US offshoring bill raises concerns, but PH IT-BPM sector remains resilient

A proposed US law called the “Keep Call Centers in America Act” has sparked discussion within the Philippine business community, particularly among stakeholders in the information technology and business process management (IT-BPM) sector.

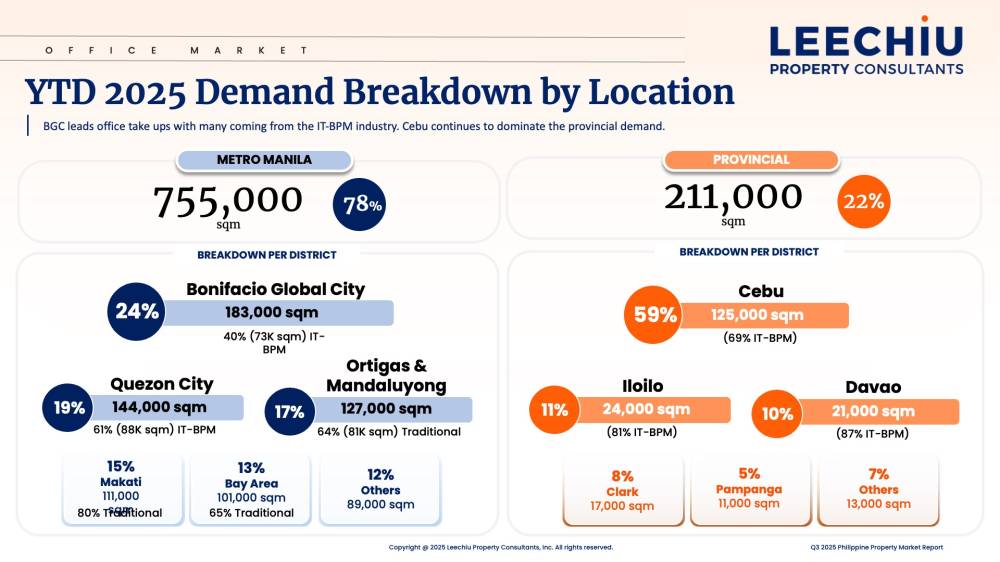

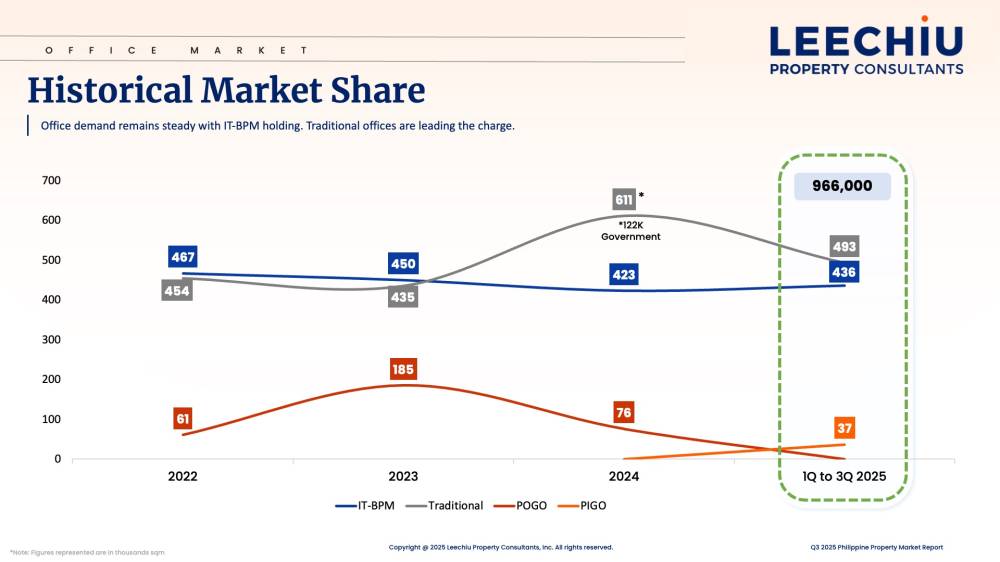

The measure seeks to limit offshoring by US companies—a move that will have direct implications for the 1.9 million Filipinos employed in the said industry, and the Philippine office market as IT-BPM firms account for nearly 45 percent of total leasing activity.

If enacted, the bill would require call center agents to disclose their location at the start of every customer call, giving US consumers the option to speak with a local counterpart instead. It would also compel US companies to notify their government 120 days before offshoring operations and impose penalties or blacklisting on those that do not comply, particularly firms that receive government funding or tax benefits.

What it could mean for the Philippines

Industry experts have noted that while the bill could temporarily affect expansion plans of some US-based outsourcing clients, it is not yet law. Similar proposals have failed to move forward in the past.

Our research shows that demand from IT-BPM firms remains the single biggest driver of office leasing across the country. Cebu, Clark, and Davao continue to see strong take-up from companies expanding outside Metro Manila, drawn by the deep talent pool, improving infrastructure, and availability of Grade A office spaces designed for outsourcing operations.

Even if some companies adopt a wait-and-see stance, the Philippines maintains a clear advantage in labor costs and operational efficiency.

Based on US labor data, a US-based call center agent typically costs companies $30 to $40 per hour including wages, benefits, and training. In contrast, the equivalent all-in cost for a Philippine-based agent is only $12 to $15 per hour. This significant difference continues to make the country a competitive choice for global firms.

Why the industry remains resilient

Beyond cost savings, the Philippines offers what many global firms value most: a skilled, English-speaking workforce and a stable business environment.

Developers also continue to deliver modern, BPO-ready office buildings that meet evolving tenant needs, including flexible layouts and sustainability features.

In Cebu, for instance, office absorption remains healthy, supported by the city’s established IT-BPM base and the availability of skilled workers. The sustained demand reflects how outsourcing firms are adapting to global uncertainty while continuing to anchor their operations in the Philippines.

Looking ahead

While the “Keep Call Centers in America Act” may create short-term concerns, many industry observers believe it is unlikely to pass into law. US firms continue to face higher labor costs and worker shortages, both of which reinforce the long-term case for outsourcing to the Philippines.

As one of the country’s most reliable growth sectors, the IT-BPM industry remains central to employment, real estate activity, and economic stability.

With strong local support, competitive costs, and proven operational expertise, the Philippines is well-positioned to remain a preferred destination for global outsourcing in the years ahead.

The author is the associate director for Commercial Leasing at Leechiu Property Consultants