Renewed optimism for Asia Pacific office market

Colliers Asia Pacific’s latest office report, entitled Asia Pacific Office Market Insights H1 2025, highlighted opportunities and challenges in key markets across the region. It specified potential demand drivers on the back of stable macroeconomic backdrop and what to expect moving forward.

Renewed momentum

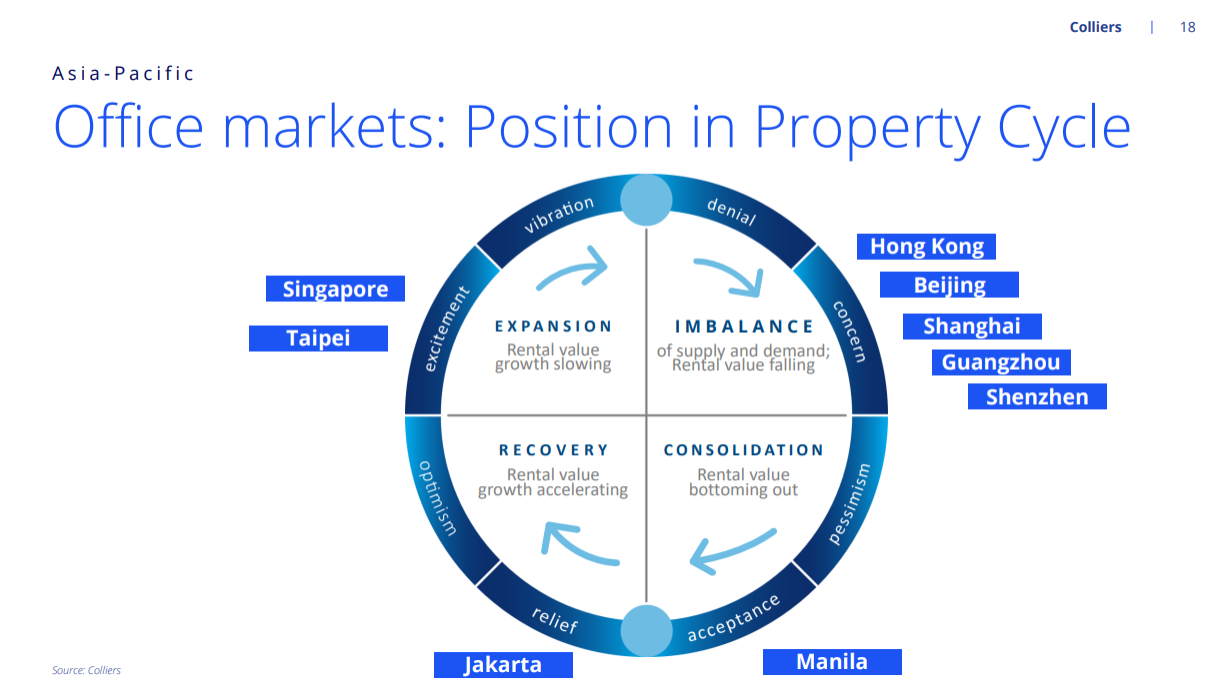

According to the report, the first half of 2025 marked a period of renewed momentum for the Asia Pacific office market.

Across 11 markets namely Australia, Mainland China, Hong Kong, India, Indonesia, Japan, New Zealand, Philippines, Singapore, South Korea and Taiwan, occupier activity gained pace, reflecting a broader recalibration of workplace strategies.

Beyond 2025, the outlook remains positive. Occupiers are increasingly focused on prime Grade A assets that offer flexibility, sustainability, and alignment with sustainability goals, signaling a structural flight to quality that is expected to define the next phase of growth across the region.

This is one trend we have been seeing in the Philippines, where companies have aggressively and proactively embraced a more sustainable approach with their leasing strategies.

Government agencies are transferring to newer and higher quality office space being offered at discounted lease rates. Large IT-BPM companies have also been the major occupiers of high quality office space in Metro Manila CBDs as well as Cebu, Davao, Bacolod, Iloilo, and Pampanga.

Sustained macro-economic backdrop

Colliers Asia Pacific’s office market report noted that economic growth continues to remain resilient in 2025, but possesses downside risks stemming from global demand fluctuations, trade volatility, and subdued consumption.

One key indicator mentioned was inflation, which largely remains under control across major economies due to effective policy measures by respective countries. The effect of trade volatilities on inflation, however, needs to be fully assessed.

Interestingly, it said that the pace of rate cuts by central banks in the region is likely to slow down and eventually interest rates are likely to remain steady at lower levels. Just like other property sectors, this favorable interest rate environment is a plus for Philippine occupiers and landlords.

In the Philippines, we also see a stable inflation environment and the lower interest rates to be beneficial to Metro Manila locators.

Vantage points: Philippine landlords and occupiers

Kevin Jara, Colliers Philippines’ director and head of Tenant Representation echoes this sentiment.

Jara said that amid global headwinds, the Philippine office market remains resilient and continues to recalibrate. A key driver of renewed demand is the return-to-office push, as companies re-establish their physical footprint.

Outsourcing firms—accounting for 48 percent of nationwide demand—are also reaffirming long-term confidence in the country by expanding operations and tapping into skilled talent beyond Metro Manila. This is fueling a more geographically diverse demand, with regional cities emerging as growth hubs.

With the market now defined by stable, reliable demand rather than vacancy shocks, and with favorable leasing conditions still in place, tenants are encouraged to secure prime spaces and long-term value.

Adaptability and flexibility

My colleague from landlord representation, Maricris Sarino-Joson, believes that adaptability and flexibility are important in today’s office market.

Adaptability keeps landlords ahead of the curve. By weaving sustainability and innovation into their properties, and pursuing certifications such as LEED, EDGE, WiredScore, or SmartScore while engaging energy-saving contractors to ease costs, they create smarter, greener spaces that tenants value today and will demand tomorrow.

Flexibility, meanwhile, is now the landlord’s greatest selling point. Shorter, more tenant-friendly lease terms and fitted spaces remove barriers for businesses, ensuring offices stay filled and properties remain relevant in a constantly shifting market.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.