Decoding the dynamics of the NCR condo market

There is a paradox in the National Capital Region’s condominium market at the moment.

While it is true that there is an oversupply of condominium inventory, we are not seeing developer-initiated significant price reductions to push these inventories out of the market.

There are no massive residential loan defaults, nor are there reported significant increases in the residential non-performing loans (NPL) data by the banking sector. In fact, residential NPLs even went down to 6.78 percent in Q3 2024 from 7.10 percent in Q3 2023, despite an 8 percent year-on-year residential loan growth to P79 billion, based on data from the Bangko Sentral ng Pilipinas (BSP).

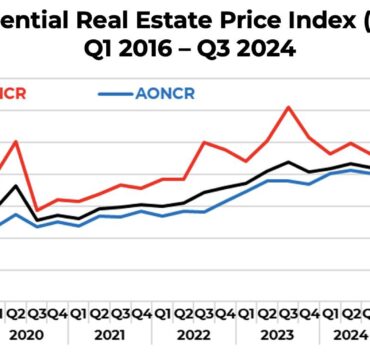

There has also been no significant decline in condominium property values in 2024 as shown in the latest BSP Residential Real Estate Price Index (RREPI).

Three possible reasons

Overall, there is no noted panic in the NCR condominium market. What gives?

There are three possible reasons. One is that the current oversupply is market-driven and part of the so-called real estate cycle comprising four phases that include recession, recovery, expansion, and hyper-supply. The market is currently under recession after the exit of Philippine offshore gaming operators (POGOs).

Second, there has been no noted speculative actions in the NCR condominium market despite the significant increase in supply and demand in recent years, which would have undermined the confidence in the market due to unreasonable prices.

Lastly, we have financially strong and patient condominium developers who are confident in the quality and locations of their developments.

Market-driven oversupply

The current oversupply is primarily a response to the sequential and significant increases in demand over the years, especially when POGOs entered the scene in 2017.

The demand and supply dynamics in the market merited increased supply. As can be observed, during the years the benchmark interest rate was stable at 4 percent, condominium demand was also stable.

However, when the benchmark interest rate was raised to 6.5 percent in October 2023 until July 2024, and had stayed elevated ever since (currently at 5.75 percent), we saw the growth of condominium loans slowing down, even reflecting a 13.2 percent YoY decline in Q3 2024 in terms of number of loan availments, based on BSP data.

Hence, the current recessionary situation in the condominium supply is not due to any significant weaknesses in the fundamentals of this submarket but due to the pandemic-induced contraction in demand given the decreased tourism and work-from-home setup, among others.

The condominium market is expected to recover once benchmark interest rate goes down to around 5 percent, tourism recovers, more businesses implement back-to-office mandates, and when the cost of borrowing is viewed by middle-income buyers as less than the projected price appreciation.

No speculative plays noted

Increases in the condominium market are very sequential and stable, except during the pandemic (2020) when a significant decline was noted.

From 2016, the BSP RREPI shows an almost doubling of condominium price index to 204.2 as of Q3 2024.

Within the condominium market, there are also distinct buyers categorized into four segments: the low-end (less than P3 million), middle income (P3 million to P7 million), high-end (P7 million to P15 million) and luxury (over P15 million) markets.

Most big developers are not engaged in the low-end market. For the luxury segment, these buyers are mostly not affected by market conditions. They acquire condominium properties as trophy assets, which puts into question the flight-for-quality argument. Our view is that this segment will buy regardless of the market situation.

For the mid-end and high-end condominium buyers, these groups may be affected by the elevated interest rates and are just waiting for further reductions until they engage again.

Therefore, as prices for each segment have been stable and market participants are distinct and clearly identified, we see that once the interest rates go down, then there will be more activities in the middle and high-end markets. It should be noted that the bulk of the current unsold inventory is in the mid-end segment and are mostly in the Bay Area (around 28 percent) and in BGC (another 30 percent)—two extremely attractive investment locations.

Financially strong, patient developers

We are seeing a very calm market because the developers have financial strength and are playing the long game.

This confidence emanates from their knowledge of the market (temporary pause because of high interest rates) and having quality inventories in good, attractive, and high potential locations, such as Bay City and BGC. Other developments are in masterplanned townships in the NCR, which are built for the long term.

Finally, we are already seeing some contraction in supply as developers start to balance and recalibrate the supply side of the condominium market. This can be seen in the sharp decline in new supply in 2024—from as high as 50,000 annual average for the three years before the pandemic (2017 to 2019) to around 10,000 last year.

Strong fundamentals

While it is true that the NCR condominium is currently under a challenging environment, the fundamentals are still strong.

The market is resilient and poised for recovery once the factors that made it significantly grow come into play again. These factors include low interest rates, low inflation, sustained OFW remittances, booming tourism, and favorable global and domestic economies.

Meanwhile, this is the best time for condominium investors to spot quality projects built by reputable developers in good locations such as in the Bay Area, BGC, and other townships with high potential for price appreciation. Check current and future infrastructure and other developments, and secure the property at the best price and terms at the right time. After all, it is a buyer’s market in the next several years.

The author is the CEO of Lobien Realty Group. We are seeing a very calm market because the developers have financial strength and are playing the long game. (https://ohmyhome.com)