Demographics as a market signal: Where residential demand is headed

As the Philippine population matures and household dynamics continue to shift, residential developers and investors must start rethinking traditional assumptions about homebuyers.

According to demographic insights from the World Bank, the country is seeing a steady rise in older, financially independent individuals. Many of them are child-free–quietly reshaping residential demand and redefining the future of housing.

With this shifting profile, developers must be ready to recalibrate their residential offerings.

A shift decades in the making

Recent World Bank data indicates that by 2030, the 35 to 39 age group will see a significant increase, while the population of children aged 5 to 9 will continue to decline. This trend has been building for decades.

From 1990 to 2023, the proportion of young children (0 to 4 years old) declined from 15.8 percent to just 8.36 percent of the total population. In contrast, adults aged 40 to 44 increased from 4.03 percent to 6.19 percent.

One major contributor is the shift in marrying age among Filipinos–now often between 35 and 44 years old. Many of these couples either delay having children or opt not to have them at all. The result is a population that is aging, more urban, and increasingly focused on lifestyle, mobility, and investment over traditional family structures.

What this means for residential demand

For developers, this isn’t a red flag—it’s an opportunity.

A growing segment of working professionals and DINKs (dual-income, no kids) are entering their peak earning years. This group–composed of individuals whose net disposable income can be used to buy real estate given their propensity to spend their income on either investments or travel–is more likely to seek out homes that support flexible lifestyles, remote work, and urban convenience.

Here’s how that translates on the ground.

Mid-size condo units are poised for a comeback. With interest rates still at manageable levels and unemployment trending down, we expect the current oversupply of one- and two-bedroom units in central business districts (CBDs) to be gradually absorbed over the next 24 to 36 months, especially by single professionals and couples with no children.

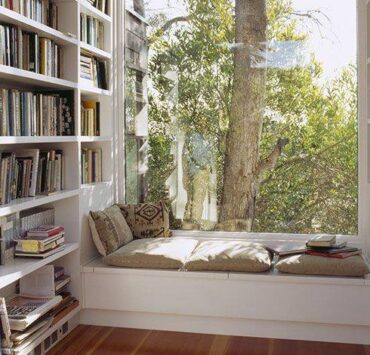

Larger, more flexible layouts will win. Today’s working professionals don’t just want compact studios. Developers should consider designing larger one-bedroom and two-bedroom units that can double as workspaces or accommodate hybrid setups. Comfort, layout flexibility, and connectivity will drive decision-making.

Growth outside Metro Manila is ripe for acceleration. For buyers who do choose to raise families, affordability and space are key. This presents a compelling case for house-and-lot communities in growth corridors outside the NCR, especially where infrastructure development is improving accessibility. Offering mid-sized homes with two to three bedrooms can meet these needs while stimulating economic growth beyond Metro Manila.

Final thoughts

As the Filipino population continues to age and diversify, residential real estate must evolve to reflect new priorities. Developers who anticipate these shifts will be better positioned to lead in a changing market.

After all, demographics don’t just tell us where we’ve been–they help us see where the market is going. The most resilient players in the industry will be those who read the signs early and respond with clarity and intention.

The author is the director of Residential Sales and Leasing at Leechiu Property Consultants Inc.