Unearthing the popularity of JVs

Real estate is an economic segment that has essentially reflected the boom-and-bust cycles of the Philippine economy.

Similar to other markets across the globe, the Philippines’ property development segment is highly cyclical as well. It’s a sector that practically mirrors the performance of the national gross domestic product (GDP).

Naturally, easing inflation results in policy rate cuts, which should redound to lower mortgage rates.

Barring any major global health or economic crisis, these positive indicators, complemented by sustained economic expansion, should result in a brisker take-up of residential units across the country.

Economic growth prospects

The Philippines has been recovering well postpandemic. From an economic contraction of 9.5 percent in 2020, the country’s GDP growth has been steady since 2021, with expansion averaging 6.1 percent a year from 2021 to 2024.

The Philippines is primarily a consumption-driven economy, with personal expenditures covering about 70 percent of the country’s aggregate GDP.

But crucial to sustaining a fast-paced, inclusive and sustainable growth is the country’s ability to attract more foreign direct investments (FDI), including those funneled into property development.

On the radar of foreign developers

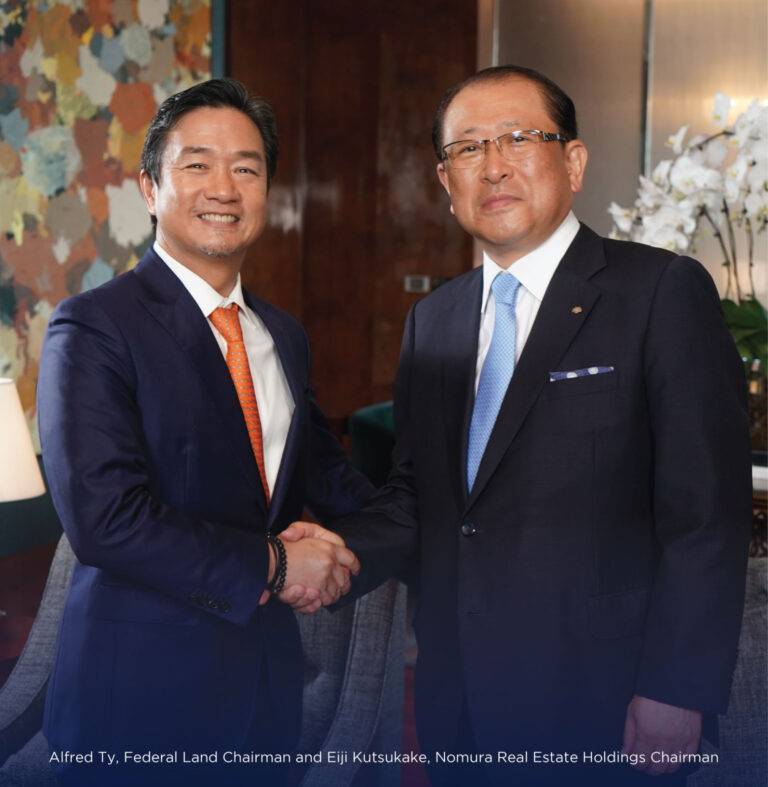

Prior to the pandemic, Colliers observed various Japanese companies investing in the local property market.

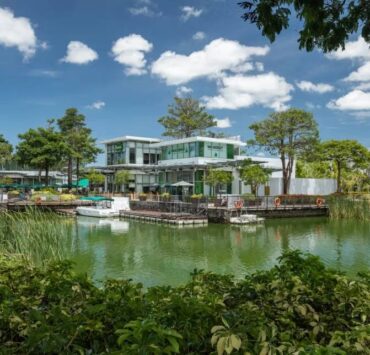

A great part of these investments were earmarked for horizontal developments outside the country’s capital, while a portion was allocated for high-rise residential towers in the central business districts (CBDs) of Metro Manila.

Colliers Philippines believes that local property firms should seize opportunities in the market by partnering with foreign developers for their residential projects. In our view, these joint ventures (JVs) should help local players differentiate and eventually stand out in a constantly evolving property market.

Especially in a property segment where launching massive townships has become the norm, collaborating with foreign developers allows local players to differentiate their partner’s unique placemaking strategy. This enables the JV firm to build not just physical structures but also destinations, effectively enhancing masterplanned communities’ livability and capital values.

It is also crucial for the JV firm to highlight project offerings like high-end amenities, integrated features, topnotch after sales service and strong capital appreciation potential to capture the interest of an affluent, discerning market.

JV is the way to go

In our view, Filipino developers should maximize the thriving popularity of joint venture projects, whether vertical or horizontal.

Local property firms should explore partnerships with foreign developers and launch premium condominiums or leisure-centric developments outside the metro.

Some JV projects outside Metro Manila are focused more on the horizontal (house-and-lot and lot-only) segment. This is understandable as these types of developments are geared towards the end-user market.

What stands out is that these JVs have so far been able to stand the test of time—from the lukewarm take-up at the height of the pandemic, stifled reservations caused by the exit of Philippine offshore gaming operators (Pogos) to shelved investor appetite at the outset of the flood control issue.

Moving forward, we expect these JVs to continue as local and foreign companies mutually benefit from these developments.

While foreign firms are enticed by strong end-user demand outside Metro Manila and potential for price acceleration, local players gain by being vouched for by prominent international brands. This is true for Japanese brands that are renowned for their globally recognized architectural and engineering standards.

The formation of more real estate JVs is a positive trend that we see for the Philippine property. It’s a win-win situation for local and international players, as well as for every Filipino aspiring to one day purchase his or her own home.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.