Luxury demand, limited completions and promos help drive MM condo recovery

Metro Manila’s residential condominium market has gained momentum in the second quarter of 2025, driven by increased demand for upscale and luxury units, declining project completions, and more competitive promotions from developers.

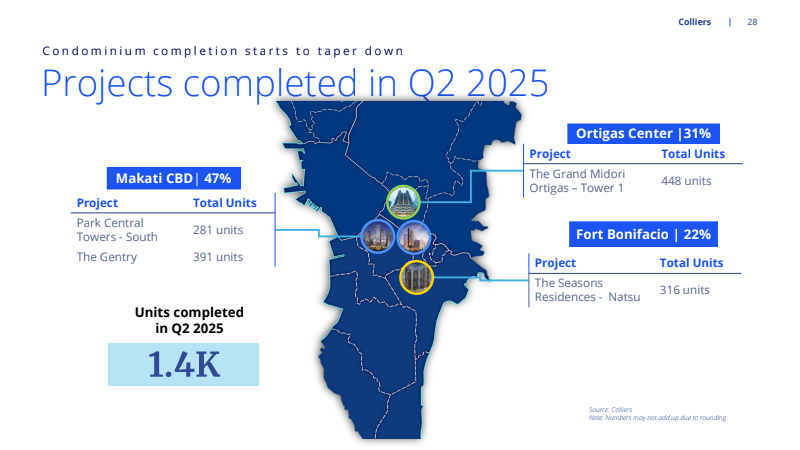

Data presented by Colliers Philippines Research director Joey Roi Bondoc highlighted that 1,400 new condominium units were already completed in Q2 2025. However, a more significant wave of supply is expected in the remainder of this year, with 7,200 units to be completed—71 percent of which will come from Bay Area.

Despite this, annual average completions from 2025 to 2027 are projected at just 5,800 units, less than half the 13,000 units delivered yearly between 2017 and 2019.

Decline in vacancy

This slowdown in new supply is contributing to a gradual decline in vacancy rates. From 25.8 percent, Metro Manila’s secondary market vacancy is expected to decrease to 25.3 percent in 2026 and further to 23.4 percent by 2027.

Still, some areas continue to face oversupply, particularly in the Bay Area, where more than 50 percent of condominium units remained unoccupied. According to Bondoc, this led many developers to take more aggressive strategies to clear inventory.

“A lot of developers right now have been implementing ready-for-occupancy promos—more innovative, more attractive offers being launched left and right,” he said. “Admittedly, we still have some condominium units left in the market that need to be absorbed, sold, or leased by residents and investors. So let’s see how this will fare over the next few quarters,”

Luxury segment gains ground

In 2024, upscale to ultra luxury launches (priced at P12 million and above) accounted for 41 percent of total new projects in Metro Manila, up from 20 percent in 2023.

High-end projects such as Aurelia Residences in Bonifacio Global City, Park Villas and Eluria in Makati City, and The Velaris Residences in Pasig City have reported strong take-up, with some developments already over 80 to 90 percent sold.

“Right now, it appears that the upscale luxury, ultra luxury projects remain well-performing and, in fact, are a cut above the rest,” Bondoc explained.

Provincial markets stay Active

Bondoc added that demand continues to shift beyond Metro Manila.

“What really stands out is the growing demand for condominium units and, more notably, horizontal house-and-lot and lot-only properties outside the capital region,” he said.

In provinces such as Cavite, Laguna, Batangas, Pampanga and Cebu, the average take-up rates for these projects ranged from 86 percent to 98 percent (H&L), and 81 percent to 96 percent (lot-only) in Q2 2025.

Cebu continues to lead in new condominium supply outside the capital, with 33,000 units expected to be completed between 2025 and 2028—nearly double that of Metro Manila’s key business districts.

Positive momentum for office

Colliers also reported positive momentum in the office sector.

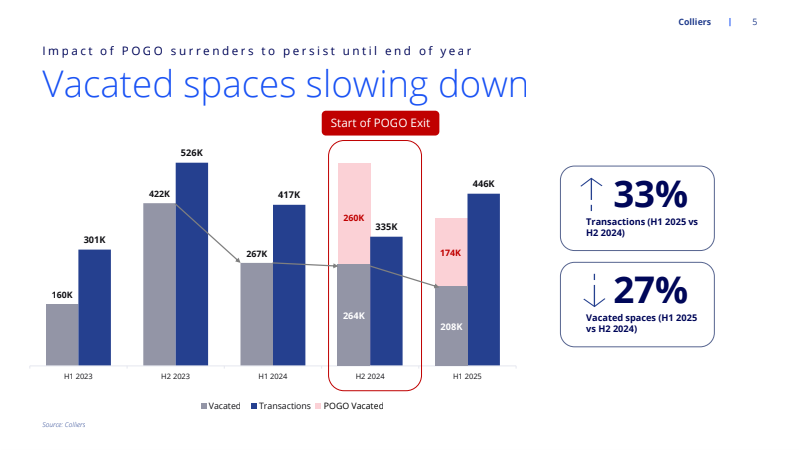

Kevin Jara, director and head of Office Services-Tenant Representation at Colliers, reported that transactions in the first half of 2025 grew 33 percent to 446,000 sqm from a year ago.

Metro Manila’s office vacancy, however, remains high at 20 percent. In contrast, provincial markets face supply shortages amid rising demand.

“Provincial remains to be a bright spot on provincial markets. We’re on track to hit our usual target 200,000 sqm in the markets outside of Manila by yearend. I think the problem right now in provincial is we’re seeing a supply gap now not being able to fulfill a potential demand in markets outside Manila,” Jara said.