Without a strong DOF, there is no strong Republic of the Philippines

Before the birth of the Republic, there was already a Department of Finance (DOF).

Established in 1897, the DOF’s first duty was nothing short of revolutionary: to finance the fight for freedom under General Emilio Aguinaldo’s leadership. From Day One, it was charged with the same mission it holds today—to fund the Filipino nation’s dreams and aspirations.

Now in its 128th year, the DOF remains the quiet force behind every functioning part of government. It operates behind the scenes, but its impact is front and center—from raising revenues, to managing the nation’s debt, to shielding the economy from shocks. In the trenches of fiscal consolidation and on the frontlines of global crises, it is the agency that keeps the Philippines alive.

Last April, in true DOF fashion—no fuss, no fanfare—the agency marked its anniversary with a simple reminder from Secretary Ralph G. Recto:

“Here we are tasked with the unglamorous, thankless, but absolutely essential job of keeping this country standing on a solid fiscal ground. For the truth is, without a strong DOF, there is no strong Republic of the Philippines.”

“We are in the business of funding the dreams and demands of this entire country. Ours is the quiet but crucial work of making sure the promises of this nation do not bounce like a bad check. Na kapag nangako ang gobyerno, hindi drawing lang,” he added.

Fueling the Nation’s Future Against all Odds

At a glance, the DOF’s work seems simple: collect revenues, fund public services, pay obligations. But behind the balance sheets is a daunting truth—this agency must power the Republic while walking a tightrope of global crises.

After the pandemic that gave the Philippine economy the hardest economic blow since post-World War II, and to current geopolitical tensions that disrupt the world, the DOF must continue keeping the country afloat today, without mortgaging our future.

Thus, under the leadership of President Ferdinand R. Marcos Jr., Secretary Recto and the Development Budget Coordination Committee (DBCC) recalibrated the Medium-Term Fiscal Program to ensure that policy is rooted in economic realities and built for impact.

The refined framework lays out a more realistic path towards reducing deficit and debt gradually while supporting job creation, higher incomes, and poverty reduction. At its core, it aims to build an economy that delivers genuine improvements in the lives of ordinary Filipinos.

“When I took this job, the President gave an uncompromising directive: spur economic growth that is felt by every ordinary Filipino. And since then, every policy we crafted, every move we made was anchored on that mission,” Secretary Recto said.

DOF Delivers Highest Revenue Effort in 27 Years, On Track to Achieve Fiscal Consolidation

The DOF is proving that bold reforms and relentless modernization can move mountains, even amid global economic headwinds.

By digitalizing systems, streamlining bureaucracy, and making every peso work harder for Filipinos, the DOF collected P4.4 trillion in total revenues in 2024, exceeding its P4.3 trillion target. This pushed the revenue effort to 16.72 percent of

GDP—the highest in 27 years. And it did so without imposing new taxes.

“We have reshaped governance and dared it to be better. And for more than a century, the people in the DOF have mastered the art of saying no to short-term solutions that become long-term problems, of making the hard decisions today so we won’t burden the children of tomorrow,” the Finance Secretary said.

“Para mapondohan ang batang nangangarap ng scholarship, masuportahan ang barangay na nangangailangan ng malinis na tubig, at matiyak na ang pampublikong ospital ay nananatiling bukas,” he added.

At the same time, non-tax revenues soared to a historic high of PHP 618.30 billion—a 56.61% increase from 2023. This was made possible by raising GOCC dividend remittances from 50% to 75%, accelerating the privatization of idle government assets, and sweeping excess and unused funds of GOCCs as mandated by Congress.

Modern Revenue Reforms for a Modern Economy

Several DOF priority bills that had languished in past Congresses were finally passed into law in 2024, generating much-needed revenues to fund public services and uplift the lives of every Filipino.

Foremost among these is the Value-Added Tax (VAT) on Digital Services, a long-overdue measure that levels the playing field between local and foreign digital service providers. For years, only local businesses complied with VAT rules, while global tech giants operated tax-free in the same market. This reform closes that gap by ensuring local businesses are protected through equal tax treatment for all.

But to support the Marcos, Jr. administration’s commitment to accessible education, all digital educational services—including courses, webinars, and e-learning platforms—remain VAT-exempt.

By expanding the VAT base to the rapidly growing digital economy, this law helps generate additional revenues that will be channeled into infrastructure, education, healthcare, and other social programs that directly benefit the Filipino people and promote economic growth.

For the next five years from the law’s effectivity, 5% of the collected revenues will be used exclusively for the local creative industries’ development to foster innovation and empower the next generation of Filipino creators and entrepreneurs.

Meanwhile, doing business with the BIR and paying taxes has never been easier with the Ease of Paying Taxes Act. This has streamlined tax filing, especially for micro and small businesses, and made tax compliance more convenient through the “file-and-pay-anywhere” system and online processes.

Moreover, because of the enactment of the Real Property Valuation and Assessment Reform Act, every local government unit is now empowered to uplift its communities from poverty. By institutionalizing a single, reliable, and transparent valuation system aligned with international standards, the law builds investor confidence and ensures that LGUs can raise revenues fairly to fund local development.

Meanwhile, the VAT Refund Mechanism for Non-Resident Tourists Act creates a modern, efficient, and transparent refund system to boost tourism and spur consumer spending. This aligns the country with international best practices and enhances the Philippines’ competitiveness as a travel destination.

Taken together, these game-changing reforms ensure that revenues work harder and go further for the Filipino people.

Deficit and Debt Remain at Manageable and Sustainable Levels

In the best of all worlds, governments spend exactly as they earn from public revenues. That never happens, of course. Sometimes expenditures happen before collection, as in any business. At other times, governments need to spend on a deficit to invest in future growth. That’s why the DOF does more than raise revenues—it also safeguards the country’s fiscal health by managing borrowings with discipline and foresight.

Thanks to prudent fiscal management, the country’s deficit and debt levels remain within manageable and sustainable bounds. The national government’s deficit has been steadily narrowing, dropping to 5.7% of GDP in 2024—a significant improvement from the pandemic peak of 8.6% in 2021.

Although the Marcos, Jr. administration inherited a large pandemic-induced debt stock of PHP 12.79 trillion in 2022, it has made meaningful progress in improving the country’s debt metrics. In 2024, the national government debt-to-GDP ratio fell to 60.7%, below the international threshold of 70%.

With the economy continuing to grow faster than its obligations, the country remains firmly on track to achieve fiscal consolidation and reduce the debt-to-GDP ratio to below 60% by 2028.

The country’s recent credit rating and outlook upgrades are a testament to international confidence in the Philippines’ fiscal fundamentals. These endorsements boost demand for Philippine bonds, keeping borrowing costs lower, which is critical for maintaining momentum in infrastructure, education, and other development projects.

Concessional, Strategic, and Transparent Financing for the Build Better More Program

The DOF leads the way in securing concessional financing to roll out the Marcos, Jr. administration’s Build Better More program. As the government’s chief negotiator with multilateral institutions and bilateral partners, it ensures that development assistance supports not only infrastructure but also long-term national priorities.

In 2024, the DOF signed 12 financing agreements worth USD 5.67 billion (PHP 333.42 billion) to fund flagship projects in infrastructure, transport, defense, health, digital innovation, and agriculture. These include the third tranche of support for the Metro Manila Subway, the country’s first-ever underground railway system.

Beyond loans, the DOF also secured USD 73.73 million (PHP 4.34 billion) in grants from development and bilateral partners for 13 high-impact projects in climate resilience, peace and development, water security, and AI-powered agricultural systems, among others. Grants are aids given by development partners with no obligation for repayment.

But the DOF’s work doesn’t stop at signing financing deals. Equally critical is ensuring that every money borrowed—or granted—is spent strategically, efficiently, and transparently. As our credibility with international partners hinges on this stewardship. They will only continue supporting us if they know their contributions yield real impact for the Filipino people.

Secretary Recto’s inspection of the Metro Manila Subway and LRT 1 Cavite Extension construction sites shows that for the Marcos, Jr. administration, funding must be matched with follow-through.

This commitment to openness and transparency has earned the Philippines the No. 1 ranking out of 50 countries in the Institute of International Finance’s global debt transparency index in 2024, achieving a near-perfect score. This recognition underscores the DOF’s dedication to responsible borrowing, good governance, and ensuring that development financing truly serves the public interest.

Removing Roadblocks to Achieve Inclusive and Investment-led Growth

It is the job of the DOF to ensure that the economy is growing sustainably and inclusively. And to increase the potential of the economy to grow, it must carefully review structures that block growth.

Through the Inter-Agency Committee on Inflation and Market Outlook (IAC-IMO), the DOF works hand-in-hand with the economic team and the Bangko Sentral ng Pilipinas (BSP) to align fiscal and monetary policies that tame inflation and sustain growth.

With the President’s decisive leadership, whole-of-government approach, and concerted efforts of stakeholders, inflation finally settled within the target after two years in 2024 at 3.2%. This favorable inflation outlook allowed the Philippines to become the first ASEAN country to ease monetary policy in 2024 to fuel investments and growth momentum.

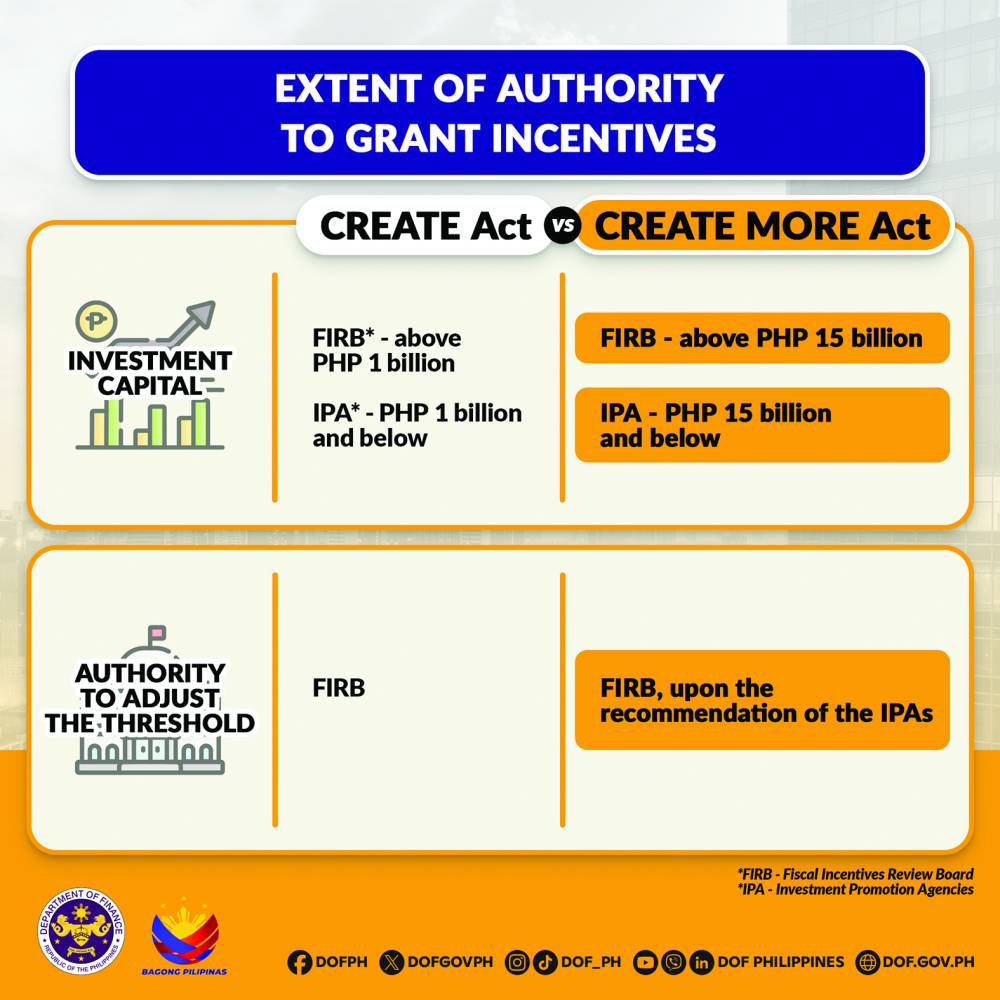

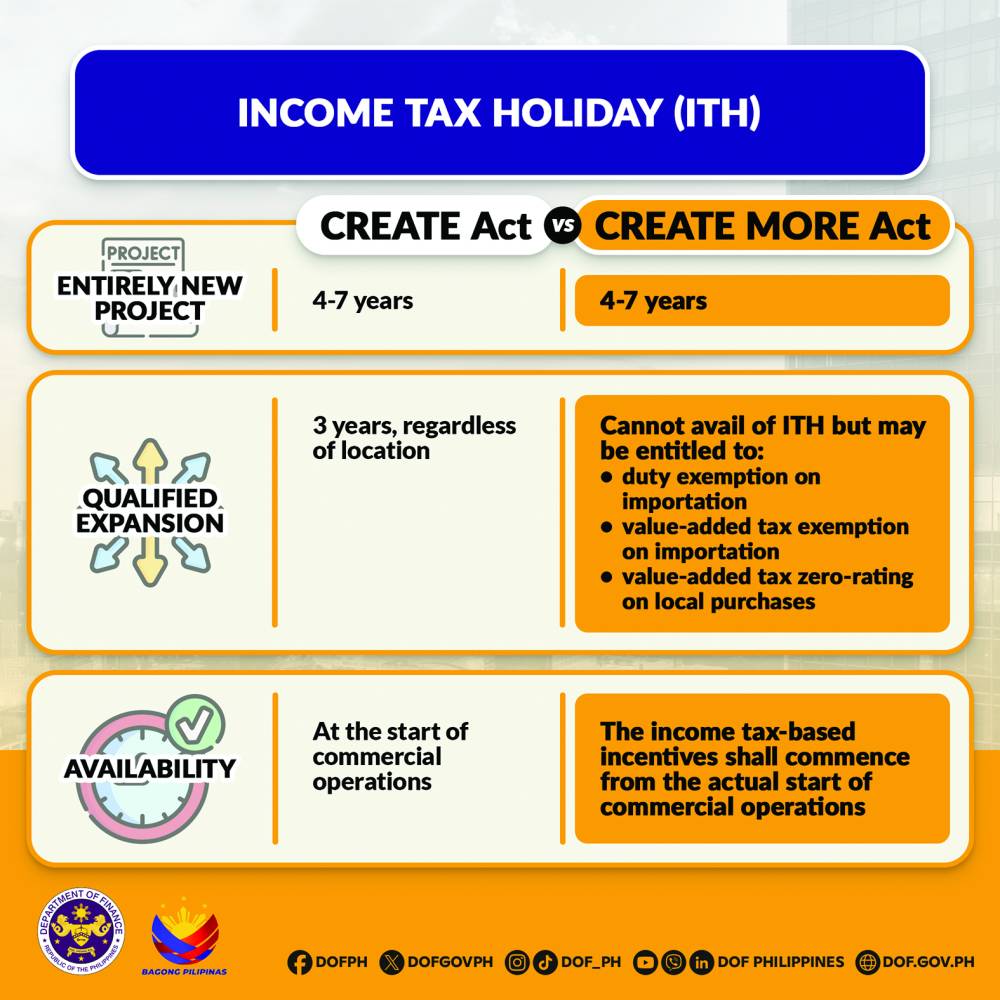

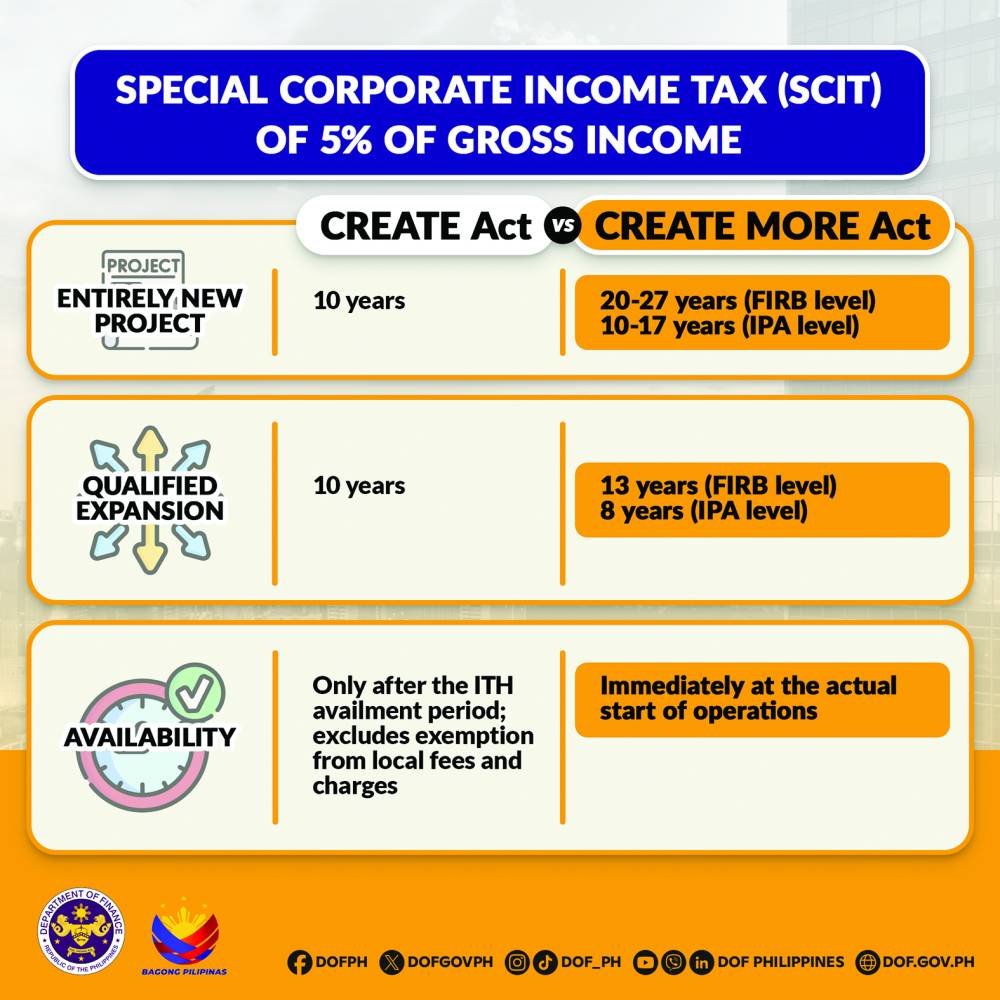

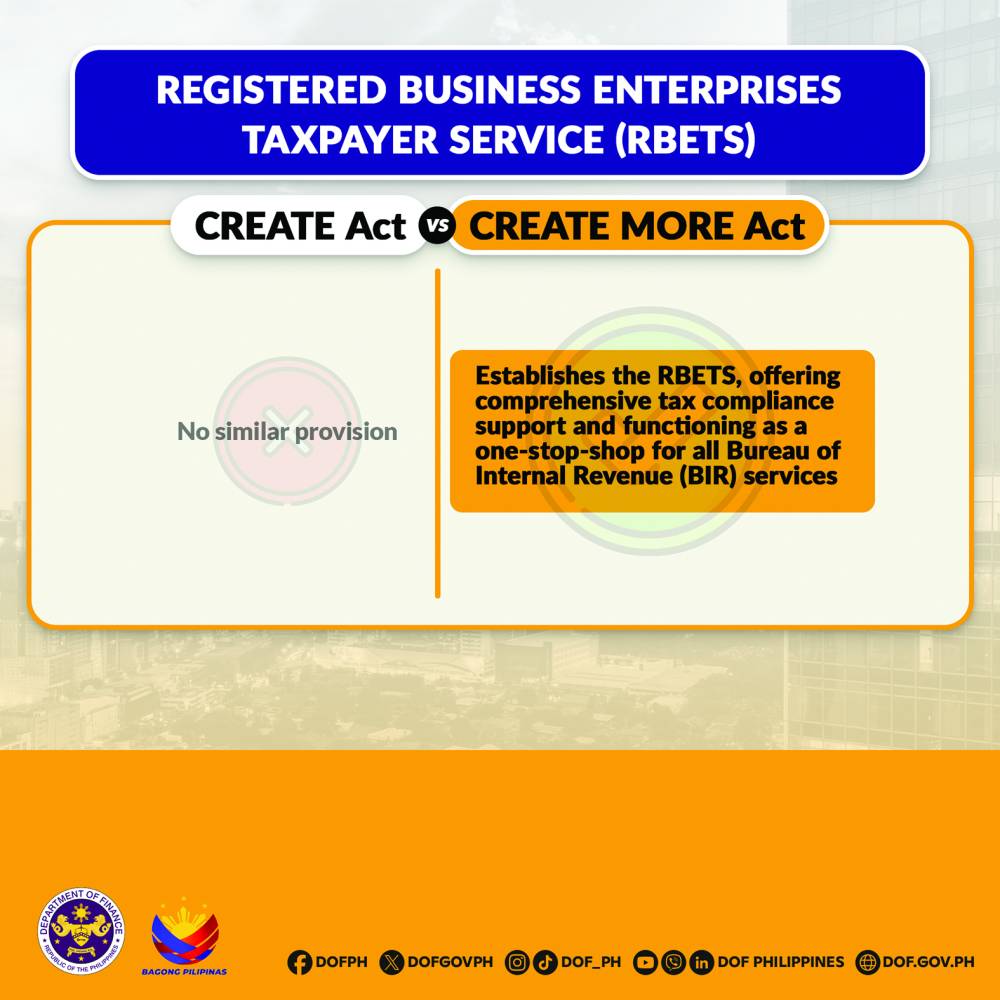

And in transforming economic momentum into real gains for every Filipino family, the Marcos, Jr. administration rolled out bold reforms to make the Philippines a magnet for private capital. Two landmark investment bills—the CREATE MORE Act and the Public-Private Partnership (PPP) Code—were signed into law in 2024.

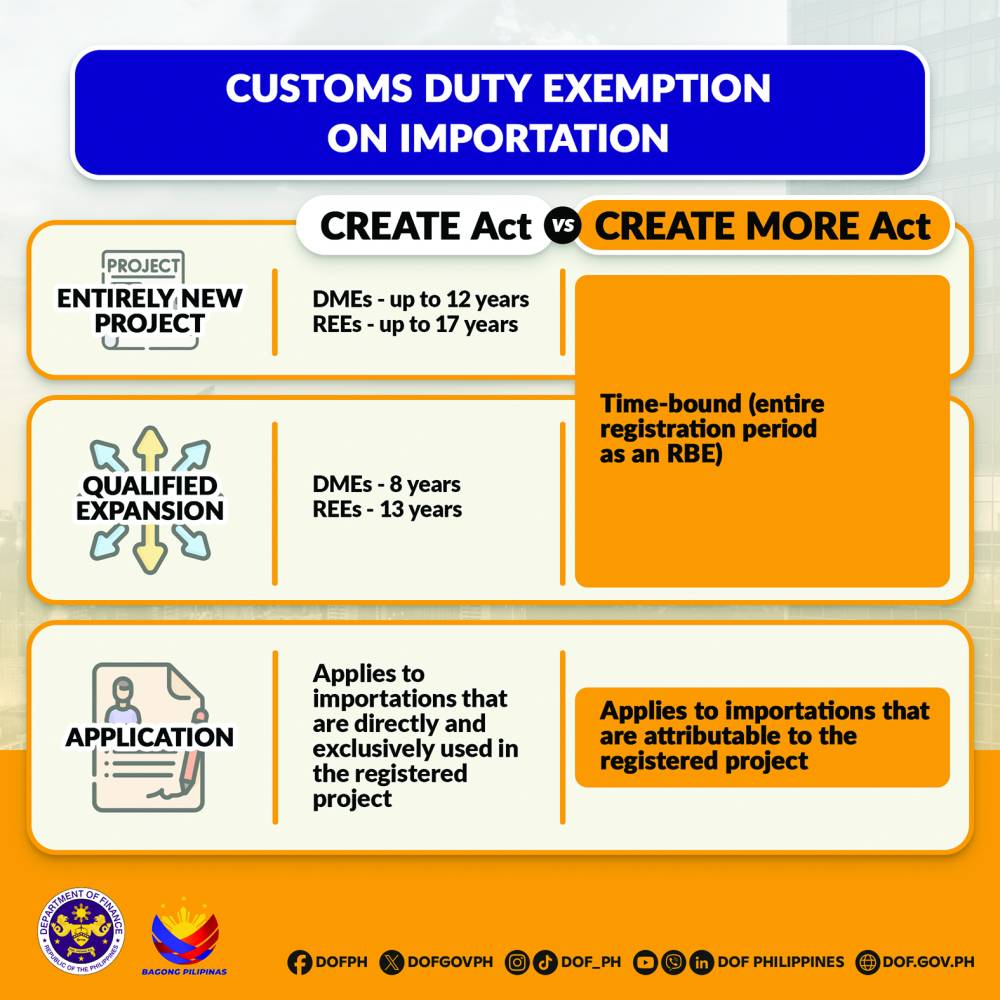

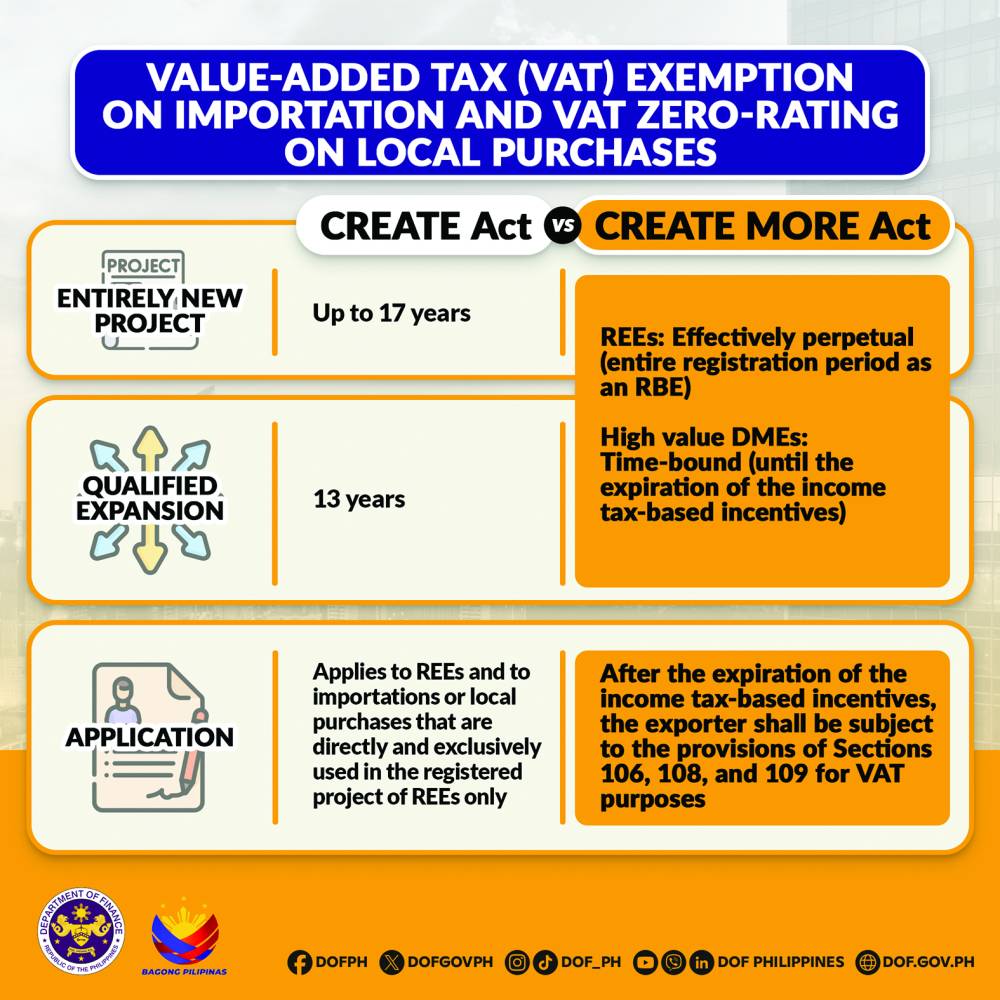

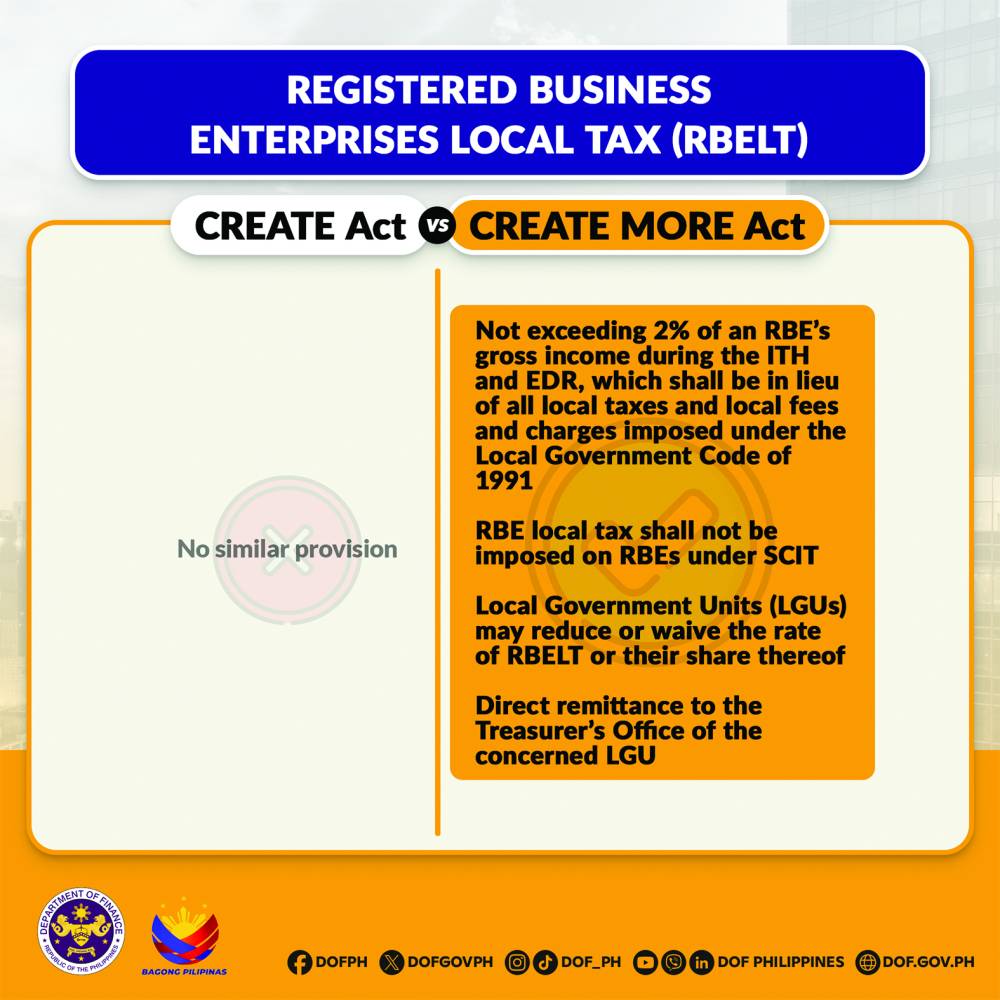

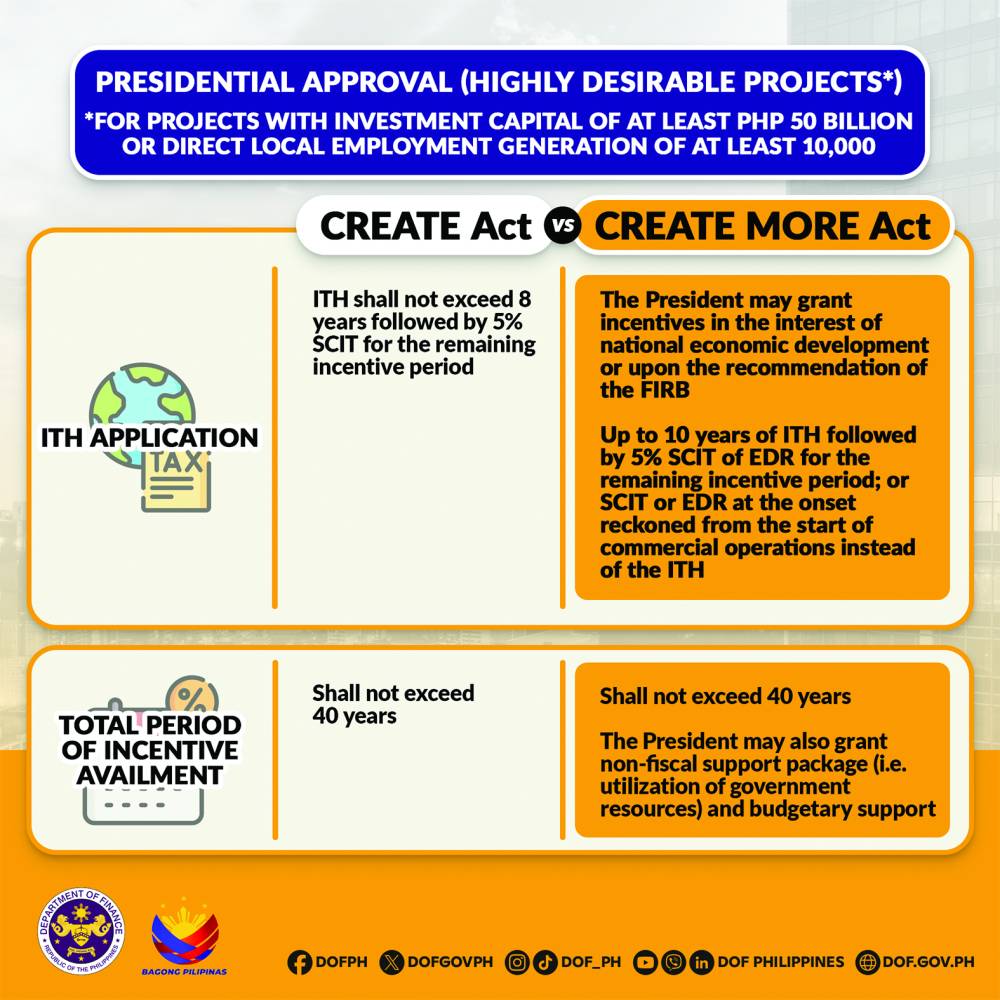

The CREATE MORE Act transforms the Philippines into an attractive destination for business by making the tax incentives regime more globally competitive, investment-friendly, predictable, and accountable. On the other hand, the PPP Code streamlines private-sector participation in infrastructure development, which has the highest multiplier effect for the economy.

Through the PPP Code, three airports were already awarded to the private sector: NAIA, Laguindingan International Airport, and Bohol Panglao International Airport. NAIA, in particular, was the fastest-approved PPP proposal in Philippine history. These projects are expected to boost tourism, connectivity, and commerce, dispersing the fruits of growth and modernization to every island in our archipelago.

These initiatives were one of the key reforms championed by the economic team during the Philippine economic briefings (PEBs) and investor roundtables in the United States, Japan, and the United Kingdom in 2024—earning the endorsement of nearly a thousand foreign investors.

2024: A Year of Triumph—But the Work Is Far From Over

Through bold reforms and growth-enhancing initiatives, the Marcos, Jr. administration has made 2024 a banner year for the Philippine economy.

Despite global headwinds, the Philippines once again emerged as one of the fastest-growing economies in Asia, clocking in at an average growth of 6% since the President took office. In nominal terms, the economy has doubled in size since 2013.

Economic growth was matched by historic gains in employment. The unemployment rate averaged 3.8% in 2024—the lowest level on record. It not only beat the government’s target, but also surpassed the 2028 target of 4.0% to 5.0%. A total of 48.8 million Filipinos were employed in 2024, the highest full-year level on record.

Behind these headline figures is a clear, be-all and end-all goal: to reduce poverty incidence to single digits—9%—by the end of President Marcos, Jr.’s term in 2028.

And we are thus far on track. As of 2023, the poverty rate fell to 15.5%, surpassing pre-pandemic levels and government targets. This translates to 2.5 million Filipinos lifted out of poverty. The administration is focused on lifting 8 million more Filipinos out of poverty by the end of the President’s term.

Ultimately, 2024 marked a significant triumph in the nation’s long development journey, a victory the DOF has helped shape from Day One. Yet, as the nation celebrates these gains, the DOF remains fully aware of the work and challenges that still lie ahead. The mission is far from over.

“Hindi po kami magiging kampante. Patuloy po ang aksyon ng gobyerno. Gaya po ng pahayag ni Pangulong Bongbong Marcos, hindi kami titigil na siguraduhin na nararamdaman ng bawat pamilyang Pilipino ang pag-unlad ng ekonomiya. Gagawin po natin ang lahat para tuloy-tuloy na mabigyan ng komportable at mas magandang kinabukasan ang bawat mamamayang Pilipino,” said Secretary Recto.

The Finance Chief underscored that there is no room for complacency at the DOF—because if it fails, the nation falters. And that’s why it bears repeating: without a strong DOF, there is no strong Republic of the Philippines.

2024 was a turning point. What the DOF will do next will define whether this momentum becomes a fleeting high—or a foundation for lasting progress for generations to come.