Optimization beyond the horizon

(First of two parts)

Colliers Philippines continues to see the Philippine property market recovering well postpandemic.

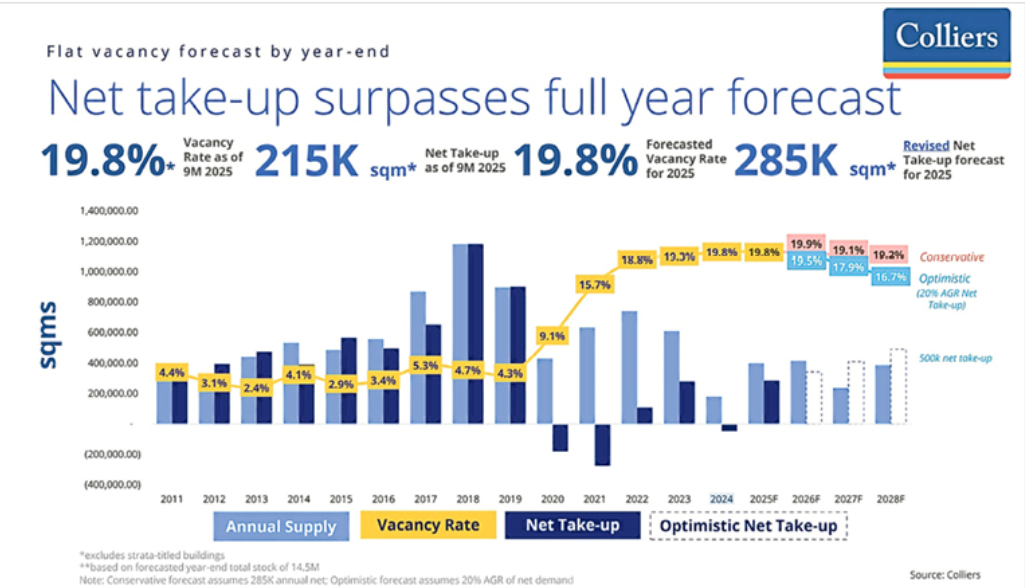

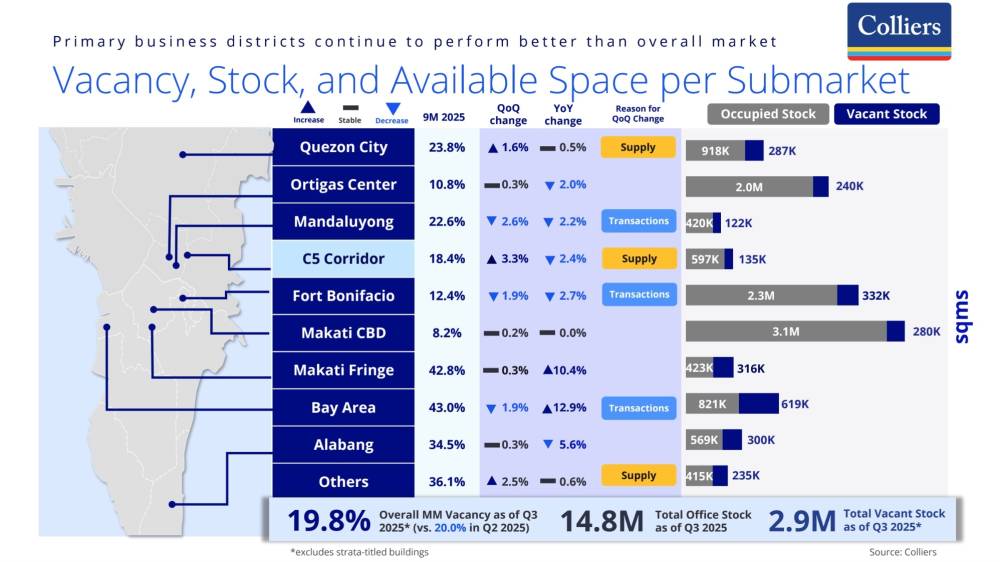

The office segment was able to breach our initial estimate as outsourcing firms and traditional occupants took up massive space the past 12 months.

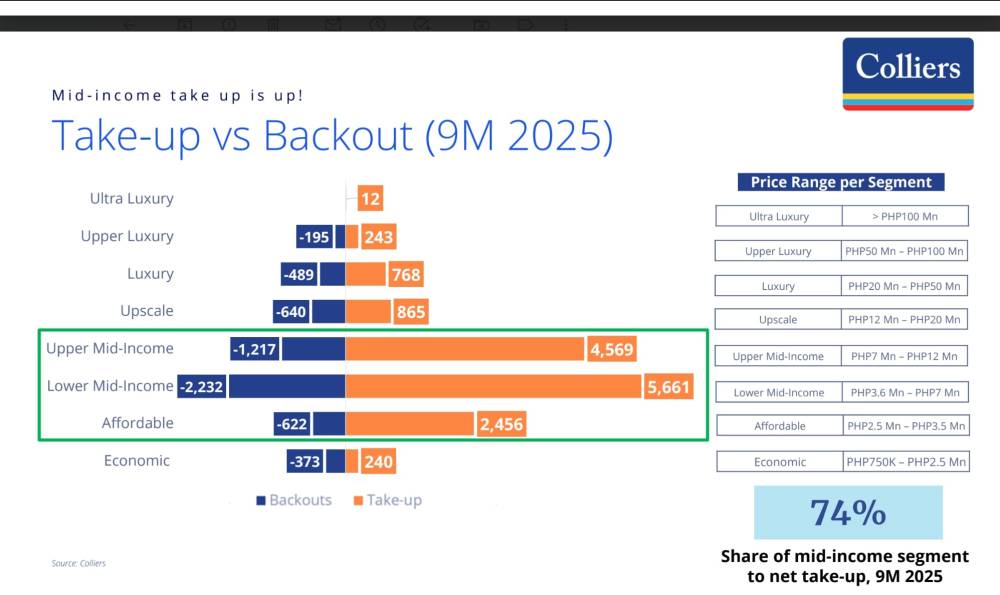

The Metro Manila condominium market surprised a lot of stakeholders, with net take-up rebounding significantly in Q3 2025 due to attractive promos offered by developers despite elevated bank mortgage rates.

The retail sector has been the most resilient, backed by brisk take-up from foreign brands and mall developers’ aggressive refurbishment of retail spaces.

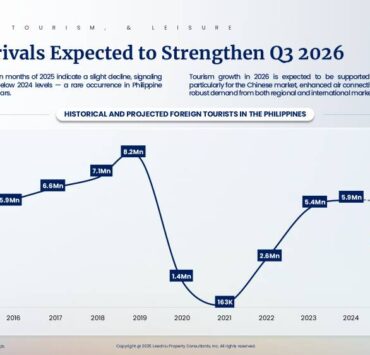

International tourist arrivals, year to date, are subpar with much of the recovery in hotel rates and occupancies due to strong local market.

Meanwhile, we remain optimistic for the industrial sector with Philippine exporters projecting decent growth next year and as more foreign investment pledges materialize in 2026.

We expect 2026 to present a mix of headwinds and tailwinds, a normal occurrence for a cyclical Philippine property market. Developers need to future-proof their businesses to remain relevant in a constantly evolving real estate market.

Condo market to normalize

Colliers projects slower completion beyond 2025, partly due to tempered condominium launches in major Metro Manila central business districts (CBDs) for the past three to four years.

From 2026 to 2028, we expect the average annual delivery of 3,600 units, down from the 13,000 yearly average from 2017 to 2019, a period when developers hastened completions to capitalize on the strong demand from Philippine offshore gaming operators.

We project condominium launches in Metro Manila to remain soft over the next 12 to 24 months. A substantial drop in unsold ready-for-occupancy (RFO) units will be an impetus for developers to start launching new projects.

Firms to focus on masterplanned fringe locations

The lack of developable land and soaring prices in CBDs are driving more developers and investors to consider condominium projects in Metro Manila fringe areas.

Among the attractive fringe locations include the C5 corridor and Quezon City, particularly the Katipunan Area. As of Q3 2025, Colliers data showed that condominium projects along the C5 corridor are doing well, with projects priced from P10 million to P63 million enjoying take-up of between 40 percent and 100 percent.

Meanwhile, condominium projects in the Katipunan area are priced from P2 million to P11 million, enjoying an average take-up of 85 percent.

Deals, promos to mop up excess supply

As of Q3 2025, unsold RFO condominium inventory in Metro Manila stood at 30,400 units.

To address the condominium oversupply, several developers are aggressively offering more attractive and innovative promos such as bigger discounts, extended payment terms, and rent-to-own schemes. The promos appear to be working, with Colliers recording improved take-up, particularly in the mid-income residential segment (P3.6 million to P12 million).

In our view, such promos and other concessions should be highlighted especially for a client base still wary of elevated mortgage rates.

Opportune time for end-users to get into condo market

Colliers believes that the Metro Manila condominium segment will likely remain a buyer’s market for 2026.

In our view, developer launches will likely remain conservative and tempered in 2026, especially with unsold RFO inventory still at more than 30,000 units as of Q3 2025. Developers are likely to continue implementing their RFO promos to continue cornering demand from the end-user market.

New projects in high growth regions

Several developers are now accelerating their geographic diversification strategies and launching more projects outside the capital region. This shift to suburbia should result in a more diverse Philippine property market, offering vast opportunities and a myriad of residential options for investors and end-users.

Colliers sees the launch of more vertical and horizontal projects in high growth regions including Southern Luzon, Central Luzon, Central Visayas, Western Visayas, and Davao region.

We see these competitive regions benefiting from the government’s infrastructure implementation and push to attract more domestic and foreign tourists. The steady inflow of remittances should also ensure stable demand for residential end-use in these localities.

We recommend that developers carefully assess the attractive product types and price points to offer to the market. It is crucial for developers to address the demand gaps for both horizontal and vertical markets.

(To be continued)

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.