Ready-for-occupancy: A smart move or a costly mistake?

Regardless of what analysts, experts and brokers have to say, the dream of homeownership will always be alive in the Philippines, with condominiums leading the charge, especially in urban living.

For many, the appeal of a ready-for-occupancy (RFO) condo unit seems like the most convenient and sensible option. But is it truly a wise investment? Or could it be a financial pitfall in disguise?

Are RFO units a smart buy?

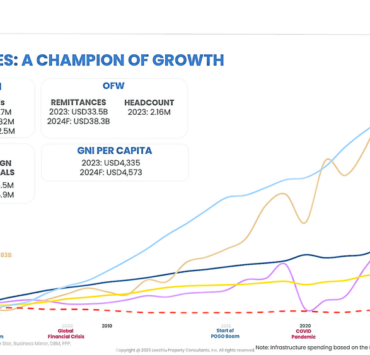

Philippine property prices have been on an upward trajectory over the last decade, despite economic headwinds.

According to the Bangko Sentral ng Pilipinas (BSP), the country’s Residential Real Estate Price Index (RREPI) saw a 6.5 percent year-on-year increase in Q3 2023, driven by demand for vertical living spaces in urban centers. While pre-selling units often get the spotlight for affordability, RFO units also have their own economic advantages.

Immediate use, immediate savings. Unlike pre-selling condos, which may take years to complete, an RFO unit allows buyers to move in right away, potentially saving on rental expenses while avoiding construction delays.

(https://www.aspc.co.uk)

Stable pricing, no surprises. Pre-selling units often look like a bargain until turnover fees, association dues, and fit-out costs creep in. RFOs offer a what-you-see-is-what-you-get deal. If the price fits your budget, you can proceed with fewer uncertainties.

Market resilience. The Philippine real estate market has historically remained resilient, even during financial downturns. The rise of real estate investment trusts (REITs), continued expansion of business processing outsourcing companies, and growth in expat housing demand contribute to the appeal of urban condos.

Who are RFO units for?

RFO condos cater to different types of buyers.

Aspiring homeowners. Those seeking a primary residence will find RFOs appealing for their immediate usability. However, buyers should thoroughly inspect units for hidden defects, check the quality of amenities, and most importantly, assess the developer’s track record.

Real estate investors. The rental market for condos, especially in Metro Manila, Cebu, and Davao, remains robust. A well-located RFO unit can generate rental yields of 5 to 7 percent annually, according to Colliers Philippines. However, the rental game isn’t foolproof. Vacancy risks, association dues, repairs and maintenance, real property tax and several other phantom costs must be factored into the ROI equation.

OFWs and remote investors. Overseas Filipino workers are major real estate buyers, often purchasing RFO units to fast-track relocation or as a tangible investment. However, distance can be a challenge. Engaging a reliable property manager is essential to ensure smooth maintenance and rental operations.

Dream vs reality

A home purchase is often emotional. We’re drawn to the vision of living in a high rise with stunning views, modern amenities, and a lifestyle upgrade. But it’s also one of the biggest financial commitments you’ll ever make. Here are a few things to watch out for.

Financing risks. Unlike pre-selling options, RFO units require larger upfront payments. Some buyers scramble to secure home loans, only to be hit by higher interest rates.

Property depreciation. Not all RFO units age gracefully. Be wary of buildings with high vacancy rates or maintenance issues. These are red flags of declining value. I personally look for online communities made and managed by unit owners so I get a feel of how properties are being managed, how buildings are being administered and how rules are being enforced.

Liquidity. Real estate isn’t easy to liquidate. If you need cash quickly, selling an RFO unit might take months, even years, especially in a slow market. You can’t expect to come across a ready buyer for something worth millions and a financial commitment worth a lifetime.

Connecting real estate to capital markets

A smart investor diversifies—and that means looking beyond real estate.

Stocks, bonds, mutual funds, UITFs and REITs can help maximize financial stability. With proper guidance and execution, these allow investors grow their funds faster, allowing them to purchase an RFO condo unit, with room to spare for all the costs that go with homeownership.

This is where investment supermarkets like FirstMetroSec come into play, empowering Filipinos to not just save, but also invest in a wide array of investment products from stocks, government and corporate bonds, to peso- and dollar-denominated mutual funds, unit investment trust funds and REITs.

REITs. Investing in REITs offers exposure to income-generating properties without the hassle of direct ownership. The Philippine REIT market has grown significantly, with some companies offering dividends exceeding 5 percent annually.

Stocks and bonds. These provide flexibility and liquidity. FirstMetroSec’s FundsMart allows investors to tap into funds professionally managed by the country’s biggest investment houses like ATR Asset Management, BPI Wealth, Manulife Investments, Philequity and Sunlife Asset Management through one powerful online account. If you want to start your investing and homeownership journey, just visit www.firstmetrosec.com.ph.

Is RFO right for you?

There’s no one-size-fits-all answer. If your finances allow it and you’ve done the research, an RFO unit can be a great investment. For those looking to make the smartest financial moves, combining real estate with strategic investments in capital markets ensures that your dream home doesn’t become a financial nightmare.

At the end of the day, it’s about building a future. Make your investments work for you, and turn your dream home into a reality with smart, informed decisions.

Email him at andoybeltran@gmail.com

The author has 19 years of experience as an entrepreneur, real estate investor, stock broker, financial literacy advocate, educator and public speaker. He is the vice president and head of Business Development and Market Education Departments together with the OFW Desk of First Metro Securities Brokerage Corp. and is a member of Metrobank’s Financial Education Editorial Advisory Board. He may be reached via andoybeltran@gmail.com