Rate hold in August a ‘possibility,’ says Remolona

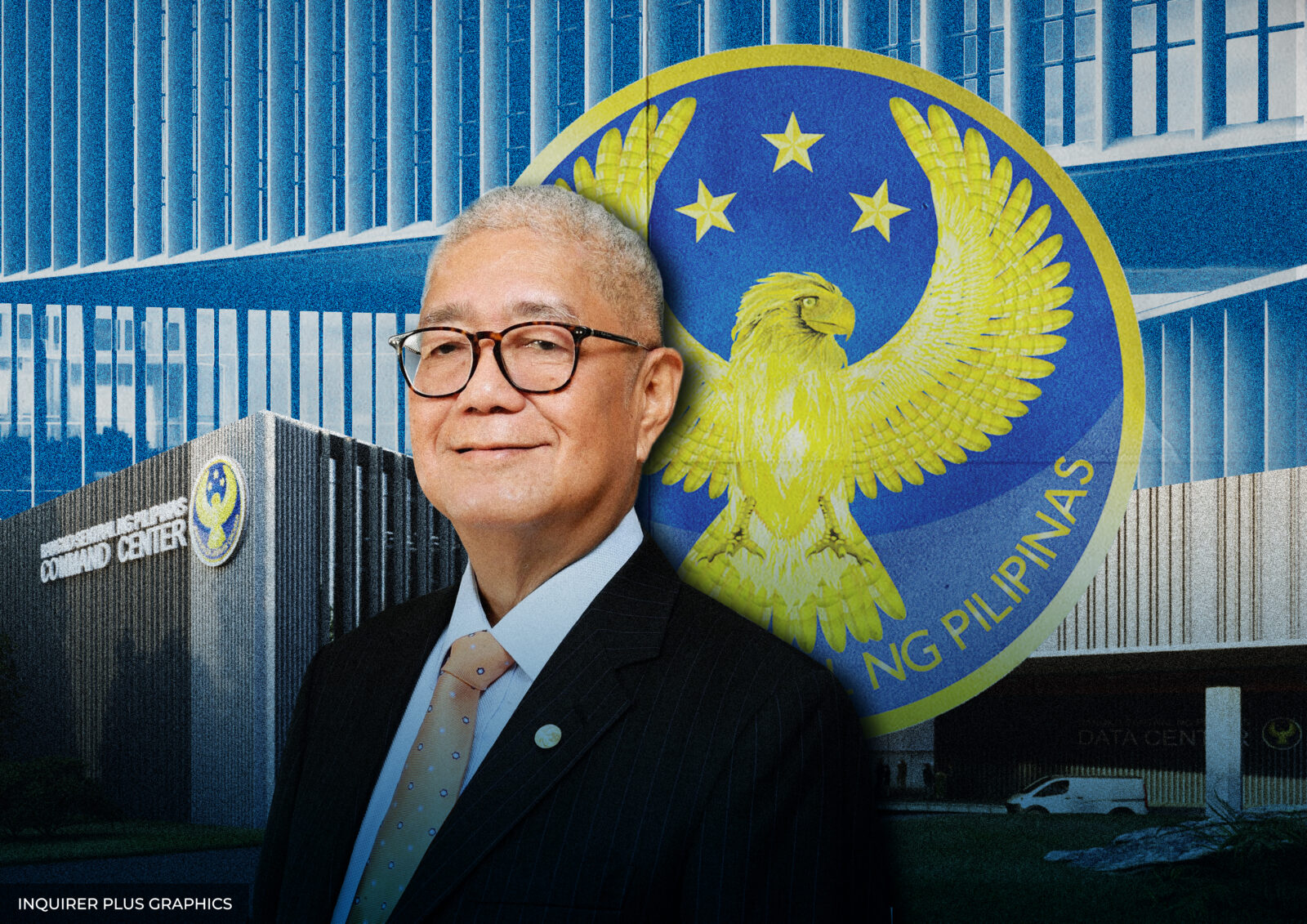

The Bangko Sentral ng Pilipinas (BSP) may pause at its next meeting in August if the upcoming data warranted a cautious easing, Governor Eli Remolona Jr. said.

But whatever the decision would be, the BSP is now less dependent on the actions of the US Federal Reserve, according to the central bank chief.

“So, we could do another rate cut in August or we could pause and do the rate cut in October instead of August. That’s one possibility,” the central bank chief said in an interview with CNBC on Friday. The Monetary Board will meet again in August, October and December to decide on the monetary policy stance.

“But we’re looking at the data every day and we’re going to decide in August what the next move should be,” he added.

Last Thursday, the powerful Monetary Board trimmed the policy rate, which banks use as a guide when pricing loans, by a quarter point to 5.25 percent. The decision was widely expected by the market, including 15 economists polled by the Inquirer.

The key rate has now been lowered by a total of 1.25 percentage points since the beginning of the easing cycle last year.

But there were some developments that would have delayed Thursday’s rate cut.

The peso is having one of its worst weeks after the Fed’s decision to hold rates powered up the dollar. Meanwhile, the BSP itself said the ongoing war in the Middle East and uncertainty over US trade policy “require closer monitoring”.

In a separate interview with OneNews TV, Remolona said the BSP has now more freedom to move away from the Fed, citing the narrowing gap between the policy rates in America and at home.

He stressed, however, the central bank was always ready to launch a forceful defense of the peso should the currency depreciation pose a serious risk to inflation.

“The dependency is much less than before. It used to be that the market expected at least a 100-basis point (bp) differential between the Fed policy rate and our policy rate,” he explained.

“That differential is now down to about 90 bps. But the market tends to look more at relative hawkishness and relative dovishness rather than just the policy rate differential. So, the dependency is much less than before,” he added.

“I wouldn’t be surprised if at some point the differential is down to 50 bps.”