Expected rate cuts, suburban appeal seen to fuel optimism in PH residential property market

Metro Manila’s real estate market showed mixed signals in Q2 2025, as residential condominium sales and new launches simultaneously increased, while rental yields remained low compared to housing loan rates.

MM condo take-up

In a press briefing, Leechiu Property Consultants Inc. (LPC) reported that take-up of residential condominium units in Metro Manila rose 2 percent to 6,643 units in the second quarter compared to the previous quarter.

Buyer demand in the residential condominium market is currently strongest in the upscale and high-end segments, where units are priced from P9 million to P35 million.

New launches also posted two consecutive quarters of growth, with 1,761 units introduced—up 31 percent from Q1.

Due to this sustained increase in both condominium sales and new project launches, rental rates remained weak in certain districts like Bay Area and Makati, as compared to the first quarter of this year.

Developers, in response to the sluggish rental returns and still elevated inventory level, have been very cautious in their launches with many prioritizing releasing their existing inventory through flexible payment schemes—offering longer payment terms, rent-to-own options, and sizable discounts.

Room for optimism

Still, there may be room for optimism, according to Roy Golez, director of research, consultancy, and valuation at LPC.

“We are looking at, I think, another two rate cuts this year by the [Bangko Sentral ng Pilipinas]. We are hoping that home loan interest will improve, thus making it more palatable for investors to purchase units on financing and, at the same time, offer them for rental income,” Golez said.

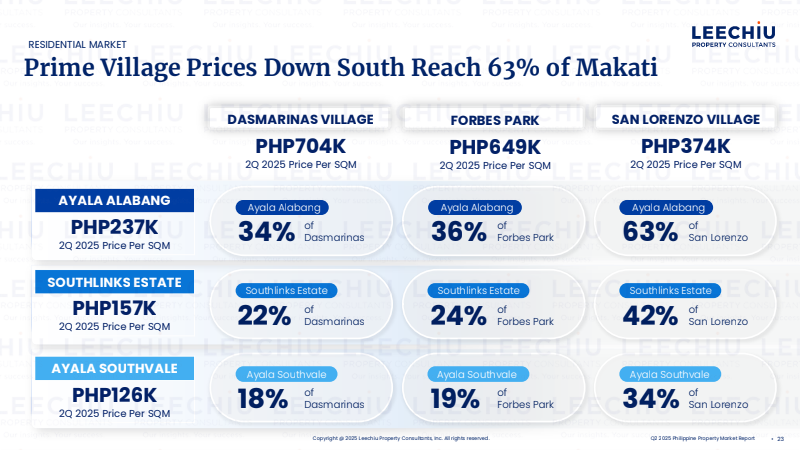

Buyers looking for prime residential lots are now eyeing southern Metro Manila, where upscale subdivisions offer more affordable alternatives to traditional central locations.

There’s also a strong demand for township projects in Cavite and Laguna. From 2024 to 2025, a total of 7,400 subdivision lots were launched across 44 projects in the area—87 percent of which have already been sold.

“Cavite-Laguna subdivisions are in the range of P57,000 (per sqm) for Laguna and P68,000 (per sqm) for Cavite. And these southern subdivisions have been quite good investments for the buyers as they have already generated about 10 to 12 percent price growth over the last 10 years.” Golez added.

Strong performance

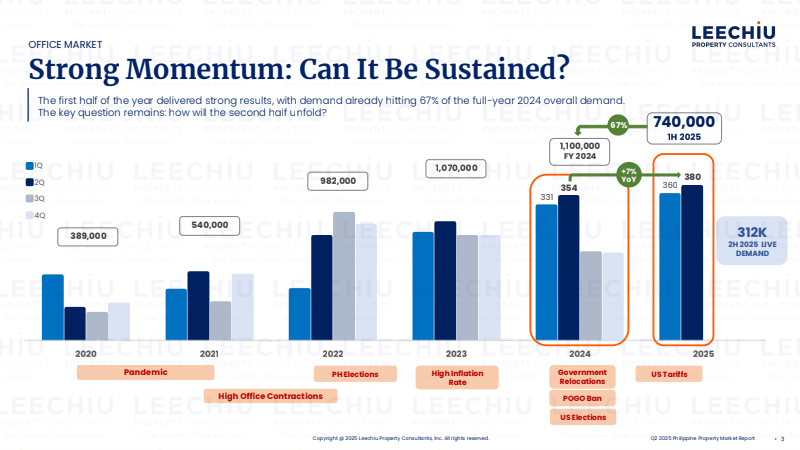

The office segment, meanwhile, recorded a strong performance in the first half of 2025, with demand hitting 67 percent of the total take-up last year.

“What we can see today is that the first half of the year has already clocked in 740,000 sqm of leasing activity. That is 67 percent of last year’s number,” said Mikko Barranda, director of commercial leasing at LPC.

The IT and business process management (IT-BPM) and traditional industries accounted for the bulk of office demand in the first half of 2025. This signals an accelerated growth and a potential to hit pre-pandemic levels for the office sector.