Top emerging locations for new malls in the Philippines this 2025

Retail development in the Philippines is accelerating in 2025, with a robust pipeline of new mall projects spread across key urban growth centers outside Metro Manila.

As consumer activity continues to rebound and tenant performance surpasses pre-pandemic benchmarks, developers are pivoting toward expansion—particularly in underserved and fast growing provincial markets.

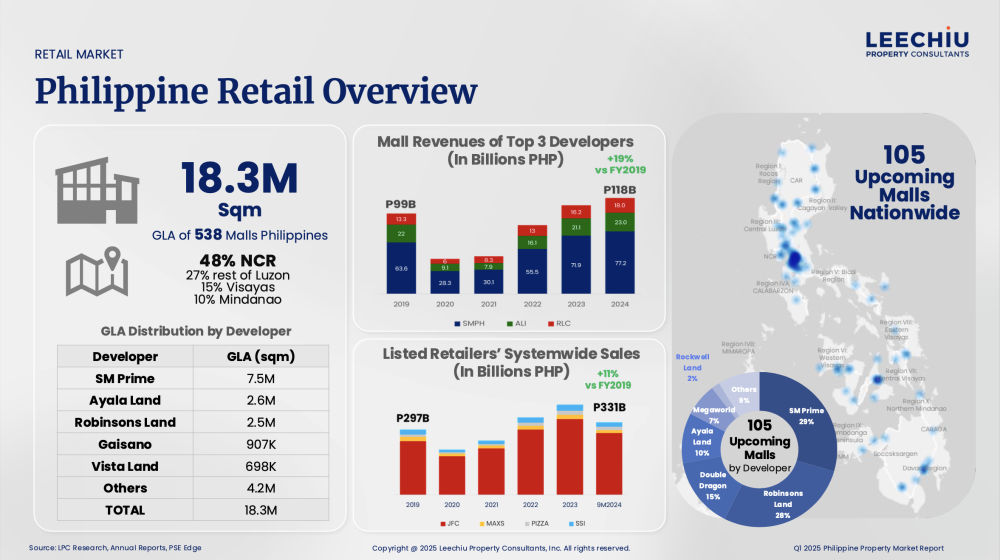

Recent industry data showed that developers have an estimated 105 new malls planned for upcoming projects. While major developers remain active in Metro Manila, the most notable growth is occurring in regional urban hubs, where infrastructure expansion, population growth, and increasing consumer demand are creating new opportunities for retail.

Central Luzon, Calabarzon lead provincial push Central Luzon and the Calabarzon Region remained at the forefront of mall expansion. These regions benefit from improving road networks, a rising middle-class population, and proximity to Metro Manila.

Developers are strategically positioning malls along major thoroughfares and within townships, often adjacent to residential and industrial zones that provide consistent foot traffic.

These areas are also home to emerging mixed-use districts and transport-oriented developments that make them attractive for tenants and end-users seeking convenience and accessibility.

Strong activity in VisMin

In Visayas, Cebu, Iloilo, and Bacolod are seeing increased developer interest.

Cebu, in particular, continues to anchor regional expansion, supported by its status as a business and tourism hub. Iloilo and Bacolod offer compelling growth stories driven by rising urbanization and consumer demand from neighboring provinces.

In Mindanao, Davao is attracting retail investments with its stable economy, growing consumer base, and maturing commercial landscape. The city is viewed as a gateway to southern Mindanao and has proven itself as a viable location for national and regional brands.

Open-air and lifestyle formats

The new wave of malls reflects evolving preferences in consumer behavior and retail development.

Developers are increasingly leaning into open-air, lifestyle-centric, and mixed-use formats, rather than traditional enclosed mall designs. This shift is partly in response to post-pandemic preferences for outdoor environments and integrated experiences.

Retail spaces in upcoming malls are expected to focus on food and beverage, health and wellness, and experience-based concepts, in line with national trends showing strong revenue growth in these categories. As of 2024, food and beverage retailers have already exceeded pre-pandemic performance by 11 percent, underscoring sustained demand for in-person dining and social interaction.

Rising revenues drive confidence

The renewed confidence among mall developers is backed by performance data.

In 2024, the top three mall operators in the Philippines recorded revenues 19 percent higher than pre-pandemic levels. This performance has strengthened the case for expansion, particularly in cities and regions where modern retail infrastructure is still catching up to demand.

Between 2019 and 2024, 977,000 sqm of new gross leasable area (GLA) was added to retail portfolios—a 9 percent expansion over five years. The trend is expected to continue, with more retail supply set to be delivered through 2025 and beyond.

Opportunities for retailers and investors

The 2025 retail pipeline signals a clear shift in strategy among mall developers—building where growth is happening. With the majority of new projects rising outside Metro Manila, retail is playing an important role in shaping the next generation of commercial centers across the Philippines.

Tenants looking to expand regionally and investors eyeing long term commercial opportunities will find increasing value in locating within these fast growing districts. As these markets mature, early movers are likely to benefit from stronger brand visibility, loyal customer bases, and access to emerging consumer segments.

As the retail landscape continues to evolve, access to timely market insights and location-specific data has become increasingly important. For tenants and investors exploring opportunities in emerging districts, working with experienced real estate advisors can help clarify options, assess long term viability, and support more informed decisionmaking.

The author is the executive director for Commercial Leasing at Leechiu Property Consultants Inc.