units are definitely breaking price barriers across the Philippines.

In Metro Manila, we continue to see luxury and ultra luxury condominiums being launched in the central business districts of Makati, Ortigas Center, Fort Bonifacio, and the Bay Area. Some of the recently launched luxury units have average prices of about P382,000 to P760,300 per sqm, with total contract prices between P25.4 million and P190 million per unit. Take-up for these projects can range from 20 percent and 86 percent.

As I previously highlighted, awash-with-cash Filipino investors continue to acquire these residential units because of their prime locations and proximity to infrastructure projects.

Over the past few years, we have also seen the preference for residential units with bespoke and high end amenities.

Filipino and foreign investors have been banking on the track record of luxury residential developers that have proven, time and again, that they can deliver luxury condominium projects on time with the committed high end amenities.

Prime location is key

Buying a property in the right location is key.

While being in a masterplanned community has become a popular option, it is also important to choose a location that is near public infrastructure projects. Previous Colliers Philippines surveys even showed the rising preference for locations that offer greener and more open spaces.

Investors need to make sure as well that they invest in a property situated in or near a location with good rental and price appreciation potential.

These are important factors especially when investors decide to flip or resell their upscale to ultra luxury investments in the future.

Enjoying strong rental prospects

Investors are constantly looking for projects with strong rental and high occupancy prospects once completed.

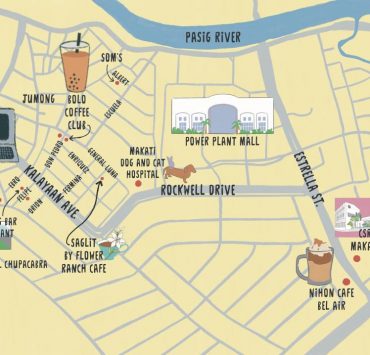

It is crucial for investors and end-users to scout for residential projects that can be leased out to local and foreign employees, students, and young families. It also helps that the project is near schools, offices, malls, and hospitals.

Business districts that house international schools are popular among foreign and consular employees, while top executives of multinational corporations (MNCs) and large Filipino firms holding office in business districts prefer high-end residential units.

Luxury condominium segment resilient in 2023

Colliers saw a stable demand for luxury and ultra-luxury projects in Metro Manila. In 2023, these segments accounted for 19 percent of total condominium units sold in the pre-selling market, up from 10 percent in 2022.

In our view, the luxury and ultra-luxury markets will likely remain resilient despite high interest rates and flattish yields in Metro Manila.

The increasing price of construction materials is also prompting developers to focus on the higher end of the residential market. Data from the Philippine Statistics Authority (PSA) show that prices of construction materials grew 8.3 percent in 2022, a 14-year high.

The constantly rising land values in the capital region also compel developers to launch more upscale to luxury units. In Q1 2024, these units accounted for 51 percent of total launches from only 30 percent a year ago.

While launches in the Metro Manila pre-selling condominium market remain tepid, property firms continue to focus on condominium units catering to upscale and luxury markets.

Room for price expansion

Over the past few years, we have seen healthy levels of price increases for luxury residential projects. On a per sqm basis, luxury and ultra-luxury condominium prices are starting to catch up with the region’s most expensive.

Prior to the pandemic, we saw project launches at about P400,000 to P500,000 per sqm, but pre-selling prices are definitely increasing.

At present, the Philippines’ most expensive is at P840,000 per sqm or about P500 million per unit.

Based on regional prices though, it appears there is still room for further expansion as the price per sqm of Metro Manila’s most expensive is relatively cheaper compared to those in more affluent cities such as London (9.4 times more expensive), New York (10 times), and Hong Kong (12.6 times).

Hyper-amenitized residential units

Colliers is seeing the proliferation of luxury developments that offer high-end amenities.

For new projects, developers should consider integrating green features such as occupancy sensors, LED lights, optimized air quality and provisions for solar panels and rainwater harvesting systems. Developers should also consider securing green building certifications for their residential towers to stand out.

Select developers have built-in fiber optic internet connections, videoconferencing areas and flexible workspaces suited for work-from-home (WFH) or hybrid working arrangements. We encourage developers to highlight amenities such as open spaces and activity areas.

Some have also incorporated unique features like glamping nook, garden gazebo, and sky promenades, as hyper-amenitized condominium developments become the norm.

Expect more “differentiators” as the luxury residential market in Metro Manila continues to expand.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.