EEI to assume P11.4-B debt of new property unit

EEI Corp. plans to shoulder the P11.4-billion debt of its newly acquired property firm while merging two more units to strengthen its real estate push.

In a disclosure on Thursday, the construction giant backed by the Yuchengco family said its board of directors had authorized the acquisition of the liabilities of First Orient International Ventures Corp. (FOIVC) in exchange for unissued shares in the latter.

This plan, however, still needs to be cleared by creditors and the Securities and Exchange Commission.

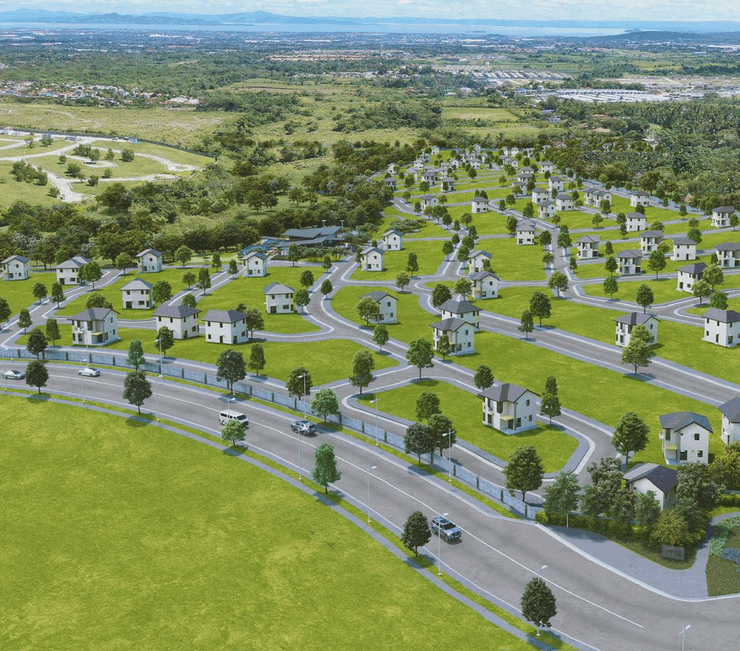

Last October, the listed firm took over the former Philippine offshore gaming operator hub at Island Cove in Cavite for P2.8 billion.

The acquisition of FOIVC marked the engineering firm’s efforts to cement its position in the real estate market.

Further, EEI said its board likewise greenlighted the consolidation of two wholly owned subsidiaries—EEI Ltd. and EEI Realty Corp.

This will be done through a share swap deal. EEI Ventures Inc. (EVI) will issue 300 million shares in exchange for full control of the two units.

EVI serves as the group’s investment and holding firm that is focused on real estate and emerging businesses.

“The consolidation also supports more efficient capital raising, as investors are increasingly drawn to “pure-play” business units,” it said.

“Housing nonconstruction assets under EEI Ventures makes it easier to attract strategic partners or explore future financing options without affecting the parent company’s balance sheet,” the group added.

The move may also help pave the way for EEI to pursue an initial public offering.

“The structure provides strategic flexibility for the future—whether through partnerships, joint ventures or an eventual listing—while keeping the group’s construction operations focused and protected,” it said.

As of end-September, the group’s consolidated assets stood at P40.04 billion.