Purpose, passion, profit drive MSME growth in PH

Behind iron grills across the Philippines, sari-sari (variety) store owners pursue dreams that go far beyond their small storefronts.

For these micro-entrepreneurs, their modest shops represent something much larger: It’s a form of resilience that helps them weather economic uncertainty, so they can provide, first and foremost, for their families.

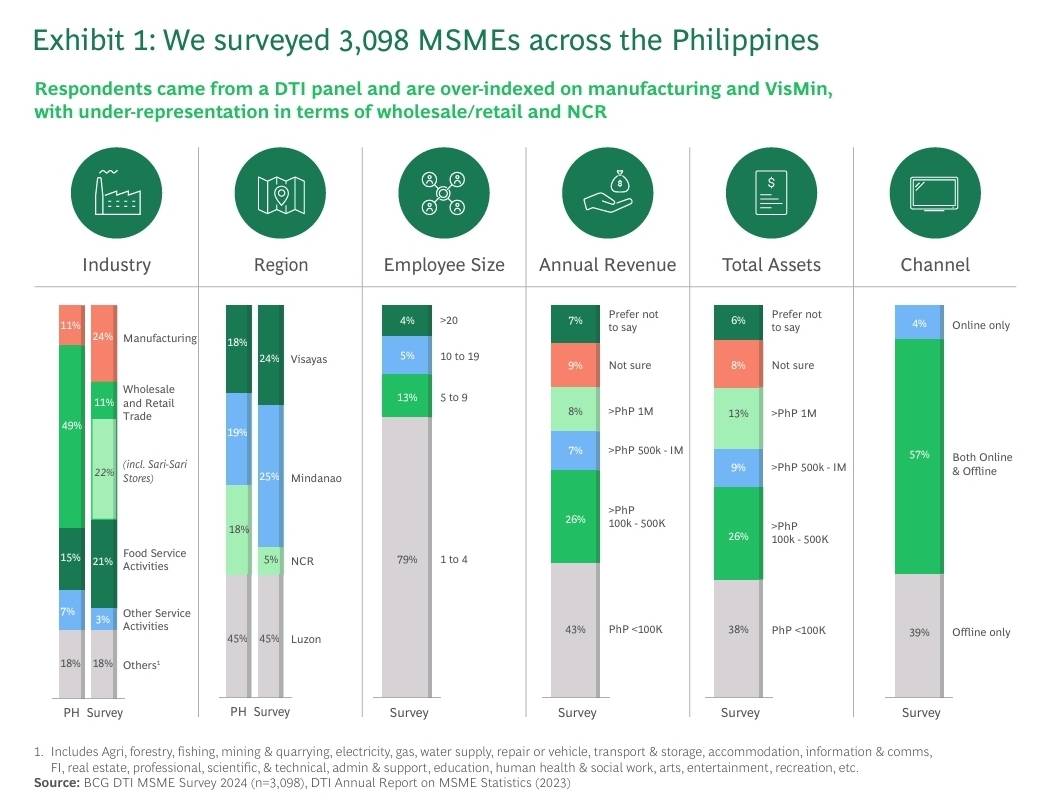

According to Boston Consulting Group’s (BCG) recent “Heart of Hustle” report, a survey of 3,098 micro, small and medium enterprises (MSMEs)—which make up 99.5 percent of all businesses in the country, including sari-sari stores, and employ over 60 percent of the workforce—paint a portrait of an economy driven by devotion to their loved ones.

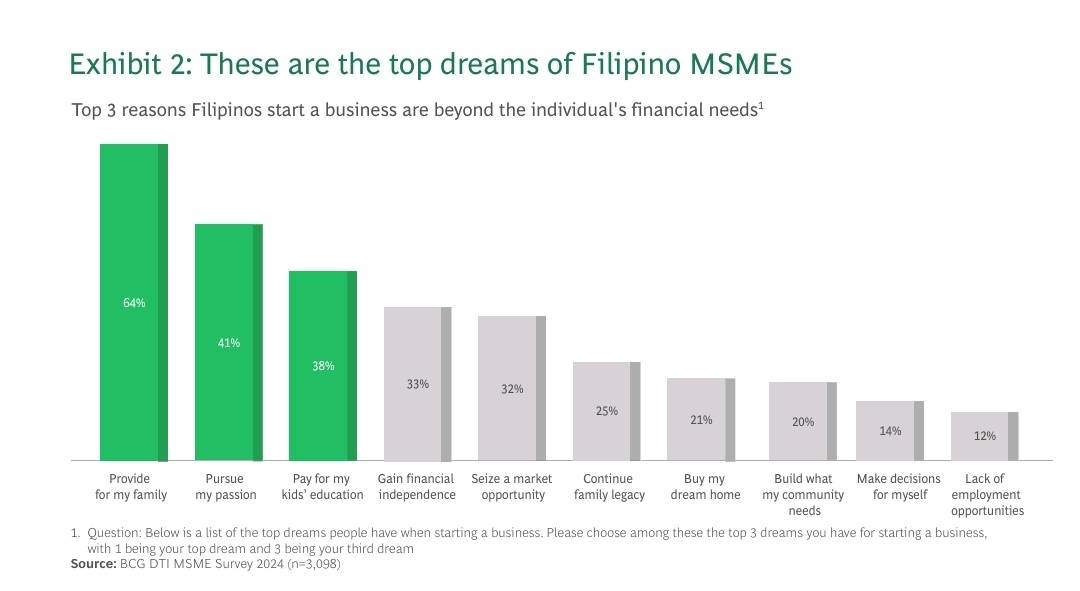

The report, written by Julian Cua, Anthony Oundjian, Jamie Bawalan, Lance Katigbak, Anjeli Panis, Christabel Dewani and Julianne Ong, show that 64 percent of business owners say they started their enterprises to achieve financial independence for their families.

The rest were primarily driven by passion for their product or service (41 percent), and the need to be able to afford their children’s education (38 percent).

However, as much as small business owners strive to support their families, they themselves lack the system to thrive in their endeavors, the report reveals, as they face complex barriers that fall five under critical areas: access to financing, markets, tools, government support and labor.

When it comes to accessing capital, more than half of MSMEs (55 percent) have never applied for a loan, with 42 percent saying they’re afraid of going into debt. Another 34 percent cite high interest rates as a deterrent.

However, among those who did receive loan approvals, 59 percent secured interest rates between just 1 to 5 percent—far lower than many expected. This points to what the report calls “a deeper issue: accessibility is not the same as availability.”

The financing challenge becomes more acute when viewed through the lens of business size. While 44 percent of MSMEs rely on personal savings as their main funding source, only 10 percent use bank loans as their primary capital source. The rest patch together funding from family, friends and increasingly, government programs.

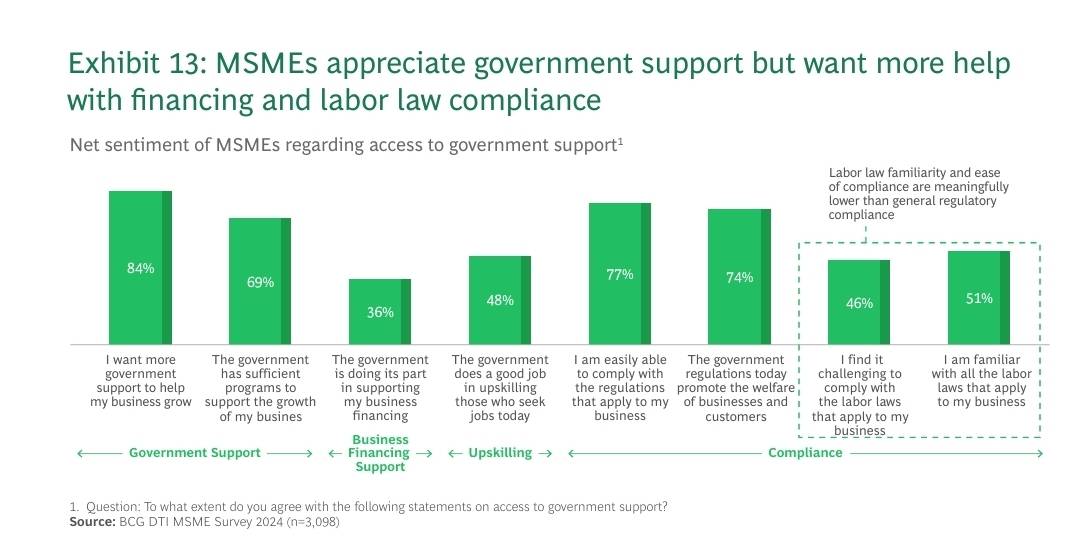

Government support receives mixed reviews from MSMEs. While 84 percent want more and 77 percent feel able to comply with current regulations, satisfaction varies significantly by program type.

The data reveals high awareness but low participation in key DTI programs. Over 70 percent of MSMEs are familiar with initiatives like Negosyo Centers and Kapatid Mentor ME, but actual participation often falls below 20 percent. The reasons range from difficulty meeting requirements to uncertainty about program applicability.

More concerning is the labor law compliance gap. While 77 percent say they can comply with general business regulations, only 14 percent are registered with the Department of Labor and Employment. Understanding of labor-specific requirements—from termination pay (19 percent awareness) to occupational safety standards (29 percent awareness)—remains limited.

In today’s digitally connected world, 77 percent of MSMEs say they want to increase their use of such tools; however, only 20 percent report actually using more business software than they did a year ago. Just 16 percent use any digital tools at all. The barrier isn’t lack of interest—it’s perception of scale. A striking 74 percent of business owners say their business isn’t big enough to justify digital tools, while 50 percent simply lack the technical expertise to implement them.

This digital hesitancy comes with real costs. The report shows double-digit gaps between current usage and future demand for basic business tools like accounting software (11 percent current usage vs 60 percent desired), website management (13 percent vs 49 percent), and point-of-sale systems (21 percent vs 73 percent).

Know your MSMEs

The study also reveals that MSMEs have four distinct archetypes, each with unique motivations and pain points:

Manufacturers stand apart as the most passionate and growth-oriented segment. They’re more likely than other business types to cite passion for their product (54 percent) and desire to build something lasting. These businesses often emerge from craft, technical skill, or family trades. They employ more people on average and are more likely to operate through multiple channels, with 77 percent selling both online and offline.

Sari-sari Store Owners represent perhaps the most financially motivated segment. Their dreams center on family welfare.

These micro-retailers face the steepest barriers. Among all MSME groups, 57 percent cite limited financing as a top challenge—the highest rate across segments. Most operate with razor-thin margins, buying from local wholesalers at retail-adjacent prices while competing against larger stores and online platforms.

Wholesale & Trade Retailers emerge as commercial pragmatists driven by market opportunity rather than necessity or passion. They’re 8 percent more likely than other MSMEs to cite “seizing market opportunities” as a primary motivation. However, they face intense competitive pressure, with 44 percent citing competition from cheaper products and 43 percent feeling squeezed by large enterprises.

Food Service Operators blend passion with financial necessity. Like manufacturers, they show strong emotional connection to their products—47 percent list passion as a key driver, the second-highest across all MSME types. Yet they operate in one of the most volatile sectors, with 51 percent citing high operating costs as a major challenge, higher than any other sector.

The report argues for a fundamental shift in how these MSMEs are perceived and supported: “MSMEs are often seen as ‘nice to have’—a sector worth celebrating, but not central to policy or national planning. That mindset has to shift.”

Their recommendations center on three core principles:

First, treat MSME support as economic infrastructure rather than social aid. With MSMEs representing 99 percent of all businesses and employing millions, investment in their growth should receive the same priority as roads, ports, or power grids.

Second, build pathways for informal entrepreneurs to gradually build credit. Rather than requiring formal prerequisites, create progressive systems that start with micro-limits and increase with demonstrated performance.

Third, recognize that MSMEs aren’t simply scaled-down versions of large enterprises. They operate in fundamentally different ways—with different time horizons, decision cycles, and resource constraints. Support systems must be designed from their reality upward, not corporate models downward.

As Secretary of Trade and Industry Ma. Cristina A. Roque writes in the report’s foreword: “MSMEs are not just economic actors, but also individuals with goals, constraints, and a deep desire to grow.”

Ultimately, the question isn’t whether Filipino MSMEs have the heart to hustle—the data shows that they clearly do. The question is whether the systems around them will rise to match their determination. Because if starting a business remains one of Filipinos’ top dreams, then supporting MSMEs should be a national imperative.