Shifting sands: Buyer preferences reshape Metro Manila condo landscape

While the Philippine economy goes full steam ahead, the condominium landscape is shifting, with developers and buyers navigating changing preferences and economic factors.

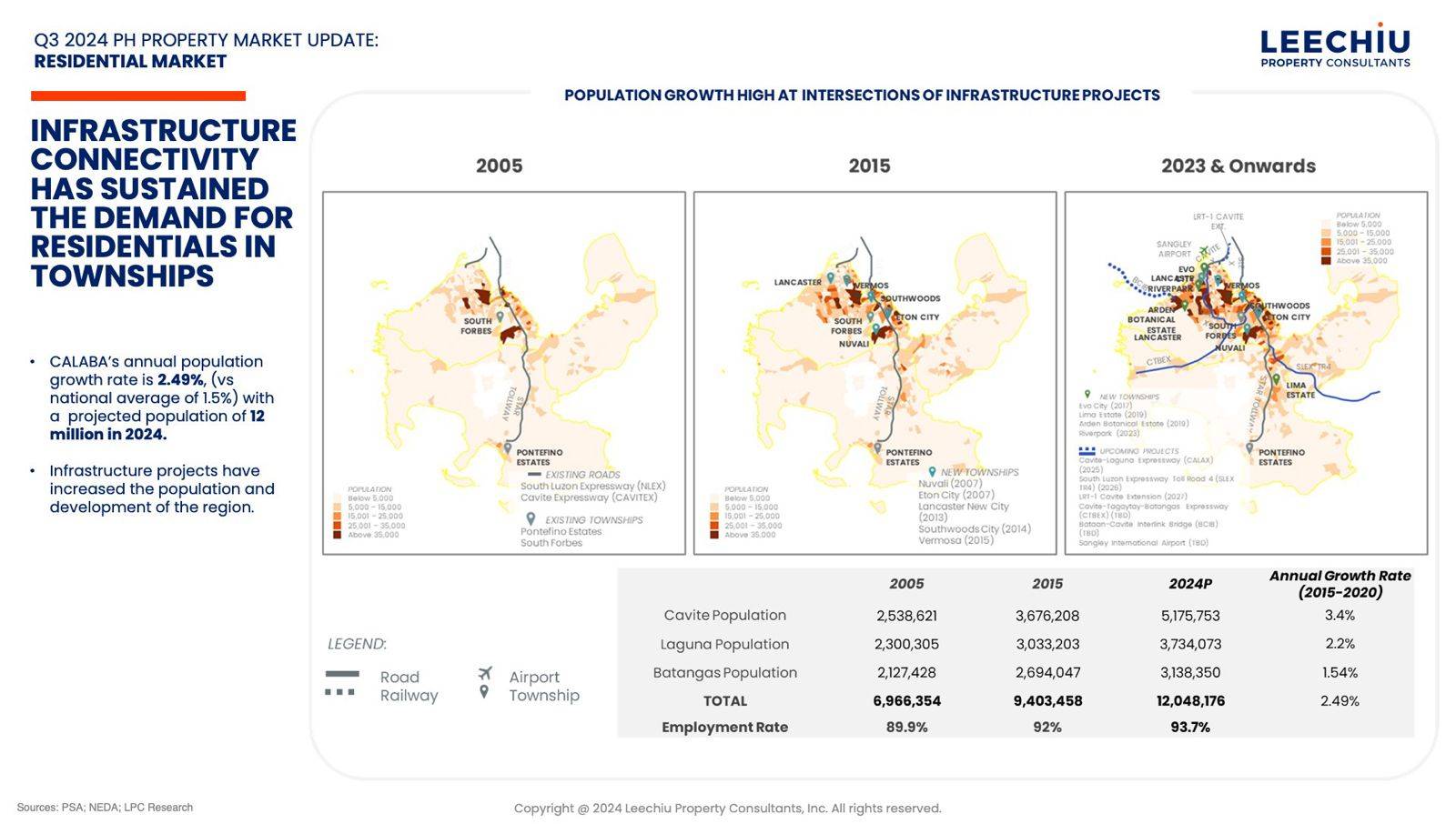

One major trend is the growing preference for properties outside Metro Manila’s bustling core. Buyers are increasingly drawn to nearby provinces, seeking more space, tranquility, and potentially lower prices.

Adding to the complexity is the prevailing interest rate environment. Higher borrowing costs are impacting affordability for potential buyers, further dampening demand for condos within the city. This is particularly evident in the decline of residential real estate loans (RRELs).

Resilient prime districts

Despite these headwinds, prime districts like Bonifacio Global City (BGC) and Makati continue to demonstrate resilience.

Capital values in these areas have steadily increased, with BGC posting a 2 percent rise and Makati a more substantial 8 percent growth. This can be attributed to the limited supply in these sought-after locations, as new developments tend to concentrate on the fringes of these central business districts.

Inventory options

Developers need to evaluate the marketing of their remaining inventory, possibly by recalibrating payment terms.

They can also offer assistance to buyers in furnishing and leasing their acquired units, as well as explore adding unsold units to their rental pools or setting up a hospitality business or a retirement facility. In this way, they can generate recurring income from unsold units, and sell to buyers looking for units that are already earning income.

Changing rental market

The rental market also reflects the changes in dynamics. Taguig, with BGC, has fully recovered to pre-pandemic rental rates, showcasing the area’s enduring appeal. Makati is also on the cusp of recovery.

However, other areas, including the Bay Area, Alabang, and parts of Makati, are grappling with the impact of the departure of Philippine offshore gaming operator (POGO) tenants, with rental rates still below pre-pandemic levels.

Careful approach

The recent BSP rate cut to 6.25 percent offers a glimmer of hope, potentially easing lending conditions for both buyers and developers.

Anticipated further rate cuts could provide additional stimulus. However, navigating the shifting sands of the Metro Manila condo market requires a careful approach.

With inventory levels at a post pandemic high, developers must adapt to changing buyer preferences. Factors like location, affordability, and amenities will play a crucial role in attracting buyers.

The Metro Manila condo market is in a state of flux. While challenges exist, the market has the potential to rebound as economic conditions improve and developers cater to evolving buyer needs.

The future of the Metro Manila condo market hinges on understanding and responding to these shifting sands. By adapting to new realities and embracing innovation, developers can navigate this evolving landscape and cater to the needs of a discerning and dynamic market.