Unlocking vast opportunities along Metro peripheries

The Philippine economy remains one of the fastest growing in Southeast Asia.

Second only to Vietnam in terms of gross domestic product (GDP) expansion, the country continues to benefit from a young workforce. This places the Philippine economy in a demographic sweet spot, with a majority of young Filipinos gainfully employed and emerging as a formidable residential market in the near term.

In our view, steady GDP expansion is essential for the country to generate decent jobs and ensure growth in individual incomes and purchasing power across Filipinos. These factors are critical in sustaining residential demand.

In our view, steady GDP expansion is essential for the country to generate decent jobs and ensure growth in individual incomes and purchasing power. These factors are critical in sustaining residential demand.

Competitive interest, mortgage rates

The Bangko Sentral ng Pilipinas (BSP) cut its policy rate for the fifth straight meeting, reducing the benchmark rate by another 25 basis points (bps) to 4.5 percent in December 2025, the lowest since September 2022.

The BSP said inflation outlook remains within the target range of 2 to 4 percent but highlighted the weaker economic outlook and the decline in business confidence as key reasons for further rate cuts. Since August 2024, the BSP has cut a total of 200 bps.

Colliers is optimistic that the latest round of rate cuts will benefit the Philippine property market. Significantly lower policy rates are expected to translate into more competitive mortgage rates.

This should have an impact on residential demand, especially for the mid-income segment (P3.6 million to P12 million per unit), which has shown some recovery in recent quarters.

Rising demand for student-centric condos

Overseas Filipino workers (OFWs) will also continue to be a major plank of demand growth.

The P2.5 million to P7 million (affordable to lower mid-income) segment remains the sweet spot of OFWs’ residential demand. The BSP’s latest Consumer Expectations Survey showed that 14.3 percent of remittance-receiving households allocate part of their remittances to real estate.

This year, OFW inflows will continue to play a pivotal role in fueling residential demand. Parents working abroad will continue to set aside money to acquire units for their families especially for children entering college. OFWs’ preference for condominium units catering to students was evident during my international roadshows.

Mid-income market roars back

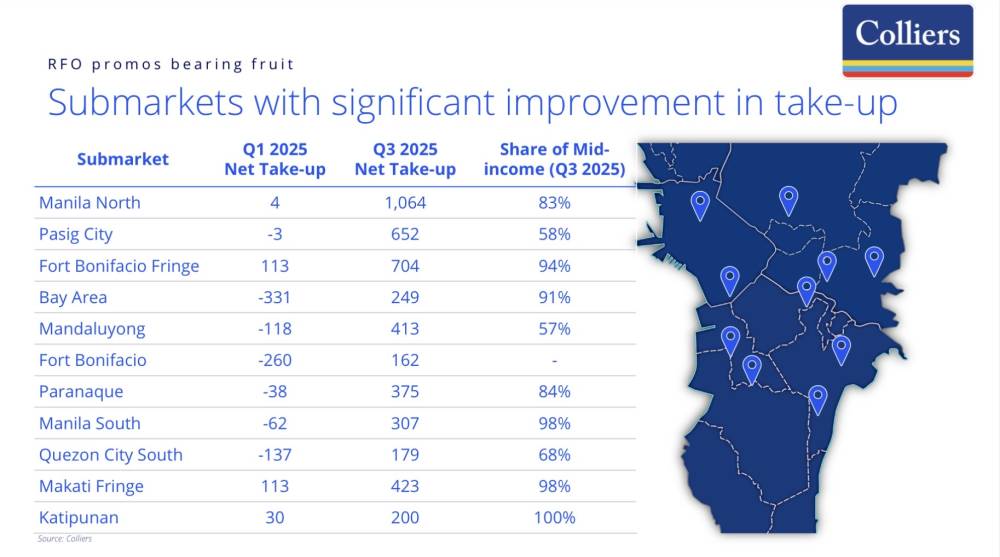

The Metro Manila pre-selling condominium market has pulled a surprise in Q3 2025, recording an increase in net take-up for two consecutive quarters.

The sustained decline in back-outs also indicates that the decent net demand in Q2 was not a blip, and that buyers are responding positively to the attractive ready-for-occupancy (RFO) promos and discounts being extended by property firms.

Interestingly, the affordable to mid-income price segments (P2.5 million to P12 million per unit) accounted for more than 90 percent of net take-up in 9M 2025.

It’s important to note that these segments are starting to rebound, as their price range appeals among Filipinos working abroad and local employees. These segments also accounted for about 80 percent of condominium completion in Metro Manila from 2016 to 2024.

With improving net take-up in the pre-selling market, it’s crucial for developers to constantly be on the lookout for parcels of developable land especially along the peripheries of major business districts where land is relatively cheap and new residential developments can cater to the affordable to mid-income segments.

Opportunities in Metro Manila peripheries

The lack of developable land and soaring prices in central business districts (CBDs) are driving more developers and investors to consider condominium projects in Metro Manila fringe areas.

Results of our Residential Survey showed that our respondents are considering to buy condominium units in peripheral areas such as the Makati fringe as well as parts of Quezon City, and Pasig City.

Colliers’ Q3 2025 data showed that condominium projects along the Katipunan area are doing well, with projects priced from P2 million to P11 million, enjoying an average take-up of nearly 90 percent.

Upgraded amenities

Colliers encourages developers with residential units along fringe areas to highlight the overall living experience of their projects such as amenities, landscape features, retail options, and accessibility.

Developers should continue promoting the upscale amenities and facilities that they offer within their residential developments.

As Colliers Philippines previously highlighted, proximity to infrastructure and institutional establishments such as schools and hospitals, will remain crucial in stoking residential appetite in the market. This should be complemented by additional features such as resort-like pools, modern and well-equipped gyms, yoga facilities, garden gazebos, as well as electric vehicle (EV) charging stations.

In a constantly evolving Metro Manila residential market, standing out by offering these amenities is important, whether the target market is an astute investor or highly mobile and dynamic end-users including young professionals and students.

Prior to joining Colliers in March 2016, Joey worked as a Research Manager for a research and consutancy firm where he handled business, political, and macroeconomic analysis. He took part in a number of consultancy projects with multilateral agencies and provided research support and policy recommendations to key government officials and top executives of MNCs in the Philippines.