Residential market turning a corner as luxury units proliferate, dominate

Metro Manila’s condominium market is starting to see the proverbial light at the end of the tunnel, after a precarious Q1 2025 when we recorded substantial backouts in the pre-selling segment of the condominium market.

Philippine developers are now taking advantage of the growing demand for more expansive condominium segments, starting at P12 million per unit up to more than P100 million per unit.

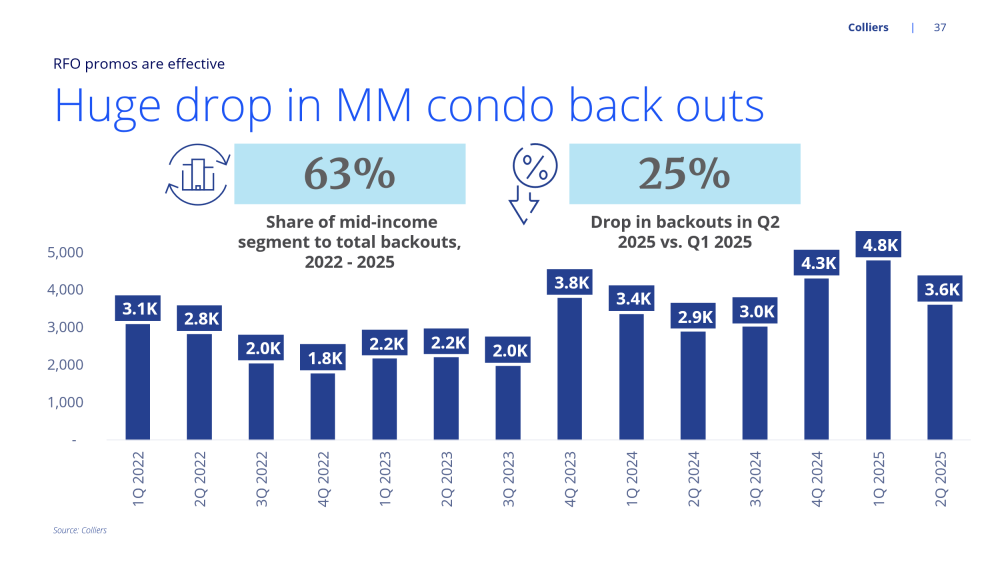

If there’s one common thing we have observed among developers’ improving condominium inventories, it is the aggressive implementation of ready-for-occupancy (RFO) promos especially for the mid-income condo units priced from P3.2 million to P12 million per unit.

What I also want to emphasize is the fact that not all business districts are reeling from the Metro Manila condominium slowdown. Certain business districts are doing better than others; specific vertical developments are outperforming some projects situated in the fringes; and specific price segments remain a cut above the rest.

Stifled delivery of new units

Colliers Philippines recorded the completion of 1,400 units in Q2 2025. Among the projects completed are in the Makati central business district (CBD), Ortigas Center, and Fort Bonifacio. For H2 2025, we expect the delivery of additional 7,200 units, with the Bay Area accounting for 71 percent of new supply.

We expect completions to drop to 5,800 units annually from 2025 to 2027, down 55 percent from the annual average of 13,000 units delivered from 2017 to 2019 at the peak of demand driven by Philippine offshore gaming operators (POGOs).

Gradual improvement in vacancy

Residential vacancy in Metro Manila continues to increase, with overall vacancy reaching 24.5 percent.

Bay Area’s vacancy reached 54 percent as it continues to reel from the impact of the POGO exodus. Other business districts like Makati CBD, Fort Bonifacio, Ortigas Center, Rockwell Center Makati and Eastwood City recorded below industry average vacancies, ranging from 5.7 percent to 19.5 percent.

We project vacancy to reach a record high of 25.8 percent by end 2025 before easing in 2026 to 25.3 percent, and further dropping to 23.4 percent by 2027.

This is one indicator that can guide developers where they should build next. A declining vacancy also indicates that the developers’ recalibrations are bearing fruit–from offering attractive RFO promos to limiting new launches in the capital region.

Net demand finally recovers

In H1 2025, take-up outnumbered backouts across all price segments from the economic (P750,000 to P2.5 million) to ultra-luxury segment (P100 million and above), with the exception of the upper luxury segment (P50 million to P100 million).

But we remain optimistic about the upper luxury segment, given that there was one project in Parañaque that raised backouts in this segment. If we take that project out of the equation, the segment would have recorded a positive net take-up, implying that most developers actively selling upper luxury units are posting net take-ups.

The good news for the period is that backouts dropped by 25 percent QoQ to 3,600 units in Q2 2025 after reaching a record-high of 4,800 units a quarter ago. As discussed, this is a clear indication that the developers’ innovative and aggressive RFO promos are effective.

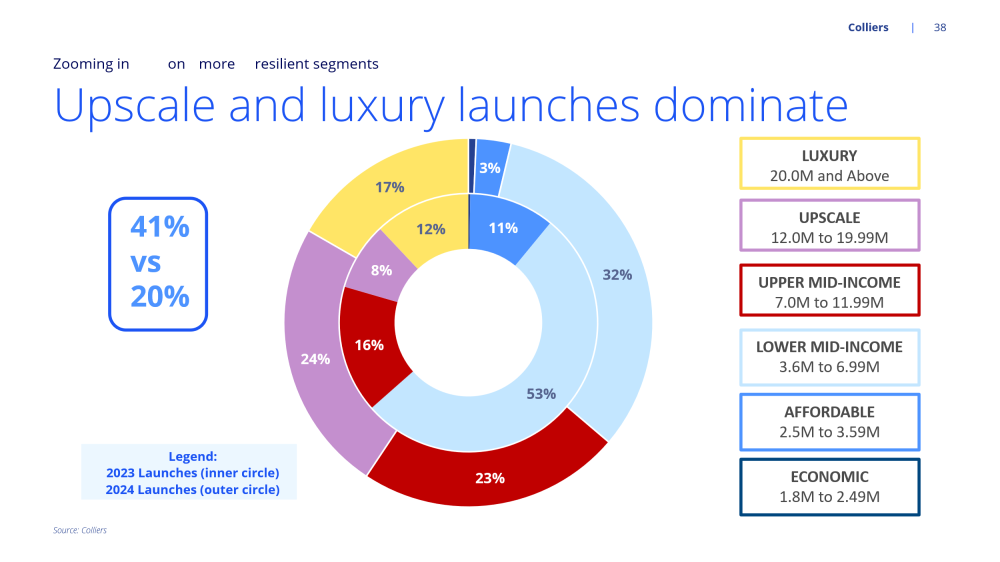

More expensive projects dominate

The share of upscale to luxury units (P12 million and higher per unit) to total launches is increasing. In 2024, these segments accounted for about 41 percent of total launches in the capital region, up from only 20 percent in 2023.

Among those recently launched include Ayala Land Premier’s Laurean Residences in Makati CBD, and Cebu Landmasters’ The Wave in Cebu IT Park. SM Prime has also launched its new luxury brand called Signature Series.

Unsold RFO inventory stood at 30,500 units as of Q2 2025, with the mid-income segment accounting for nearly half. Meanwhile, the upscale to luxury segments only account for 10 percent of the unsold inventory. This is one of the reasons why property developers continue to zero in on the high-end price segment.

Is the worst over for the Metro Manila condominium market? Hopefully.

But developers shouldn’t be complacent. Property firms should continue to innovate and recalibrate. After all, there are opportunities amid uncertainties.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.