Hustle alone won’t save you: Business model must be rock-solid

Too many entrepreneurs treat networking, marketing or content as magic fixes.

We join clubs, attend meetups, post daily, hustle hard. But no matter how busy you seem, if your business model is flawed, nothing sticks. I’ve learned this after mentoring thousands of entrepreneurs and guiding teams at Mansmith & Fielders.

Let me show you why so many fail despite the hustle, what a strong business model really means (including its 11 building blocks), how to evaluate yours and what to do when it’s broken.

What I see most often

Here’s what happens in the field:

- A founder spends P100,000 a year on networking, gets leads and conversations, but no orders follow.

- A business launches a flashy website, hires influencers, but can’t cover costs for goods, labor and distribution.

- Teams argue over marketing tactics without testing if people will actually pay.

These are symptoms of a broken business model.

Networking helps, but it can’t fix core flaws. Before your next event, campaign or partnership, make sure your business model works.

The 11-Block Business Model Framework

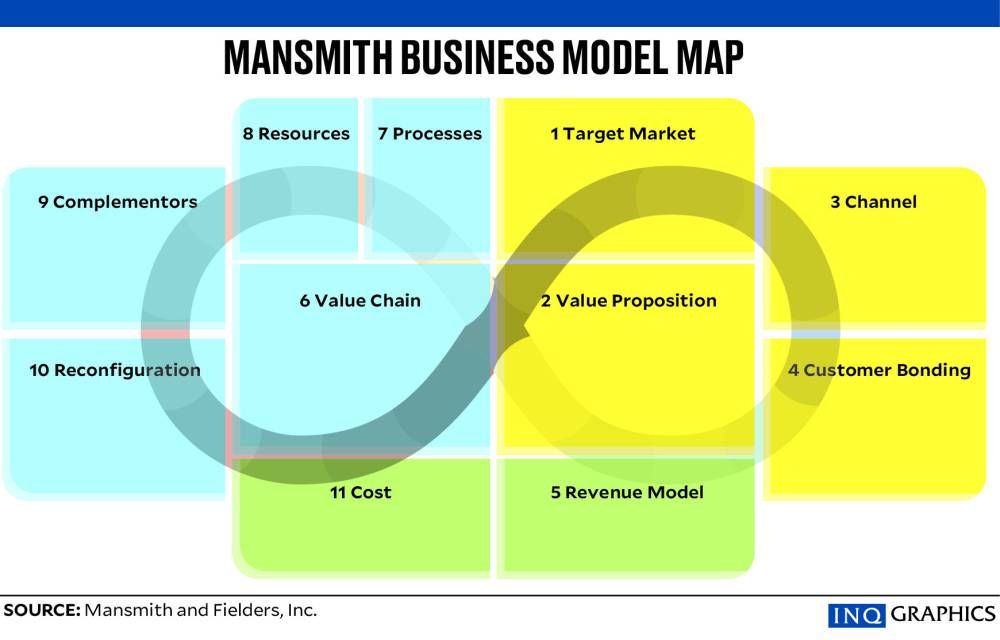

In June 2010, I launched the 11-Block Business Model Framework, a tool to diagnose and design business models across three critical components: the offering model, operating model and financial model. This framework has helped many companies build scalable, sustainable businesses.

The offering model starts with your target market, the specific customers whose needs you understand deeply. A vague audience means your offer won’t resonate.

Next is your value proposition: what problem do you solve, and why should customers choose you?

Then there’s your channel strategy: how your product or service reaches customers. Whether digital or physical, channel cost and efficiency affect your profitability.

Finally, your customer bonding strategy is a system to create loyalty and repeat buyers.

The operating model begins with your value chain: all activities need to deliver value, from sourcing to production, distribution and service.

Then, key processes are how you onboard customers, maintain quality, manage inventory and deliver service.

These systems make or break scalability.

Next, here are the key resources: your people, technology, brand, intellectual property and capital. Supporting these are your complementors: partners, suppliers, platforms, collaborators who add value or disrupt your operations if they fail.

The last block is reconfiguration, your business’s ability to adapt, pivot or innovate. This strategic agility is vital.

The financial model has two pillars. First is your revenue model: how you earn and collect income through subscriptions, one-time sales, licensing or usage-based pricing. Second is your cost structure, all fixed and variable costs like salaries, rent, logistics and service delivery. The balance between revenue and costs determines sustainability and profitability.

Together, these 11 blocks form a complete picture. Ignore one and you risk building something that looks good but fails under pressure.

Signs your business model is the problem

Even if you hustle and network, your business model might still be broken. Watch out for these red flags. There are too many to ignore!

- Market vagueness: You can’t describe your target market clearly and try to sell “to everyone.”

- Low-quality magnet: You attract low-value or hard-to-retain customers.

- Weak ‘why’: Your value proposition is superficial, and customers don’t see a strong reason to pay.

- Pain-free problem: You solve a problem that isn’t urgent or painful.

- Channel trap: Your channels are expensive, slow or confusing, and you rely too much on one.

- Leaky bucket: Low retention or repeat purchases

- Promo dependency: You rely only on discounts or promos to bring customers back.

- Broken product chain: Quality issues from weak sourcing or production

- Ecosystem fragility: Supplier or partner failures cripple you.

- Chaos scaling: Internal processes are chaotic; scaling causes more problems, not revenue.

- Founder bottleneck: The business can’t run without you or a few key people.

- Copyable company: No strong brand or intellectual property advantage; competitors easily copy you.

- Platform dependency: Too reliant on one platform or partner

- Stale strategy: No innovation; locked into old strategies despite market changes

- Revenue overreliance: One revenue stream or client dominates risk

- CAC-CLTV imbalance: High cost of customer acquisition (CAC) versus low customer lifetime value (CLTV).

- Margin squeeze: Costs grow faster than revenue; margins thin or negative.

- Overscaled overhead: Your fixed costs are too high or unnecessary for your current concept or scale.

The quick commerce case

Quick commerce, the ultra-fast delivery of low-margin goods, may seem like a breakthrough in logistics and last-mile delivery. But when evaluated using the 11-block framework, it reveals important strategic gaps.

Its target market is broad: urban millennials who value convenience but are often price-sensitive and prone to switching brands. The value proposition is centered on speed rather than quality, affordability or uniqueness. This raises the question: Is speed alone a sustainable differentiator?

The channel strategy depends heavily on paid digital media, increasing customer acquisition costs. Meanwhile, customer loyalty is built through promos and discounts, not long-term engagement, limiting repeat purchases and retention.

Operationally, the model demands capital: dark stores, real-time systems and rider fleets. While these deliver speed, they also create inefficiencies. Complementors such as, suppliers and logistics partners, offer limited differentiation, making profitable alignment difficult.

More critically, quick commerce may lack strategic flexibility. Can it pivot to slower, more profitable formats, or is it locked into speed at all costs?

Financial challenges persist: low basket sizes, thin margins and high operating costs weaken unit economics. Without external funding, many players struggle to sustain operations.

This raises important questions: Is the pricing model both viable and acceptable to consumers? Are decision-makers influenced by sunk cost fallacies or momentum bias?

Strategy is not just about innovation. It’s also about alignment, differentiation and long-term profitability. Quick commerce reminds us that growth without fundamentals is rarely sustainable.

Hustle matters: work ethic, persistence and visibility count. But hustle without a valid business model is wasted effort.

I’ve seen founders tirelessly take every meeting, post daily, cold call for hours, yet stall. Not from lack of effort or talent, but because the business mechanics don’t align. They promote something that:

- has no clear customer,

- has no scalable delivery system, or

- doesn’t make money.

In contrast, low-profile founders who focus first on product-market fit, profitable delivery and clear value grow slower but steadily, often with minimal public promotion. Their working business model amplifies the impact of marketing and networking, instead of compensating for failure.

How to evaluate and redirect your business model

If you’re unsure, the fix isn’t guesswork; it’s structured evaluation and testing.

That’s why I created the 55-video Business Model Course under Continuum Academy. It teaches founders how to formulate, evaluate and redirect their models using the 11 blocks.

This course is based on years of field application, with real, relevant examples for Filipino entrepreneurs. It’s practical and actionable, not just theory.

The goal is simple: help entrepreneurs answer these key questions:

- Is my value proposition strong enough to win and keep customers?

- Can my operating model deliver at scale, cost-effectively, without burning me out?

- Does my financial model give me the margin and cash flow to grow sustainably?

You don’t fix these by working harder. You fix them by understanding how the parts fit together and finding leaks.

What to do next

If you’re joining another networking group, investing in more content or launching another promo without clear results, do a strategic pause.

Ask yourself:

- Does my business model truly work?

- Are my offering, operating and financial models aligned?

- Am I solving a problem worth paying for, delivering it efficiently and making a fair return?

Use it to find weak spots and fix them before scaling.

Build your model first. Fix the foundation. Then market, then network, not the other way around.

Because in business, effort only works when the structure is sound.

Don’t just hustle. Build smart.

Josiah Go is chair and chief innovation strategist of Mansmith and Fielders Inc. He will speak at the 9th Mansmith Entrep Summit on Nov. 8: “De-Risk to Succeed: How to Spot the Flaws in Your Business Model

Before the Market Does.” It’s live nationwide via Zoom. Register early at mansmith.net to get a free copy of “Entrepreneurship: The Four-Gate Model,” the no. 1 entrepreneurship book in the Philippines today.

Josiah Go is chair and chief innovation strategist of Mansmith and Fielders Inc. He is also cofounder of the Mansmith Innovation Awards. To ask Mansmith Innovation team to help challenge assumptions in your industries, email info@mansmith.net.