PH industrial: In the thick of things amid global trade shifts

The Philippines has been attracting high-value manufacturing investments which occupy industrial lots and warehouses.

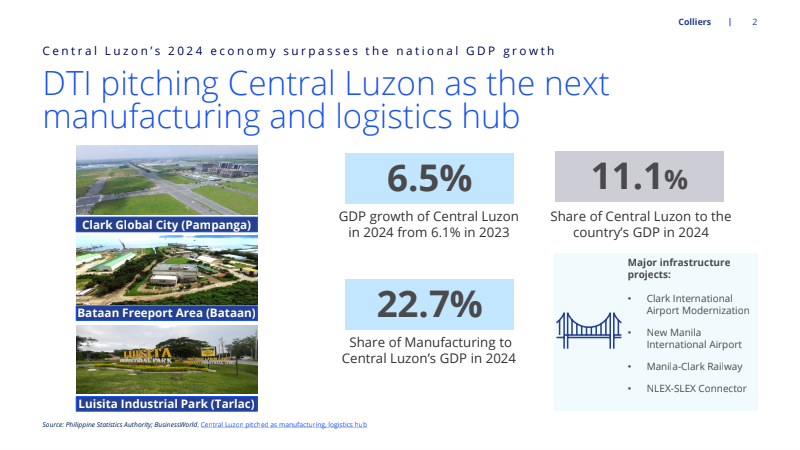

Central Luzon—especially Pampanga, Bulacan and Tarlac—has long been attracting multi-million dollar investments resulting in greater absorption of industrial space in the region.

Meanwhile, property developers have become prudent with their expansion plans in both Central and Southern Luzon. Aside from improving infrastructure network, sustained economic expansion, and availability of highly skilled workforce, Colliers believes that fostering a more conducive business environment will likely play a crucial role in sustaining the inflow of foreign direct investments into the country’s major industrial corridors.

Colliers Philippines believes that maximizing pro-investment measures is important in shielding the Philippine industrial sector from global geopolitical concerns, which could raise cost of doing business and hike prices of input that Philippine-based exporters use for their goods.

Aside from diversifying export markets, developers with industrial footprint should thoroughly assess expansion plans in the country’s two major industrial corridors. Instilling a more comprehensive supply chain and diversifying export markets are pivotal in raising our industrial sector’s competitiveness.

Maximize investments from non-traditional markets

Colliers encourages industrial developers to take advantage of the government’s efforts to attract investments from the country’s traditional and non-traditional trade partners.

During the past 12 months, investment promotion agencies (IPAs) such as Philippine Economic Zone Authority (Peza) and Board of Investments (BOI) have been actively enticing investors from Taiwan, South Korea, Japan, Thailand, Vietnam, Canada.

More companies will likely look into the Southeast Asia region as a new hub for manufacturing expansions driven by diversification of supply chain and tapping of alternative resources outside of China.

We expect the Philippines to likely benefit from the China+1 (C+1) strategy. According to Peza, several Chinese and Taiwanese firms have expressed interest to diversify and shift their operations to the Philippines due to US President Donald Trump’s new trade policies.

In our view, the Philippines needs an efficient supply chain system to capture investments amid Trump’s new tariff impositions. This is also crucial in future-proofing the country’s industrial sector, enabling the Philippines to attract foreign direct investments (FDI) amid challenges posed by elevated tariffs.

Central Luzon leads the way

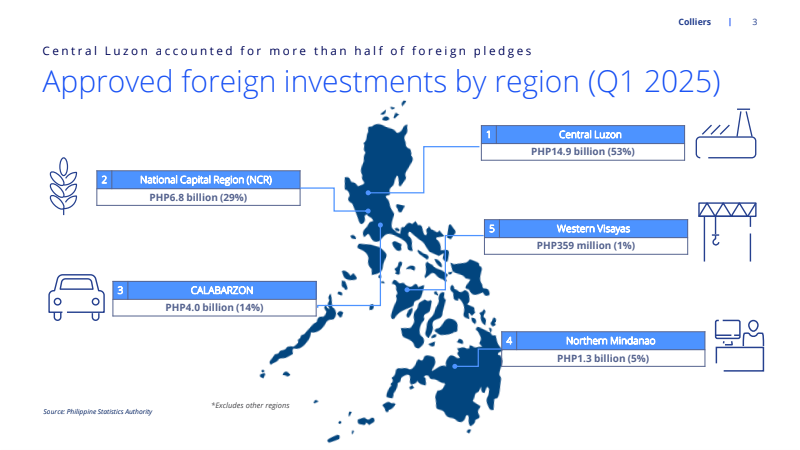

Data from the Philippine Statistics Authority (PSA) showed that Central Luzon (CL) attracted P14.9 billion worth of approved foreign investments in Q1 2025, representing more than 50 percent of the total P27.9 billion pledges during the period.

Colliers sees Central Luzon emerging as a key industrial hub outside the Calaba (Cavite-Laguna-Batangas) corridor, driven by investments from high-value manufacturers.

PLG Prime Global Co., one of the world’s leading manufacturers of luggage and travel goods, is planning to resume its operations in Hermosa Ecozone Industrial Park in Bataan. The company previously operated in Hermosa from 2018 to 2022 before transferring its luggage manufacturing facility to China.

Other industrial parks in Central Luzon which continue to attract locators include Aboitiz InfraCapital’s TARI Estate, which recently turned over a 42-ha lot to its anchor tenant. Meanwhile, Victoria Industrial Park expects up to 20 locators and plans to expand by up to 100 ha over the next three years.

In our view, Central Luzon’s proximity to Manila’s air and sea ports and ongoing industrial park developments by major property firms should further boost industrial activities in the corridor.

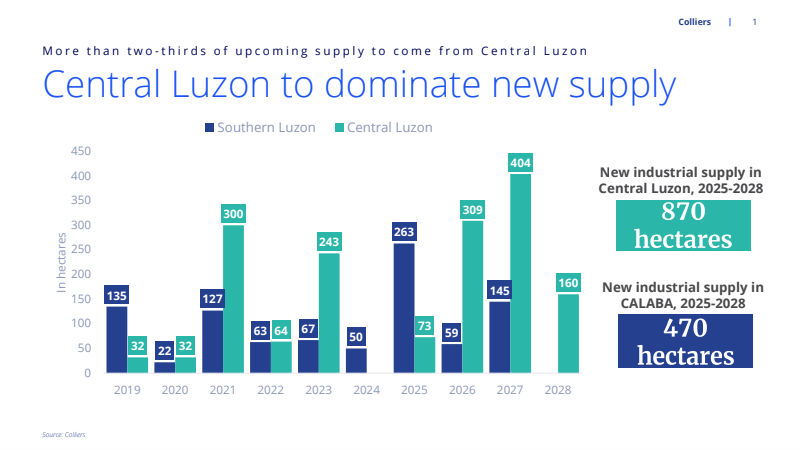

Aside from Pampanga and Tarlac, we also see the expansion of industrial activities in Bataan, Bulacan, and Subic. From 2025 to 2028, Colliers sees the delivery of 870 ha of new industrial supply in Central Luzon, almost twice the 470 ha of expected new supply in Calaba during the same period.

With a report from Mat de Lima, associate director for Capital Markets and Investment Services (CMIS) at Colliers Philippines

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.