REITs continue to deliver stability amid market shifts

In today’s uncertain investment climate, real estate investment trusts (REITs) have once again proven their resilience.

Despite significant volatility in both local and global markets, REITs in the Philippines are quietly outperforming broader indices, offering stability, income, and long term growth for investors.

Outperforming in a down market

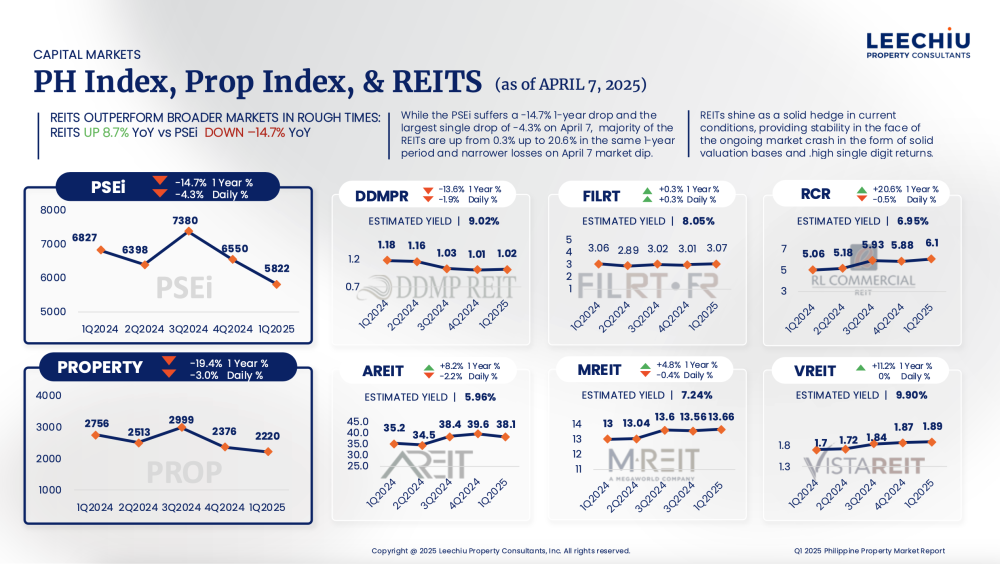

Amid news on Trump’s tariffs early April, the Philippine Stock Exchange Index (PSEi) recorded a 12-month decline, highlighted by the largest single-day drop of 4.3 percent on April 7.

In contrast, several listed REITs have not only weathered the downturn but posted positive returns, with gains ranging from 0.3 percent to 20.6 percent over the same period.

In this same 12-month period, the REITS outperformed not only the broader PSEi market but also the Property Sector stock index. This performance underscores how REITs can act as a defensive asset class amid economic headwinds and must be seen as an asset class in its own right.

Why REITs work

REITs offer the unique advantage of combining tangible real estate-backed stability with the liquidity of publicly traded equities.

Their income-generating nature—derived from professionally managed and balanced rental portfolio earnings—provides consistent dividends, typically in the high single digits. For investors seeking stable returns, particularly in times of low interest rates and uncertain capital markets, REITs offer a reliable stream of cash flow while maintaining capital value stability inherent to tangible real estate.

What also makes them attractive is transparency. Philippine REITs are governed by strict disclosure requirements and are typically backed by high quality commercial properties, many in prime central business districts (CBDs) like Makati, Bonifacio Global City, and Ortigas Center.

A strong hedge in tough conditions

We’ve observed that investors—both institutional and retail—are increasingly turning to REITs to hedge against inflation and declining equity valuations.

The underlying asset base of REITs—office buildings, logistics hubs, malls, and infrastructure projects—continue to hold intrinsic value even as paper assets fluctuate. With inflation under control and rate cuts anticipated from the BSP within the year, REITs may even enjoy valuation uplifts in the months ahead.

Looking forward

We believe REITs will play a larger role in the portfolios of forward-thinking investors. The performance in Q1 2025 serves as a strong endorsement of their value proposition—tangible real assets, steady income, professional management, and relative protection against volatility.

As more assets are securitized and more REITs enter the market, the opportunity set for investors will continue to expand. For those looking for safety without sacrificing returns, REITs remain one of the smartest plays in a market that is still finding its footing.

In the face of market uncertainty, REITs aren’t just surviving—they’re leading.

The author is the director of Investment Sales at Leechiu Property Consultants