Link between property values and interest rates

We have all been hearing about higher for longer interest rates in the Philippines, which is a lot like what’s happening in the United States. This has sparked concerns among investors, including those with interests in real estate.

The Monetary Board of the Bangko Sentral ng Pilipinas (BSP) adjusts benchmark interest rates to manage price stability. To control inflation, BSP has kept the key policy rate at 6.5% for six consecutive meetings, the latest of which was held in June 2024. Governor Eli Remolona mentioned in last month’s meeting that a rate cut might happen in August.

With inflation expected to slow down this year, a possible rate cut of about 50 bps is anticipated in 2024, according to the BSP governor.

Now, here is where it gets interesting: high interest rates usually makes borrowing money for buying property less attractive. This can cause property demand to dip, and prices to go down or stabilize.

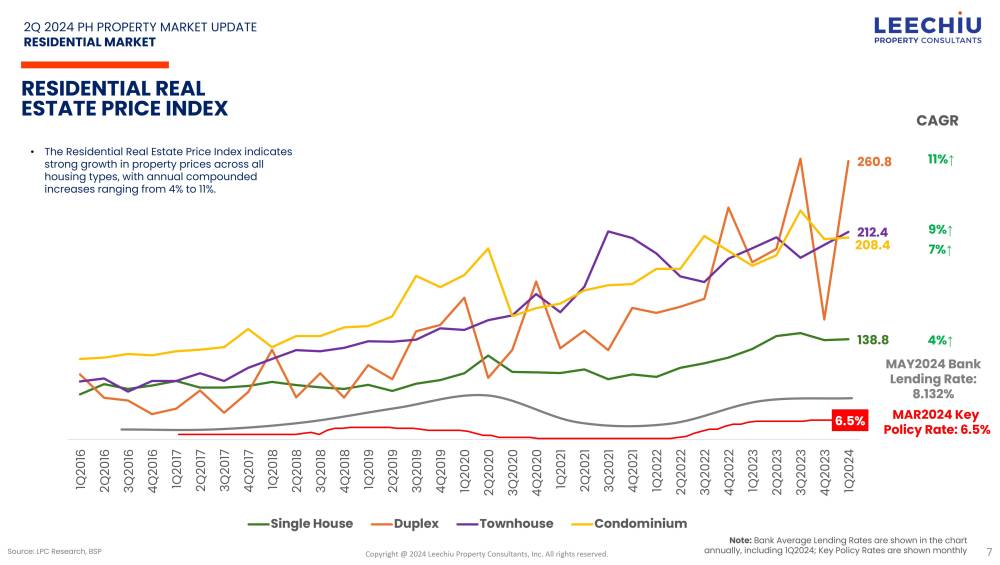

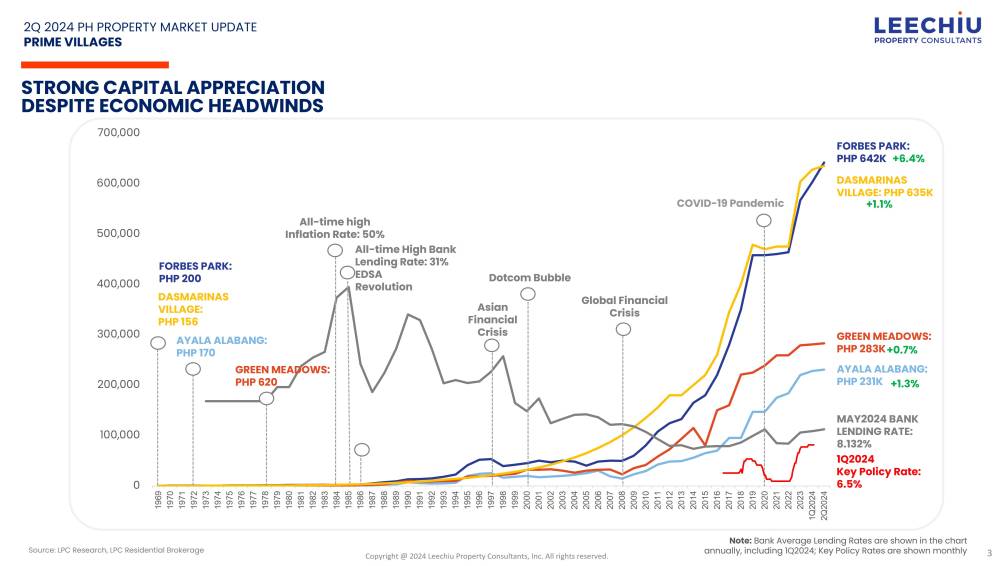

If we look at average historical land values in the mature districts of Metro Manila for the last eight years, we see a steady climb of values for the Makati Central Business District (CBD), Bonifacio Global City (BGC), and Ortigas Center from 2016 to 2019. By 2020, values started to stabilize, coinciding with the start of the pandemic.

During the pandemic, lower interest rates led to reduced borrowing costs, but property owners held on to their assets due to market uncertainty, resulting in flat land values. This trend was also seen in prime residential lots, as owners had no pressing need to sell.

However, this is not the case for retail sales of real properties by developers, as they offered friendlier payment terms to continue to aid buyers and keep their own sales figures up. The lower borrowing rates coupled with friendlier payment terms attracted buyers even during a period of unstable household income during the pandemic.

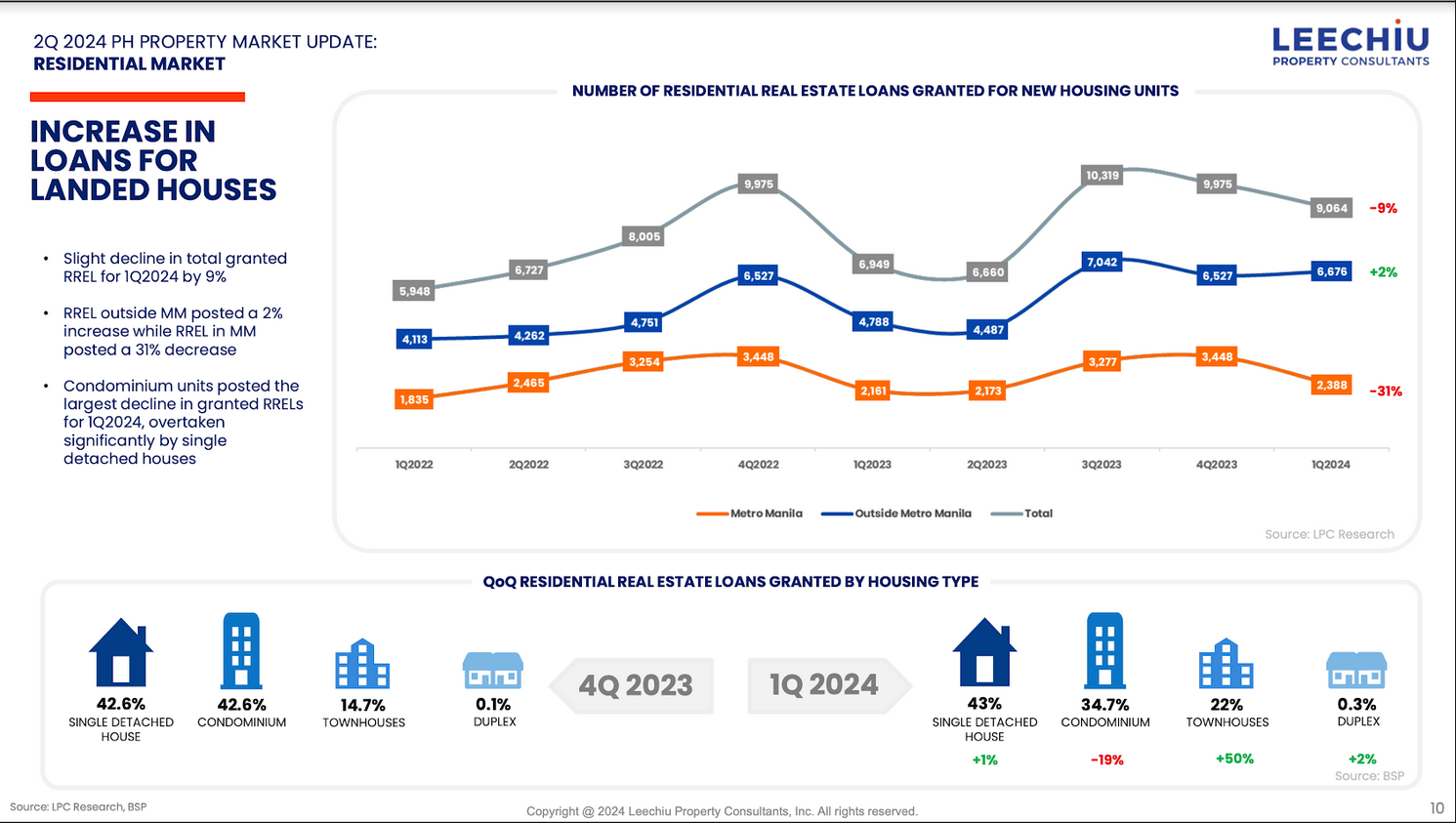

With attractive sales levels, as shown in the Residential Real Estate Loans (RREL) of BSP, developers were prompted to keep launching new units, and the Residential Real Estate Price Index (RREPI) kept going up.

But then fallout risk increased with the friendly payment terms and reinjected residential units in the market. Developers then re-strategized their payment terms and imposed stricter buyer screening in 2023. With plans in place, new residential projects still kept getting launched which brought unsold inventory to about 63,000 units in Metro Manila.

If key policy rates go down in coming periods, commercial land values may rise again. Meanwhile, for retail residential units, particularly for Metro Manila, RREPI growth may be tempered by the volume of unsold supply available in the market. Significant price growth may be observed when inventory reaches a more manageable level.

At the end of the day, though, it comes down to supply and demand. Even if key policy rates go down, if owners refuse to sell, values will remain.

When the key policy rates go down in the coming periods, RREPI growth, particularly for Metro Manila condominium units, may be tempered by the volume of unsold supply available in the market. Significant price growth may be observed when unsold inventory levels reach a more manageable level. Meanwhile, commercial land values may start climbing again if key policy rates drop.

She is Associate Director and Head of Research at Leechiu Property Consultants Inc.