South Luzon’s lasting viability for masterplanned communities

The Calabarzon Region, especially the Cavite-Laguna-Batangas (Calaba) corridor, remains a major economic and property hub. Its viability for more massive masterplanned communities is consistently brought to the fore.

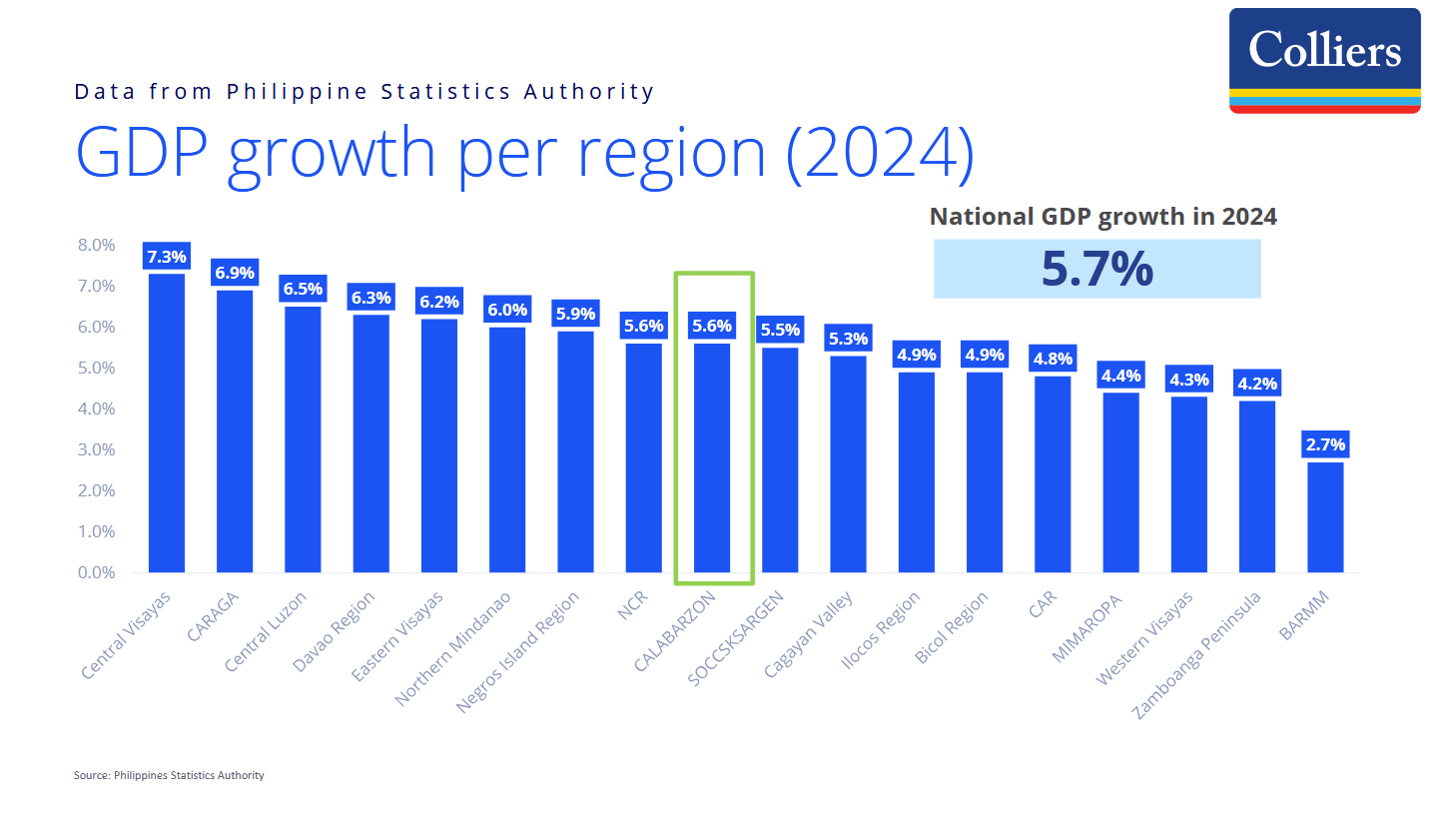

Sustained regional economic growth

Data from the Philippine Statistics Authority (PSA) show that the Calabarzon economy grew by 5.6 percent in 2024, almost at par with the national growth of 5.7 percent. The region is also the second largest contributor to the national economic output, next only to the National Capital Region (NCR).

Calabarzon’s economy is heavily driven by industrial activities, accounting for almost half of its aggregate economic output. The region retains its stature as the country’s major industrial hub.

Over the years, the region saw the influx of large multinational exporters and manufacturers which further propped up Southern Luzon’s viability as a major industrial and manufacturing corridor.

Infra raises competitiveness

The expansion of manufacturing activities in the region, however, requires better infrastructure.

We are optimistic that the major rail and expressway projects in the pipeline would support Southern Luzon’s expansion. Southern Luzon region is a major beneficiary of the national government’s infrastructure push.

Among the projects likely to benefit the region include the North-South Commuter Railway, LRT-1 Cavite Extension, NLEx-SLEx Connector Road, and Cavite-Laguna Expressway (Calax), Bataan-Cavite Interlink Bridge, Cavite Bus Rapid Transit, Cavite-Batangas Expressway (CBEx) and the Nasugbu-Bauan Expressway (NBEx).

The improvement of infrastructure network within and around the region is crucial in fostering sustainable and inclusive growth.

Aside from complementing business activities, major road projects lined up by the government will further unlock land values and raise property prices in the corridor, potentially raising demand for properties.

OFW segment fueling residential take-up

Calabarzon is also a major source of deployed overseas Filipino workers (OFWs), helping ensure stable end-user residential demand.

At Colliers Philippines, we always note that the P2.5 million to P7 million (affordable to lower mid-income) price range is the sweet spot of OFWs’ residential demand. Several developers have launched residential units in Calaba offering affordable to lower mid-income residential units.

Data from PSA showed that the region accounted about a fifth of the 2.19 million deployed OFWs in 2024. Based on the central bank’s latest Consumer Expectations Survey, about 12.7 percent of remittance-receiving households are allocating a portion of their remittances for their real estate purchases.

Given these data, we believe that remittances sent to Calaba households will play a crucial role in driving residential take-up across the country.

Strong residential take-up, sustained price acceleration

Cavite’s improving connectivity to Metro Manila as well as the aggressive launch of mixed-use communities helped lift raise land and property values in the province.

Average take-up of condominium projects in Cavite is at 87 percent, with an average price of P123,000 per sqm. For Cavite’s house-and-lot (H&L) segment, the average take-up rate is at 95 percent with an average price of P3.2 million per unit. Lot-only units in Cavite are about 92 percent sold, priced at an average of P20,000 per sqm.

Meanwhile, Laguna remains an attractive option among investors and end-users who plan to live and invest in less dense communities.

Average take-up of condominium projects in Laguna is at 88 percent, with an average price of P122,000 per sqm. For Laguna’s H&L segment, the average take-up rate is at 94 percent with an average price of P3.7 million per unit.

Lot-only units in Laguna are about 94 percent sold, priced at an average of P18,000 per sqm. Colliers sees the entry of national players further raising average condominium and lot prices in Laguna.

Meanwhile, the continued development of infrastructure projects around Southern Luzon especially Batangas and stable inflow of industrial investments should partly raise residential land and property prices in the province.

Average take-up of condominium projects in Batangas is at 85 percent, with an average price of P138,000 per sqm. For Batangas’ H&L segment, the average take-up is at 88 percent with an average price of P3 million per unit. Lot-only units in Batangas are about 89 percent sold, priced at an average of P14,000 per sqm.

These formidable demand figures have supported the sustained price acceleration of residential projects in the Calaba corridor from 2016 to 2025.

Townships’ aggressive differentiation

The continued evolution of residents’ and investors’ preferences has resulted in further innovation and differentiation of property projects, with major townships that integrate the live-work-play-shop lifestyle now proliferating across the region.

Developers are actively integrating retail, hotel, and institutional components such as schools and hospitals into their township developments.

Some property firms are also taking a more aggressive stance with their differentiation strategies and are also building massive conference halls, beachfront properties, golf communities, and active lifestyle amenities such as biking and hiking trails.

In an increasingly competitive environment, developers need to distinguish their projects from others.

Apart from the typical land uses such as office, residential, retail and hotel, developers in South Luzon should actively incorporate institutional uses such as education and healthcare as well as entertainment and recreational facilities for outdoor sports such as football and wakeboarding.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.