Optimizing growth beyond the core

The results of our recent survey indicate dominance of return to office (RTO) scheme over work from home (WFH). This makes now an opportune time for landlords to push office development, especially in Metro Manila submarkets poised to reach landlord’s market status within 12 to 24 months.

Meanwhile, the Metro Manila ready-for-occupancy (RFO) market saw some recovery in Q2 2025 after posting sluggish absorption in the previous quarter, thanks to aggressive promos and discounts extended by developers. Makati fringe and Quezon City were the most preferred locations for RFO units, but we also see a recovery in appetite in Pasig and the Bay Area.

Lower base rents

Nearly 60 percent of our respondents ranked lower base rents as their most preferred concession when looking for office space to lease, followed by rent-free fit out periods. Meanwhile, fit-out allowance and no or delayed rent escalation were the least preferred concessions.

Current work setup

Six out of 10 respondents are now working in a traditional office setup, slightly higher from the 54 percent in our Q4 2024 survey. The rest are still implementing hybrid work arrangements. In our view, having a well-designed physical office space will be key in enticing workers to RTO.

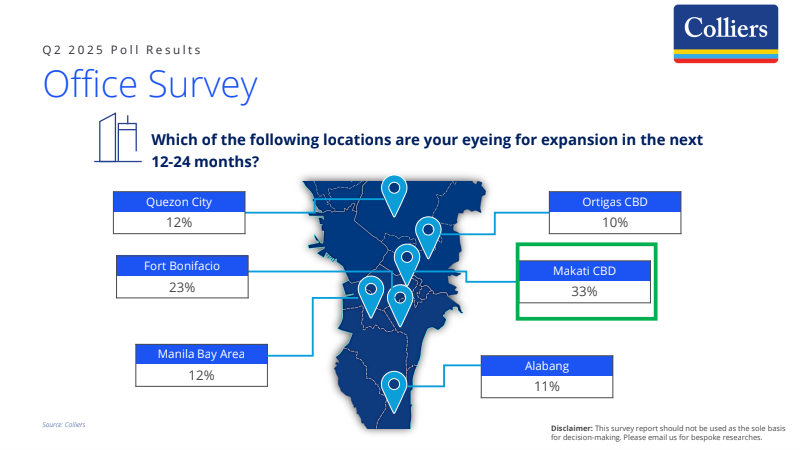

Expansion plans

A third of our respondents chose Makati CBD for their expansion plans, trailed by Fort Bonifacio at 23 percent. Other preferred locations include the Bay Area (12 percent), Quezon City (12 percent), Alabang (11 percent), and Ortigas CBD (10 percent).

In H1 2025, more than 50 percent of Metro Manila office transactions were expansions, with relocations accounting for 27 percent. Apart from outsourcing firms, industries engaged in flexible workspaces, logistics, banking and financial services and information technology (IT) continue to take up office space in Makati CBD, Fort Bonifacio and Ortigas CBD.

Promos for condos in MM

Developers remain focused on offering attractive and innovative promos especially for projects that have substantial unsold RFO stock. Select developers are offering up to 40 percent discount on total contract prices (TCPs) for spot-cash payments, early move-in, rent-to-own promos and even gift certificates of up to P150,000.

The promos appear to be working, with Colliers recording improved net take-up in Metro Manila in Q2 2025.

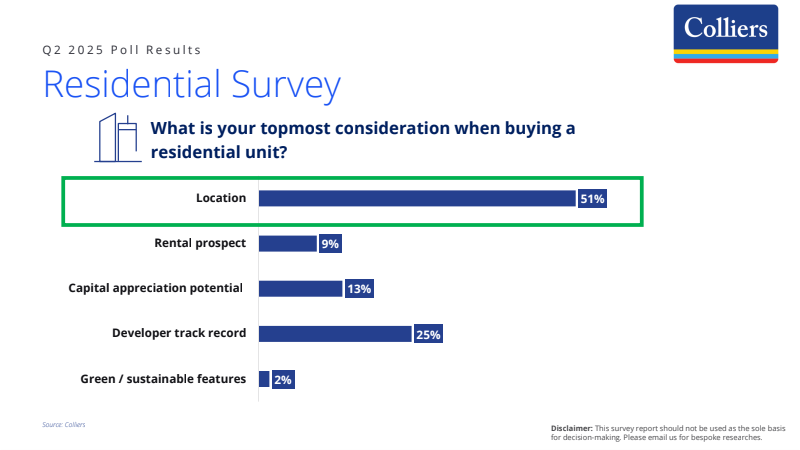

Topmost consideration

More than half of our respondents chose location as their topmost consideration when buying a residential unit.

In our view, buying a property in the right location is key. Vertical units that are located in integrated communities and near public infrastructure also have great capital appreciation potential and rental prospects. Colliers believes that these are important especially if a buyer decides to flip or resell his/her property in the future. Investors and buyers should also take into account the developers’ track record.

RFO inventory

As of Q2 2025, remaining condominium inventory in Metro Manila stood at 81,000 units; 30,600 of which are RFOs. Among the locations with high unsold RFO inventory include Quezon City, Pasig City, Manila, Mandaluyong, Makati Fringe, and Bay Area.

Colliers encourages buyers to be on the lookout for projects located in these areas as developers are likely to offer bigger discounts and more attractive payment terms due to slower demand and elevated vacancies for turned-over projects.

Hotel amenities and services

Results of our Q2 briefing poll showed that fitness centers/pools (24 percent), express check-in/check-out (20 percent) and hotel/airport transfer (20 percent) were essential amenities and services our respondents look for when staying in hotels.

We encourage hotel operators to be mindful of guests’ preferences. It’s obvious that guests put a premium on convenience and wellness. In our view, constant upgrading of services and amenities is crucial in attracting new guests and expanding base of loyal customers.

Locations to visit

Nearly half of our respondents chose Boracay and Palawan, trailed by Cebu (16 percent) and Siargao (16 percent).

Colliers encourages hotel operators to remain aggressive in targeting foreign visitors aside from the Philippines’ key source markets like South Korea and Japan. Developers should consider building hotels or leisure-oriented residential communities in popular Philippine destinations.

Next staycation

More than a third of the respondents chose Fort Bonifacio for their next hotel staycation destination, followed by Makati CBD (25 percent) and the Bay Area (19 percent). What’s interesting is that these business hubs are also attractive destinations for business travelers. Hence, hotel operators should continue offering and highlighting their mix of offerings to continue capturing a significant part of the business+leisure (bleisure) market.

Tapping this market is essential to draw more customers following the growing demand for meetings, incentives, conferences, and exhibitions (MICE) facilities in Metro Manila CBDs.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.