Nvidia earnings in focus as rising US yields, debt rattle markets

NEW YORK — An earnings report from semiconductor giant and artificial intelligence bellwether Nvidia takes center stage for Wall Street in the coming week, as stocks hit a speed bump of worries over federal deficits driving up Treasury yields.

US equities pulled back this week after a torrid rally, as investors turned their attention to tax and spending legislation poised to swell the US government’s $36 trillion in debt. Long-dated US Treasury yields rose amid the fiscal worries, with the 30-year yield topping 5 percent and hitting its highest level since late 2023.

Stocks were dealt another blow on Friday when US President Donald Trump targeted the European Union and Apple in threats to ratchet up his trade war.

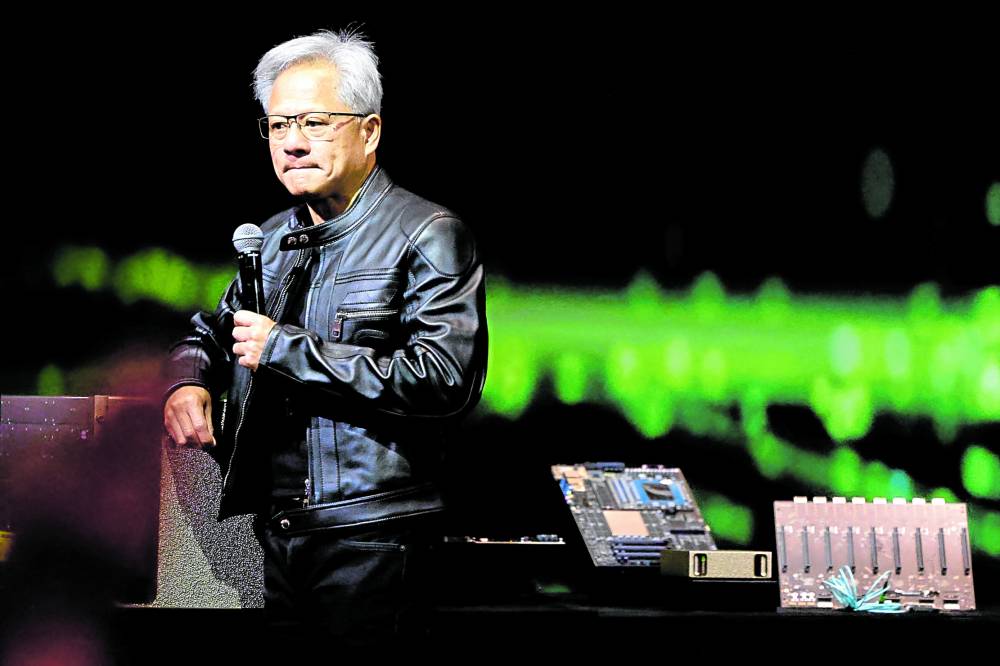

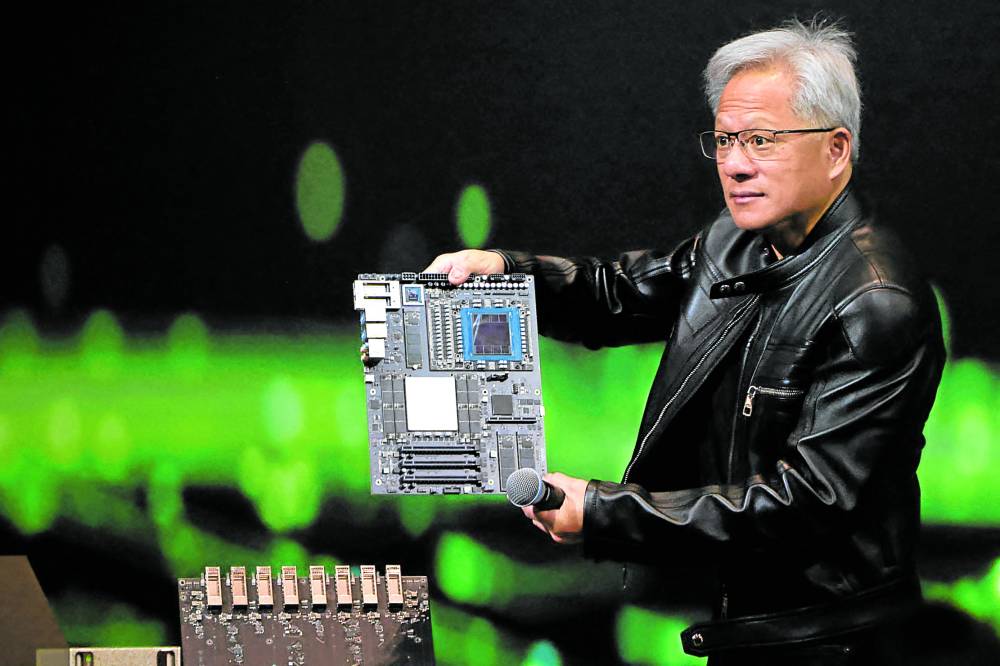

Focus will shift to Wednesday’s quarterly results from Nvidia, one of the world’s largest companies by market value whose stock is a major influence on benchmark equity indexes.

“All eyes are going to be on Nvidia’s report,” said Chuck Carlson, CEO of Horizon Investment Services. “The whole AI theme has been a major driver of the market and Nvidia is at the epicenter of that theme.”

Nvidia will be the last of the “Magnificent Seven” megacap tech and growth companies to report results for this period. Their stocks have been mixed in 2025 after leading the market higher as a group in the last two years.

Nvidia shares are down 2 percent this year after soaring over 1,000 percent from late 2022 through the end of 2024 as its AI chip business spurred massive increases in revenue and profits.

Nvidia’s first-quarter earnings likely jumped about 45 percent on revenue of $43.2 billion, analysts estimated in an LSEG poll.

After big tech companies earlier in the quarter signaled robust AI-related spending, Nvidia can deliver a strong message about AI and how companies’ spending plans are faring, said Art Hogan, chief market strategist at B Riley Wealth.

“Nvidia can reinvigorate the enthusiasm for that theme.”

Popular with retail investors

Nvidia, popular among smaller retail shareholders, is an investor sentiment indicator, said Wasif Latif, chief investment officer at Sarmaya Partners.

“Given its sheer size and attention that it is commanding, there are going to be a lot of people looking for what happens with the stock,” Latif said.

US-China relations could also be in focus with Nvidia’s report. The company said last month it would take $5.5 billion in charges after the US government limited exports of its H20 artificial intelligence chip to China.

Trade developments have whipsawed the stock market this year, especially after Trump’s April 2 announcement of sweeping tariffs on imports globally set off extreme asset price volatility.

Since then, Trump’s easing of tariffs, especially a US-China truce, has helped equities rebound. The benchmark S&P 500 index ended on Friday down 1.3 percent for 2025, and down 5.6 percent from its February record high.

Stocks slipped on Friday after Trump pushed for a 50-percent tariff on European Union goods starting June 1 and threatened to impose a 25-percent tariff on Apple for any iPhones sold, but not made, in the United States.

Trump’s fiscal plans consumed investor attention for much of the week, especially after Moody’s downgraded the US sovereign credit rating due to concerns about the nation’s growing debt pile.

The US House of Representatives, controlled by Trump’s Republican party, on Thursday narrowly passed a tax and spending bill that would enact much of his agenda while adding an estimated $3.8 trillion to the debt over the next decade. The bill is heading to the US Senate for its review.

Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers.