AI seen boosting PH bank lending

Loan growth in the Philippines could further rise in the coming years, with the broader adoption of artificial intelligence (AI) expected to help lenders tackle bottlenecks in the lending process and manage credit risks, according to global financial technology firm Intellect Design Arena.

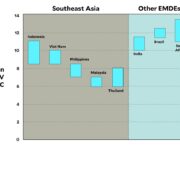

Brajesh Khandelwal, an executive vice president at Intellect, said annual credit growth in the Philippines could accelerate to between 15 and 18 percent as early as next year—up from the current pace of about 12 percent—if banks move quickly to integrate AI-enabled tools into their lending operations and broader workflows.

He noted that AI can streamline know-your-customer procedures by reviewing loan applications and supporting documents, flagging errors and anomalies and helping loan officers more clearly distinguish reliable borrowers from risky ones.

Such improvements, he said, could help lenders temper the risk of defaults, especially in borrower segments with strong growth potential but are underserved due to a high perception of credit risks.

“The market, as a whole, might take some time [to adopt AI],” Khandelwal told reporters on Thursday. “But the banks who adopt the AI-based lending practices would be able to command the growth.”

Latest data showed outstanding loans from big lenders, excluding their short-term placements with the central bank, rose by 10.5 percent from a year ago to P13.7 trillion in September. Business loans, which make up the bulk of the banking sector’s portfolio, grew 9.1 percent to P11.6 trillion.

Meanwhile, retail loans surged by 23.5 percent to P1.82 trillion, accounting for 13 percent of the total, with credit card receivables rising by nearly 30 percent to P1.09 trillion.

At present, analysts believe that banks are facing twin pressures: protecting margins in a low-rate environment while managing credit risks as they increase their exposure to higher-yielding—but largely untested—consumer segment.