Recalibrate over retreat: Assessing what’s driving hospitality post-pandemic

Colliers Asia Pacific released its latest hospitality report entitled, “Asia Pacific Hospitality Insights May 2025: Recalibrating for Strategic Long-term Value Vision”.

This report highlighted the shift toward more deliberate, strategy-led growth. What’s notable is that key Asia Pacific markets are seeing sustained growth and further expansion in the near term. It also covers inbound tourist figures, expansion of international hotel chains and regional outlook beyond 2025.

The report also noted that hotel performance across the region remains resilient, with revenue per available room (RevPAR) rising–primarily driven by growth in average daily room rates (ADR). Interestingly, it added that near-term gains will likely be supported by higher occupancy, improved operational precision, and enhanced guest experiences.

Earlier, the Department of Tourism (DOT) reported that foreign arrivals reached 2.1 million in the first four months of 2025, down 0.8 percent year on year. Note that in 2024, total international tourists reached only 5.95 million, much lower than the government’s target of 7.7 million. This is compelling the DOT to look for other source markets including India.

Exploring markets

Like the Philippines, which relied heavily on Chinese tourists pre-pandemic, other regional economies are exploring alternative markets to buoy arrivals and tourism revenues. The report highlighted that Thailand, Vietnam, and South Korea–once heavily dependent on Chinese travelers–are now looking to the emerging wealth of India.

It added that “with a rapidly growing middle and upper class, Indian travellers are spending more per stay, seeking experience-led travel and becoming a reliable year-round source market. This pivot is helping many destinations sustain high room rates despite lower overall volumes.”

Nikhil Shah, managing director for Hospitality & Alternatives of Colliers India, stressed that “India is driving a structural shift in Asia Pacific’s hospitality landscape, fueling resilient domestic growth while emerging as a powerful outbound force.”

“With strong demand across the luxury, lifestyle and MICE segments, and rising investor confidence in experience-led assets, India is now central to regional tourism flows, sustaining premium pricing and reshaping travel dynamics. Despite limited liquidity in the investment market, robust valuations persist— not necessarily driven by cap rate-based transactions, but by long-term conviction in the sector’s future,” Shah said.

Hospitality trends

It’s a mixed bag for hospitality investment trends in other parts of the region.

Hong Kong remains a major market, attracting more than 12 million visitors in Q1 2025. Hotel occupancy rose to 88 percent in Q1 2025 with the Hong Kong Football Festival in July likely to attract more international visitors.

Indonesia continues to explore other demand sources but Bali, being a leisure-focused locality, remains a major crowd-drawer. Bali continues to attract luxury players including Mandarin Oriental.

Japan attracted a record 36.87 million foreign visitors in 2024 while domestic tourism is nearly matching pre-COVID levels. Japan remains attractive to global hospitality investors due to its favorable yield spread and long-term growth outlook.

Meanwhile, South Korea’s hospitality sector is gaining investor attention amid a tourism rebound and anticipated rate cuts. Developers are pivoting back to hotel projects as residential demand is slowing down. Foreign capital flowing into the country is increasingly active, as investors view hotels as a stable alternative to traditional real estate.

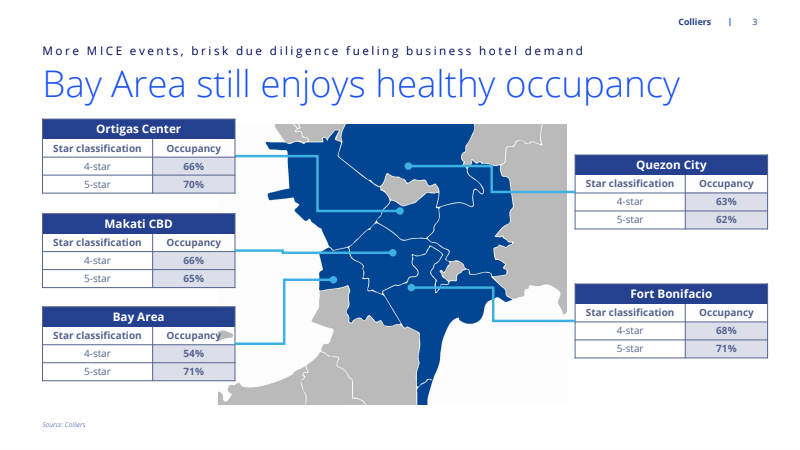

For the Philippines, Colliers anticipates stable hotel occupancy (above 60 percent) and a 3 percent average daily rate (ADR) increase in 2025, supported by rising foreign arrivals and brisk MICE activities. Developers are advised to align with airport infrastructure projects to identify future growth corridors and capitalize on evolving travel patterns.

Relentless expansion

We are seeing a relentless expansion of foreign hospitality brands in the Philippines. The travel and tourism sector has tremendous potential, given the projected rise in arrivals and modernisation of airports and other big-ticket public infrastructure projects across the country.

Adopting a bullish forecast, we expect average daily rates and occupancies to improve for the remainder of 2025.

For feedback, please email joey.bondoc@colliers.com

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.