F&B tenants drive the next wave of retail development

The Philippine retail sector is on the upswing, with the food and beverage (F&B) sector driving the charge.

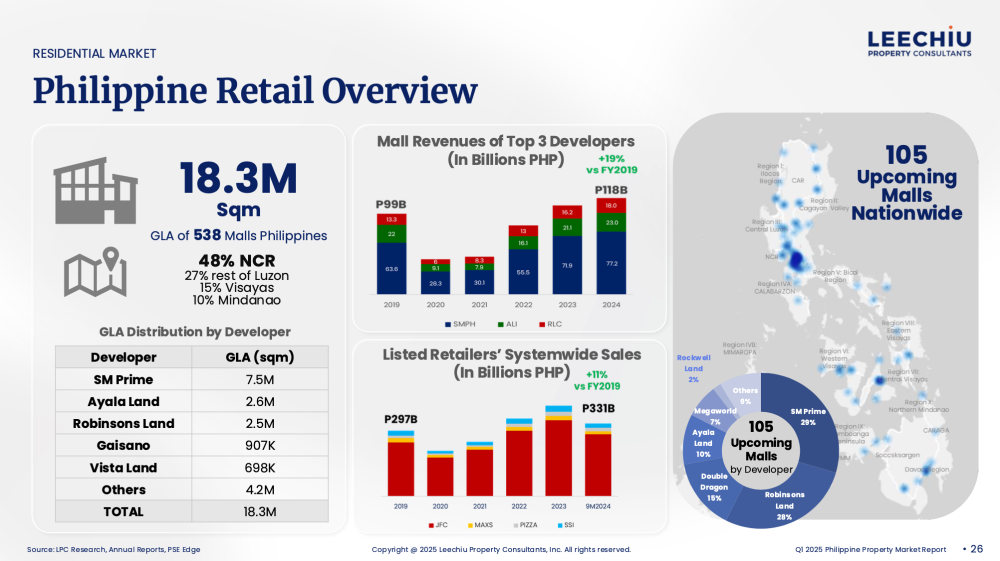

At present, revenues from F&B retailers have already exceeded pre-pandemic levels by 11 percent, outperforming other categories and solidifying the sector’s role as a key anchor in retail real estate recovery.

This resurgence is reshaping leasing strategies, guiding mall design, and influencing expansion priorities among both local and international brands.

Surpassing pre-pandemic performance

Based on our latest research, the country’s top three mall operators recorded a 19 percent increase in overall revenues compared to 2019.

Leading that growth is the F&B segment, which has not only bounced back but emerged as a core driver of mall traffic and tenant performance. This growth reflects the return of discretionary consumer spending and the cultural significance of dining out in the Philippines.

As more Filipinos seek out shared experiences in public spaces, F&B concepts have become critical to reactivating foot traffic and increasing dwell time.

Experience-driven demand

Unlike other retail categories that continue to shift toward e-commerce, F&B thrives on in-person experiences.

Restaurants, cafés, dessert shops, and quick-service formats benefit from their ability to create atmosphere, community interaction, and lifestyle value that cannot be replicated online.

This dynamic made F&B tenants essential in newly designed malls and mixed-use developments, which increasingly prioritize open air dining, lifestyle zones, and community integration. The demand for experiential retail has also contributed to higher lease absorption in prime malls and neighborhood retail centers.

Strategic expansion across growth areas

As of the first quarter of 2025, there are 105 new malls under development across the Philippines, many of which include expanded F&B provisions in their design and tenant mix.

While Metro Manila remains a key target for flagship dining brands, developers are actively integrating food-centric zones into new projects in Central Luzon, Calabarzon, Visayas, and Davao.

These regions are witnessing rising population density, improved road infrastructure, and growing consumer demand—all of which support sustained F&B activity. Retailers are responding with aggressive site acquisition strategies in regional malls, townships, and transport-oriented developments.

Leasing implications

F&B’s dominance has altered how developers and landlords approach leasing.

Retail centers now prioritize food clusters, allocate prime frontage to dining concepts, and offer flexible fit-out terms to attract high performing tenants.

This has created competitive leasing conditions, particularly for brands with strong concepts and proven track records. Landlords are becoming more selective, seeking operators who can deliver consistent foot traffic and align with the broader vision of next generation retail environments.

What’s ahead for F&B retail growth

As the Philippine retail sector continues to recover and evolve, F&B will remain a cornerstone of growth. Its ability to combine experience, social interaction, and consumer loyalty makes it one of the most resilient and adaptive segments in the market.

Given the robust mall pipeline and sustained demand for dining experiences, the appetite for F&B real estate is only expected to grow.

For F&B operators planning to expand, working with a knowledgeable property consultant can provide critical support—from identifying high-traffic locations and evaluating mall pipelines to securing lease terms that fit both operational needs and long-term brand strategy.

In a competitive and fast moving retail environment, informed guidance can help businesses grow with confidence.

The author is the associate director for Commercial Leasing at Leechiu Property Consultants Inc.