Pampanga’s sizzling property landscape

I haven’t written much about Pampanga recently. Over the past couple of weeks, I visited Cebu, Bacolod, and Iloilo and provided market updates to our clients and property stakeholders. Last week I focused on the attractiveness of Cavite and Laguna. It’s about time I featured my home province.

From the start of business process outsourcing (BPO) operations in Clark Freeport to the massive redevelopment and transformation of previously fringe locations such as Porac, there’s no doubt Pampanga’s property market is one of the most competitive across the Philippines, with a wide range of projects catering to all types of investors and end-users.

Born, raised, and schooled in Pampanga (I’m a proud Angeles City Science High School and University of the Philippines-Clark alumnus), I have seen how a former military facility has transformed into an important central business district (CBD), and how it attracted multinational outsourcing firms when the industry was just in its infancy in the Philippines. Some of the call center pioneers in the country first operated in Clark.

Angeles City is home to some of the old rich and landed families in Pampanga, and we have seen how major national developers partnered with homegrown developers to launch massive projects here. San Fernando was a witness to mall operators’ first foray into the province. Mabalacat City and Porac remain on the radar of developers launching house-and-lot and lot-only projects.

Top BPO site in the countryside

Clark continues to attract major BPO locators and is a key backup site for Metro Manila-based operations. Clark, Angeles, and San Fernando employ more than 20,000 outsourcing workers. Among the major locators in the area are Alorica, Beepo, Cloudstaff, Concentrix, iQor, Sutherland, TaskUs, TATA Consultancy, Teletech, Majorel, and VXI.

At present, BPO firms based in Pampanga provide a mix of voice and back-office as well as higher value knowledge process outsourcing (KPO) services such as health information management. The push to capture a greater slice of the higher-value outsourcing pie should be supported by a large number of science, technology, engineering, and mathematics (STEM) graduates in Pampanga and nearby Tarlac and Bulacan.

Maximize proximity to infrastructure

We encourage developers to be more strategic in launching new projects as proximity to public infrastructure projects helps raise land and property values, especially in key cities including Angeles, Mabalacat, and San Fernando.

Given the exciting new and upcoming public projects such as the NLEx-SLEx connector road and North-South Commuter Railway, we recommend that national and homegrown developers scout for feasible sites for vertical and horizontal residential projects outside the Angeles-San Fernando-Mabalacat-Magalang-Porac areas.

Assess viability of more townships

Over the past decade, Colliers has observed a more pronounced launch of new townships outside Metro Manila.

Pampanga, for example, has captured the interest of national developers.

One of the ongoing mixed-use developments is Rockwell at Nepo Center in Angeles City which will feature mid-rise residential condominiums, and Power Plant Mall Angeles, the developer’s first outside of Rockwell Center in Makati City. This is one masterplanned community that is likely to highlight accessibility and convenience for residents. We also see the development of a Power Plant Mall in Angeles cashing in on the rising disposable incomes of Pampanga consumers.

In our view, masterplanned projects in Pampanga will become more popular, especially among investors demanding a live-work-play-shop lifestyle. We see these projects cornering demand from experienced, affluent, and astute property investors.

Growing appetite for vertical developments

By end- 2023, Pampanga’s condominium stock had reached 3,900 units, more than double the 1,470 units recorded by end-2020.

From 2024 to 2026, Colliers expects the delivery of 550 new condominium units per year. San Fernando will likely account for about 62 percent of the upcoming supply during the period with the completion of Megaworld’s Bryant Parklane in its Capital Town township.

Other condominium projects in Pampanga that are recording good takeup rates include Rockwell Land’s The Manansala (sold out) and The Bencab in its Nepo Center township, SMDC’s Now Residences, Megaworld’s Chelsea Parkplace and Montrose Parkview, Alveo Land’s Marquee Residences (sold out), Century Properties’ Azure North towers (two out of three towers sold out), and Filinvest Land’s Golf Ridge in Mimosa.

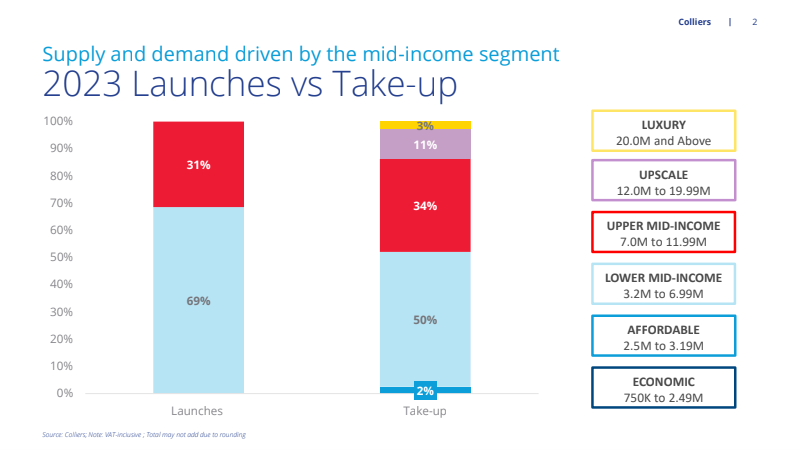

Takeup for condominium units in Pampanga is still heavily driven by the mid-income market. In 2023, the lower and upper mid-income segments (P3.2 million to P12 million) accounted for more than 80 percent of total condominium units sold in the province. But given Pampanga investors’ rising affluence and growing preference for vertical developments, I won’t be surprised if I see more upscale and even luxury project launches in the near future.

Nowhere to go…

National players continue to expand and look for developable parcels of land in Pampanga. This has resulted in a hefty increase in land values in the prime residential and office hubs of Angeles, San Fernando, Mabalacat, Magalang, and Porac. Meanwhile, some homegrown players remain active with their horizontal projects, looking at sites outside of their traditional growth areas.

Given the growing appetite for condominium units as investment options within Pampanga, Colliers has seen demand coming not just from Kapampangans but also from Metro Manila-based investors looking for residential investments outside of the capital region that have enormous price appreciation potential.

As a Kapampangan and a property analyst, I can tell you that Pampanga’s property market will only become more exciting moving forward. Just like my favorite sisig, Pampanga’s property landscape will definitely continue to sizzle for the years to come.

And akin to the trajectory of airplanes taking off from the runway of the recently-modernized Clark International Airport, there’s nowhere to go for Pampanga properties but up! -JOEY ROI BONDOC

For feedback, email joey.bondoc@colliers.com

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.