Riding the cycles of a resilient PH property sector

The real estate sector moves through cycles of growth and decline.

Investors should be able to recognize and understand the highs and lows of this cyclical market if they aim to build a successful property portfolio.

Different phases

Real estate phases include recovery, expansion, hyper supply, and recession. And like any business cycle, industry experts said these phases aren’t time-bound nor are they predictable. One phase may last longer or shorter than another during some cycles.

A number of factors influence these cycles. For example: When the general public is doing well and flourishing financially or when the economy is stable, it is expected for the real estate market to perform well, too. Interest rates, the demographics of an area, and government policies also directly affect real estate cycles.

The Philippines is no exemption. Its real estate sector has already been through this cycle a number of times, allowing it to evolve into a resilient industry that has now become a significant contributor to the economy.

The industry may have faced periods of decline and weakened financial states, but as seen in the past, it has always circled back to expansions in ideas and designs, and property booms.

Government safeguards

The Philippine government has also implemented safeguards learned from the previous financial crises.

In 2002, for instance, a law was enacted to transfer non-performing loans of banking institutions to a separate entity called a special purpose vehicle, also a privately-owned asset management company. Idle assets and properties were then later developed as new emerging urban districts and other landmark developments.

Eventually, the real estate industry stabilized in the early 2000s with the help of reforms such as Republic Act No. 9225 or the Citizenship Retention and Reacquisition Act of 2003, which allowed foreign citizens to acquire dual citizenship in order to acquire estate properties in the Philippines. Increasing remittances from overseas Filipino workers (OFWs) likewise drove the construction of residential buildings and subdivisions.

Fueled by BPO demand

During this period, the growth of the business process outsourcing (BPO) industry also fueled the demand for office spaces, helping alleviate the oversupply situation, especially in Metro Manila’s central business districts.

The annual demand coming from offshoring and outsourcing sectors during this decade averaged more than 400,000 sqm, according to international property consulting firm Jones Lang LaSalle. This demand encouraged the development of new urban centers even outside Metro Manila.

As the cycle goes, however, the world faced a global financial crisis in 2008 and real estate demand dwindled as the economy weakened. Office rents fell by 15 percent as BPO expansions froze.

The crisis compelled the Bangko Sentral ng Pilipinas to strengthen oversight of banks’ real estate exposure by adopting stress testing.

Renewed investor confidence

By 2010, the Philippine economy bounced back and investors became confident once again to expand in the country.

The property boom was driven primarily by foreign investments, BPO sector, OFW remittances, and the growing tourism industry. The property market then started to flourish amid rapid urbanization and aggressive expansion of mixed-use developments; common spaces emerged as the needs of urban living evolved.

This marked the start of a decade-long bull run for the real estate industry.

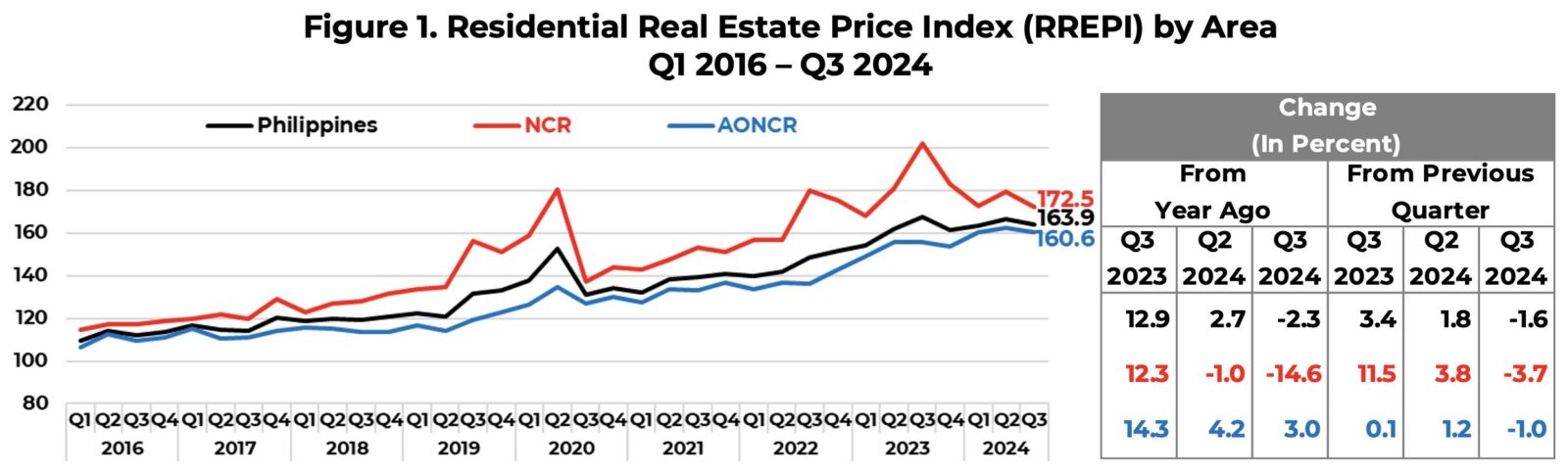

From 2016 to the first two quarters of 2020, the BSP residential real estate price index (RREPI) saw an upward trend. The RREPI is used as an indicator for assessing the real estate and credit market conditions in the country.

Pandemic slowdown

In 2020 however, the COVID-19 pandemic slowed down the growth of the Philippine economy, which also affected the real estate sector.

Growth from the past decade was halted as lockdowns took a heavy toll on economies, with unemployment, declining business and consumer confidence, and slowdown in remittance inflows affecting the industry.

Philippine house prices fell in the third quarter of 2020, which continued to be a bad performing year for the real estate market.

Recovery began in the second quarter of 2021 as the economy gradually started opening up, and increases in the RREPI have been more visible compared to the height of the pandemic.

Effects of government and business policies aimed at countering the losses during the pandemic became felt by the third quarter of 2022. Many businesses resumed normal operations and started implementing return-to-office plans, while the boom in e-commerce has likewise driven the demand for warehousing, logistics, and supply chain solutions.

Headwinds

Geopolitical tensions like the Russia-Ukraine conflict, however had put a strain on the continued growth of the property sector. The Philippine offshore gaming operators’ (POGOs) exodus also has had a significant impact on the office and residential markets in the country.

Mitigating or at least navigating these headwinds will demand a combination of agility and innovation on the part of property developers.

Growth opportunities

Concerns have emerged as residential property prices declined by 2.3 percent year-on-year in the third quarter of 2024—the first contraction since Q3 2021. However, experts remain optimistic as they highlighted the ample growth opportunities in the Philippine real estate market.

Addressing shifting demands with suburban townships and sustainable horizontal developments, tapping foreign brands to expand in the Philippines, and focusing on affordable and sustainable developments will definitely be important for the recovery of the real estate market.

The industrial and logistics sectors, buoyed by the e-commerce boom and decentralization, are also seen to maintain their resilience, along with opportunities for further growth via innovation.

Sources: Inquirer Archives, bsp.gov.ph, globalpropertyguide.com, jpmorgan.com, concreit.com