MPIC income up 36% on brisk sales

Higher gains from its power and water businesses offset declines in the toll road unit of conglomerate Metro Pacific Investments Corp. (MPIC) in the first quarter, with its net income surging by 36 percent to P11.5 billion.

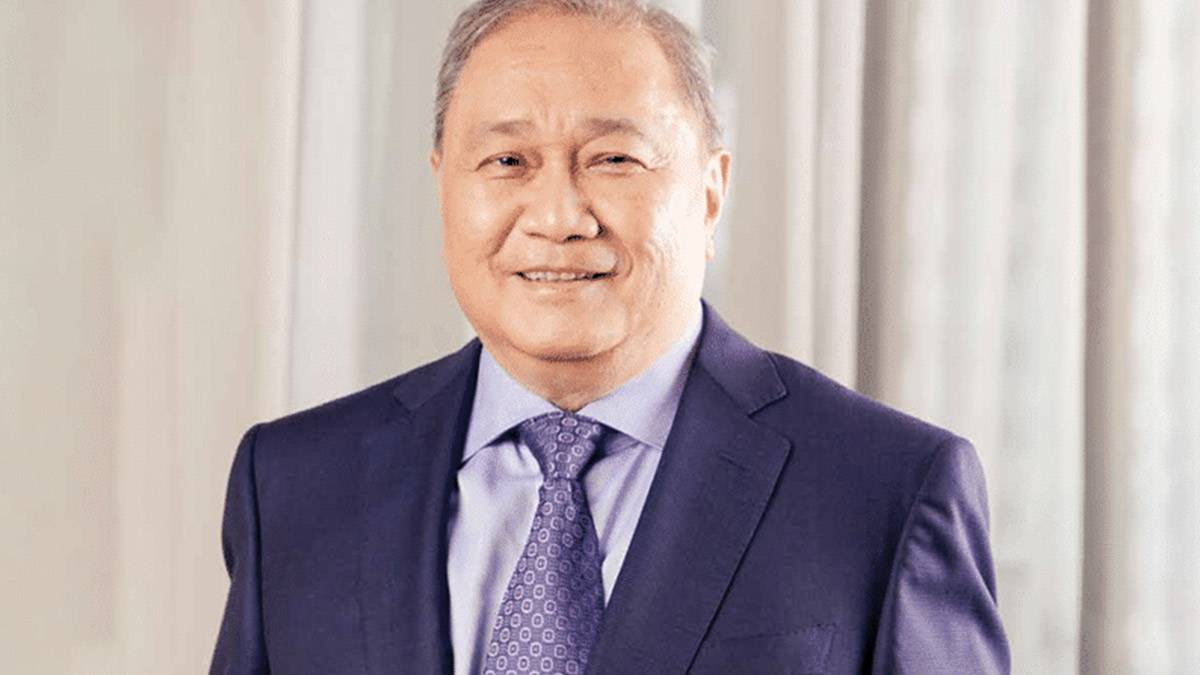

In a statement on Wednesday, the company led by billionaire Manuel Pangilinan said core earnings, which exclude nonrecurring gains, had jumped by 17 percent to P6.6 billion.

Operating revenues, meanwhile, rose by 9.5 percent to P19.3 billion.

“We are pleased with our strong start to 2025, marked by solid performance across our core businesses and improved earnings momentum,” Pangilinan, MPIC chair, president and CEO, said in a statement.

The tycoon also noted they were accelerating investments in power generation and agribusiness, as both were “critical to supporting national development and ensuring long-term value creation.”

“As we deepen our role in building essential infrastructure, we reaffirm our commitment to helping drive inclusive and sustainable progress for the Philippine economy,” he added.

Power distribution under Manila Electric Co. (Meralco) grew net income during the period in review by 9 percent to P10.4 billion, while total revenues climbed by a tenth to P114.5 billion.

This was on the back of a 2-percent climb in energy sales to 12,493 gigawatt-hours (GWh).

Sales in the residential segment went up by 3 percent to 4,257 GWh on newly energized accounts and slightly warmer weather during the quarter.

However, energy sales in the commercial segment were dampened by softer demand from the real estate sector following the exit of Philippine offshore gaming operators.

Maynilad revenues increase

West Zone concessionaire Maynilad Water Services Inc. booked a 6-percent increase in revenues to P8.6 billion as it benefited from an 8-percent tariff increase implemented in January.

Lower expenses and higher interest income resulted in its bottom line expanding by 17 percent to P3.6 billion.

At the same time, however, Metro Pacific Tollways Corp. (MPTC) reported a 15-percent decline in earnings to P1.5 billion, sans a similar one-time gain recognized in the same period last year.

According to MPTC, higher interest expenses on borrowings meant to fund its acquisition of PT Jasamarga Transjawa Tol also cut earnings.

Higher toll rates and traffic growth in the Philippines, however, led to a 16-percent increase in total revenues to P8.7 billion.

MPTC also confirmed its full takeover of Egis Investment Partners Philippines Inc. (EIPPI) after purchasing the remaining 55.4-percent stake in the latter for P5.5 billion on March 14.

EIPPI is the local unit of France-based Egis Group, which specializes in construction engineering and mobility.

This effectively increases MPIC’s stake in North Luzon Expressway Corp. to 83.6 percent.