Time to supercharge the green economy

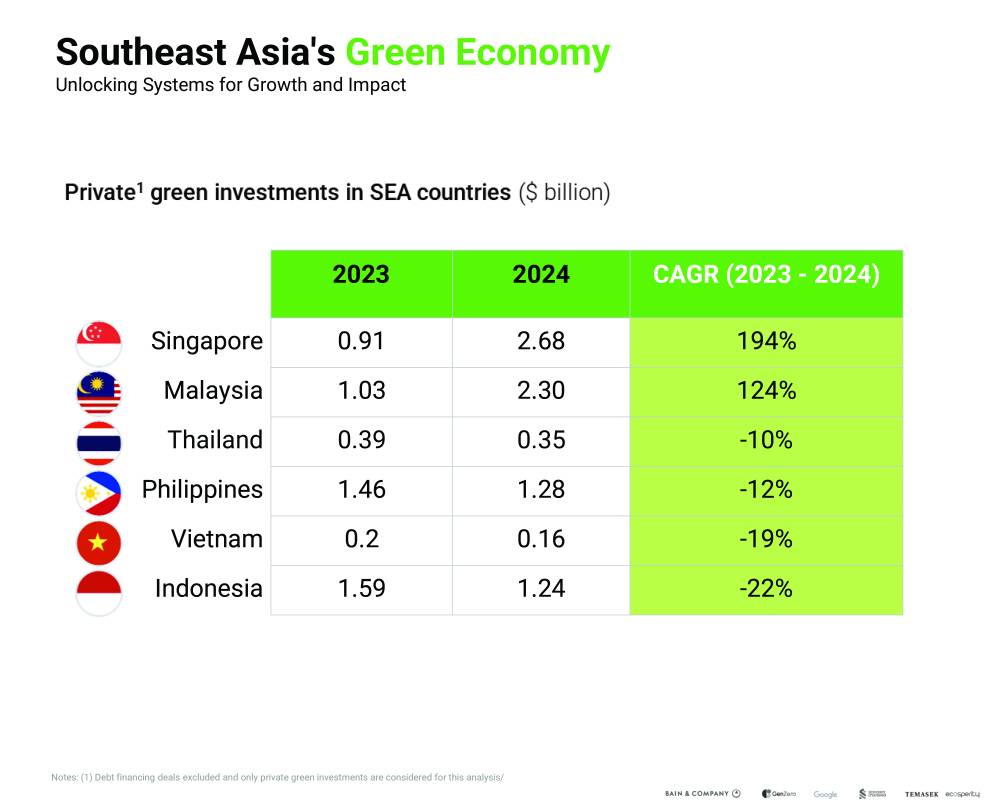

The Philippines saw a decline in the number and value of “green” investments by the private sector in 2024, putting the country further away from achieving its 2030 decarbonization goals.

According to the “Southeast Asia’s Green Economy: Unlocking Systems for Growth and Impact” report produced by Bain & Company, GenZero, Google, Standard Chartered and Temasek, the number of “green” deals dropped to 11 in 2024 from 15 in 2023, with the combined investment value likewise declining 12 percent to $1.282 billion from $1.464 billion the year prior.

The overwhelming majority of the investments last year went into solar projects, with wind deals a distant second, followed by other renewable energy projects, including hydro and geothermal energy. Reductions, however, were seen in waste management and green cement sectors.

The report underscores that solar investments grew 1.5 times in the past year while wind energy projects surged six times. On the other hand, investments in waste management dropped significantly, from $600 million in 2023 to none in 2024.

But even with the decline in total investments last year, the Philippines accounted for 16 percent of the total private “green” investments that went into the region, the third highest after Singapore with 33 percent and Malaysia with 29 percent.

Vietnam, on the other hand, cornered just 2 percent of the total “green” investments in 2024, while Thailand secured $355 million in investments, which is equivalent to 4 percent of the total, according to the sixth edition of the Southeast Asia Green Economy Report that was launched during the recent Ecosperity Week organized by Temasek.

Indonesia rounded up the list of six Southeast Asian countries in the report, attracting $1.241 billion or 15 percent of the “green” investments that went into these member countries of the Association of Southeast Asian Nations.

Risk aversion

That the Philippines recorded a decline in investments can be attributed to the high inflationary environment and the elevated interest rates that caused investors to become more risk-averse, a situation that was also seen in other countries in the region.

Indeed, only Singapore and Malaysia saw a significant increase in “green” investments in 2024, with the Philippines, Thailand, Indonesia and Vietnam all registering year-on-year declines.

Anshari Rahman, Director of Policy and Analytics at GenZero, a Temasek-founded investment platform focused on accelerating decarbonization, acknowledges that staying on course toward achieving net-zero climate goals has become “increasingly difficult amid immediate challenges like inflation and energy security.”

But at the same time, Rahman warns that “losing sight of the climate crisis risks far greater long-term consequences.”

Fortunately, while there has been a general decline in government investments, the private sector has been picking up some of the slack, although still far short of ideal.

The report indicates that on the whole, corporations in the region showed an increase in setting targets and developing road maps toward achieving climate goals, mainly to achieve net zero—to capture as much carbon as what is emitted—by 2030.

“Green investments still lag,” the report points out.

Altogether, investments rose by 33 percent to $8 billion in 2024 from $6 billion the year before, but this was not enough as “all SEA (Southeast Asian) countries continue to have a significant gap between required vs. actual investment.”

For the Philippines, the report indicates year-on-year improvements in its infrastructure and technology metrics, from “unlikely on track to deliver target” in 2023 to “likely on track to deliver target” in 2024.

This is mainly due to better power grid interconnectedness and the availability of more charging stations for electric vehicles.

Dale Hardcastle, partner for Asia-Pacific at consulting firm Bain & Company and one of the authors of the report, underscores the urgent need in the region for “bold, coordinated action” to meet its 2030 climate goals to avert the worst impacts of the climate crisis.

“Southeast Asia (SEA) stands at a pivotal juncture in its green transition. Over the past decade, the region has demonstrated growing ambition, heightened awareness, and early decisive steps toward sustainable development. Yet, progress has been uneven,” he says.

“And with only five years remaining to meet the critical 2030 climate targets, [Southeast Asia] is not yet on track to fulfill its climate pledges. The opportunity to alter this trajectory is narrowing rapidly,” Hardcastle adds.

Call to ramp up

Thus, Hadcastle and Franziska Zimmermann, managing director for sustainability at Temasek, stress that the time has come to “accelerate” green transition in Southeast Asia, which is estimated to be the world’s fourth-largest energy consumer, with demand increasing by 3 percent of the year alongside economic and population growth.

“We are at a critical juncture in our global fight against climate change. With just five years until 2030, the window to avert the worst impacts of the climate crisis is closing rapidly,” she says.

“The past two years have been the hottest on record, with global temperatures breaching 1.5 Celsius above pre-industrial levels for the first time. At the same time, the global sustainability movement is facing its strongest headwinds—political pushback, protectionist policies, growing anti-ESG sentiment, and corporations reassessing climate goals,” Zimmermann adds.

Thus the call is to maintain the momentum, especially in Southeast Asia, which can be the center of “green” growth that can meet the emissions goal while creating economic growth and jobs.

“The path forward is not easy, but the potential rewards are immense,” Zimmermann stresses.