Optimization beyond the horizon

(Conclusion)

This is the conclusion of Colliers Philippines’ residential outlook.

Despite the slower-than-expected Philippine economic growth in Q3 2025, property developers remain optimistic that end-user demand from overseas Filipino workers (OFWs) and local professionals will help support the growth of the property market in 2026.

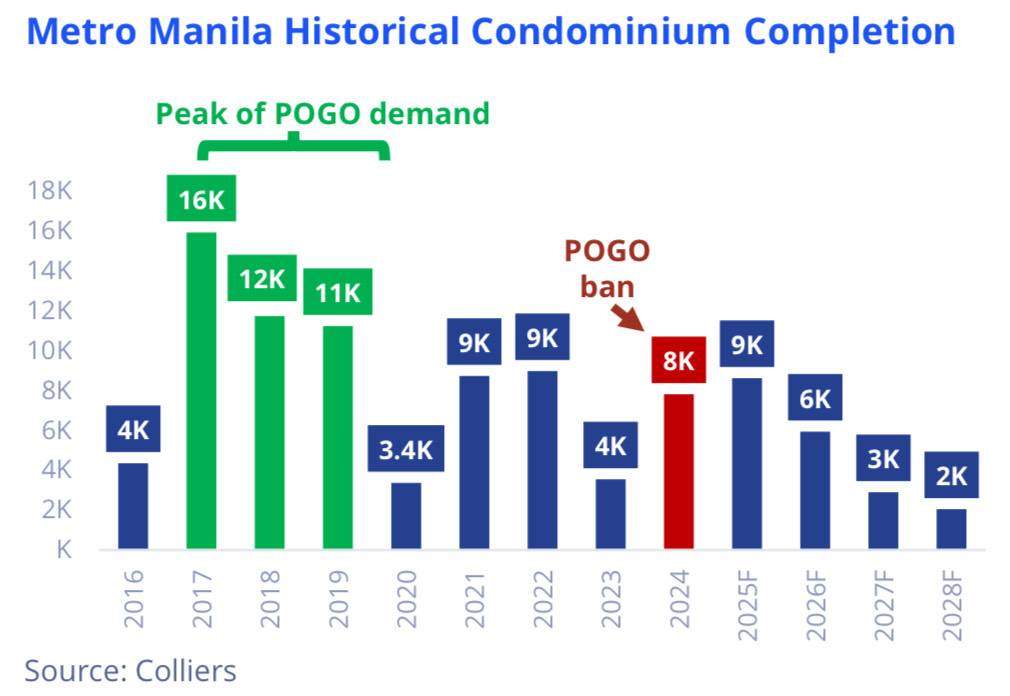

In Metro Manila, previous concerns about tepid condominium take-up are now being addressed by developers by offering attractive leasing and payment models for their ready-for-occupancy (RFO) condominium units.

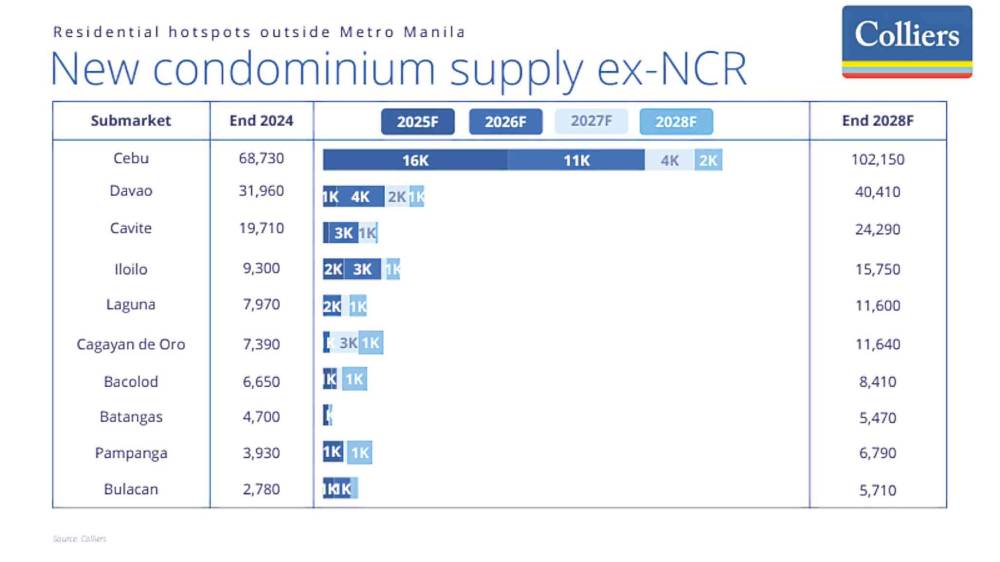

Outside the capital region, we continue to see sustained take-up for horizontal projects, especially in high growth areas like Central Luzon, Southern Luzon, Western Visayas, Central Visayas, and Davao Region.

A more pronounced shift to suburbia

We believe that developers will continue to venture into horizontal residential projects outside Metro Manila where demand comes from end-users. Colliers data showed that horizontal units in key provinces in Calabarzon, Central Luzon, Central Visayas, Western Visayas, and Davao Region have better absorption with remaining inventory life only ranging between one and three years.

Horizontal projects remain attractive. We encourage developers to consider the viable locations for house-and-lot (H&L) and lot-only projects, including provinces in Calabarzon, Central Luzon, Central Visayas, Western Visayas, and Davao Region. H&L projects in these property hotspots recorded an average annual price increase of 3 to 12 percent from 2016 to 2024. Lot-only developments, meanwhile, recorded stronger price appreciation during the period, ranging between 8 percent and 18 percent annually from 2016 to 2024.

Previous Colliers polls also showed the attractiveness and viability of these locations, which are among the major recipients of remittances from OFWs. More than half of the 2.33 million deployed Filipino workers in 2023 are from these areas. The steady inflow of remittances ensures stable demand for residential end-use.

New infra to guide firms’ landbanking and development initiatives

As Colliers Philippines highlighted previously, infrastructure projects have helped redefine and redirect developers’ expansion strategies.

The construction of key public projects, especially in prime property destinations outside the capital region, has provided access to properties that can be redeveloped into massive integrated communities. These townships offer a mix of vertical and horizontal projects.

Due to road projects, business opportunities have spilled over to nearby areas such as Cavite, Laguna, and Batangas. In other parts of Luzon, Pampanga, Bulacan, and Tarlac remain attractive options for property firms.

This has been evident with the more pronounced launch of townships in these provinces.

Outside Davao and Cebu, growth areas in Visayas and Mindanao include Bacolod, Iloilo, and Cagayan de Oro. These cities and provinces are among those that will likely benefit from the government’s massive infrastructure push even beyond President Marcos’ term. Among the new projects lined up for completion in these localities include the New Manila International Airport, Davao Airport Expansion, MRT-7, North-South Commuter Railway, Metro Cebu Expressway, and Panay-Guimaras-Negros Island Bridges.

Because of these massive public projects, developers have aggressively and strategically landbanked in these areas.

What’s sizzling in 2026?

Colliers Philippines believes that developers should continue offering attractive RFO promos for their unsold condominium units in Metro Manila. These innovative schemes helped resuscitate the Metro Manila RFO market in 2025 and continued implementation will play a pivotal role in stoking appetite in the Metro Manila vertical market.

Aside from game-changing RFO promos and sustained demand for horizontal, we see demand for residential units being sustained by OFW remittances. Outsourcing jobs being generated in the countryside should also partly stoke demand for horizontal and vertical units for end use.

While the Bangko Sentral ng Pilipinas has been cutting interest rates, the decline has not translated to mortgage rate reduction.

In our view, lower mortgage rates will be instrumental in fostering a long-term and sustainable recovery for the Philippine residential market.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.