Office vacancy rates show modest improvement: Are we at the start of a stabilization cycle?

After years of navigating a highly volatile real estate environment, we at Leechiu Property Consultants are beginning to see early indicators that the Philippine office property market may be entering a more stable phase.

From our position working closely with occupiers and developers across the country, we can confidently say that while the recovery is still in its early stages, the signs are encouraging.

Vacancy levels ease slightly

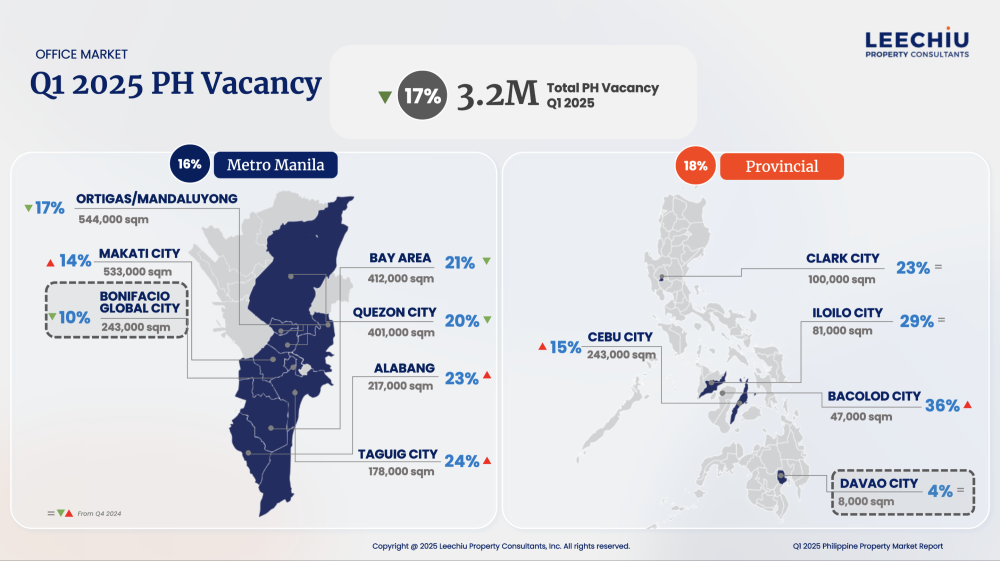

Total office vacancy reached 3.2 million sqm by the end of Q1 2025, representing around 17 percent of total inventory.

While this reflects only a slight decline from the 3.3 million sqm recorded in Q4 2024, it marks a meaningful shift.

For those monitoring the market closely, it signals gradual recovery. The sector continues to absorb the lingering oversupply brought on by the pandemic and the exit of Philippine offshore gaming operators (POGOs), indicating a slow but steady path toward rebalancing.

District-level data reinforces this trend. Demand for office spaces in Makati and Bonifacio Global City (BGC) continues to be attractive, followed by the Ortigas/Mandaluyong/San Juan area, which also saw notable take-up during the first three months of the year.

These are welcome developments as we continue to work through the available inventory.

Leasing activity picks up

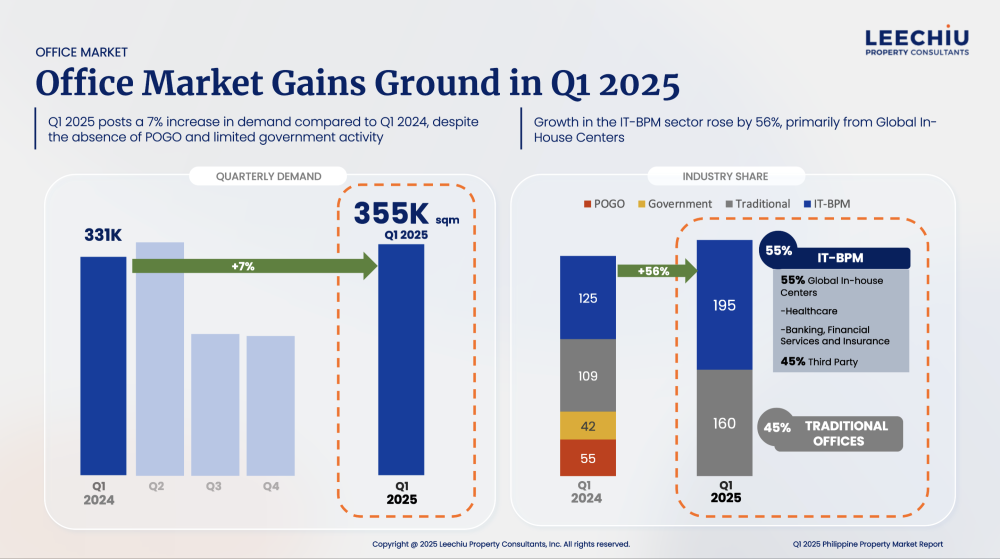

Approximately 355,000 sqm of office space was transacted in Q1 2025—a 7 percent increase year-on-year. The IT and business process management (IT-BPM) sector remains the dominant driver, with global in-house centers (GICs) accounting for much of the growth.

Our leasing pipeline remains active, with 462,000 sqm of requirements in progress and 85,000 sqm already under negotiation. This suggests a healthy appetite for expansion and relocation, particularly among high-growth industries in the outsourcing sector such as healthcare, finance, and technology.

This trend is also prevalent in the countryside, with provincial cities like Cebu and Davao as key source markets for IT-BPM firms expanding their operations. The growing interest in these regional hubs reflects their continued confidence in these locations as part of their overall growth strategy.

Less space being vacated

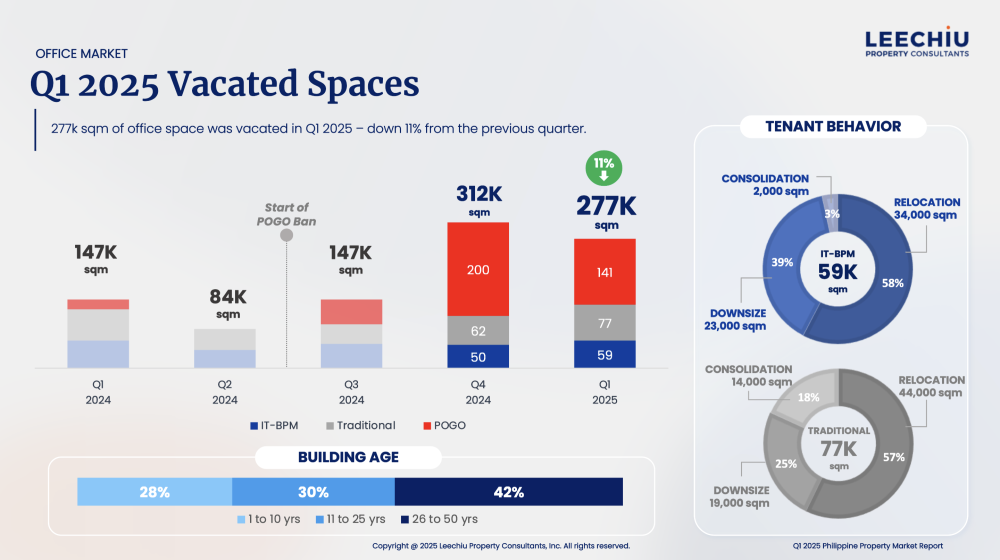

Another sign that the market is beginning to turn is the declining volume of contractions. Approximately 277,000 sqm was returned in Q1 2025—an 11 percent improvement over the previous quarter.

We’re seeing fewer companies downsizing, and more looking to consolidate or optimize their footprints. This tells us that tenants are now thinking longer term.

We also expect contractions to continue slowing in the coming quarters, as most POGO spaces have already been vacated following President Ferdinand R. Marcos Jr.’s announcement last year.

Are we stabilizing?

While we remain cautiously optimistic, we must acknowledge that we’re not fully out of the woods. Global macroeconomic forces continue to influence sentiment, and vacancy rates remain in the double digits—still well above pre-pandemic levels.

That said, the pace of market contractions has eased, and the country’s fundamentals remain solid. Active tenant interest, steady transaction activity, and gradually improving vacancy levels all point toward growing stability.

If this momentum holds, more balanced market conditions may emerge by the second half of the year.

Final thoughts

The Philippines is in the early stages of a stabilization cycle, with the market gradually regaining its footing.

As always, success will depend on our ability to respond to evolving tenant needs and broader economic shifts.

For now, Q1 has provided a promising start, and we remain hopeful that this positive trend will carry through the rest of the year.

The author is the director of commercial leasing at Leechiu Property Consultants