Preparing Philippine businesses for sustainability compliance

Sustainability is no longer just a buzzword in the business community—a catchphrase to show they are abreast of the times and in sync with emerging trends.

As the world increasingly realizes that climate change and the upheaval it will create are happening at a much faster pace than before, consumers and investors alike are demanding that companies they do business with are mindful of their environmental footprints and taking steps to slow the destruction of the planet.

The Philippines has made important strides but, according to Benjamin Soh, founder and managing director of ESGpedia, “it remains behind Asean (Association of Southeast Asian Nations) neighbors such as Singapore and Malaysia, where more stringent environmental, social and governance (ESG) requirements are already in place”. But that situation is going to change significantly soon.

The Securities and Exchange Commission (SEC) has announced that it “is transitioning to mandatory sustainability reporting for publicly listed companies by 2026 … This transition aims to enhance transparency, accountability, and align with global trends, particularly regarding environmental, social, and governance reporting.”

Soh says SEC’s move aims to align local practices with international standards, including the International Financial Reporting Standards.

He expects this to strengthen the Philippines’ position as a major business destination in the region and beyond.

Strategic step

For Philippine companies, adhering to the SEC’s new requirement is not just about compliance but a strategic step to meet investor expectations and stay competitive in a region that values sustainability, Soh points out.

The most crucial stakeholders, he stresses, need to be aware of a company’s sustainability efforts. They include investors, consumers, regulatory bodies and employees.

“Investors are increasingly incorporating ESG criteria into their decision-making, and consumers are more likely to choose brands that align with their values. Regulatory bodies are tightening sustainability disclosure requirements, so it is becoming increasingly necessary for companies to stay on top of compliance.”

At the same time, “Employees, especially in today’s competitive job market, are looking for companies that are not only successful but also socially responsible,” Soh stresses.

He adds that transparency across all levels ensures that each of these groups can see a company’s commitment to sustainability to boost credibility and engagement and is prioritizing environmental and social responsibility.

Transparency

Soh also points out, “Transparent sustainability practices can unlock access to sustainable financing options such as green bonds and sustainability-linked loans.”

Transparency in reporting can also improve internal processes, enhance operational efficiency and reduce costs, particularly in areas like resource use and emissions, Soh says.

For Soh, sustainability is not just for big businesses. Micro, small and medium enterprises (MSMEs), which account for a huge chunk of Philippine enterprises, should also focus on reducing greenhouse gas emissions, improving resource efficiency and strengthening ESG data reporting.

Soh does not think sustainability can hamper MSMEs growth. “While implementing sustainability measures may seem like an added cost initially, the long-term benefits far outweigh the investment.”

He explains, “Sustainable practices help companies improve efficiency, lower resource usage and reduce operating costs, while also enhancing brand reputation and meeting regulatory demands.

“Sustainability does not come at the expense of business growth. On the contrary, it often unlocks new opportunities, heightens business competitiveness in securing tenders and deals, and strengthens resilience. SMEs can grow sustainably without compromising profitability or their competitive edge.”

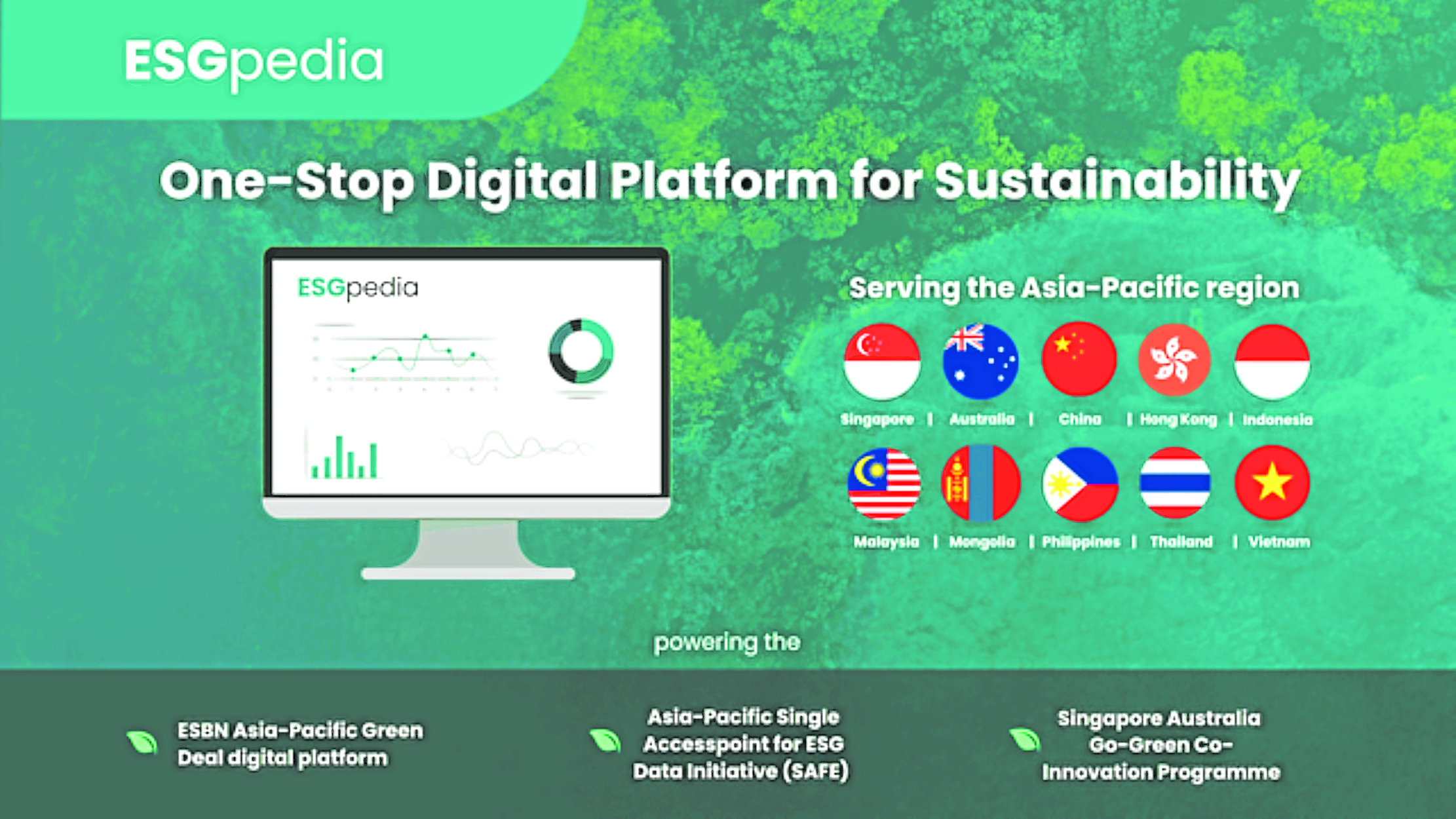

ESGpedia

ESGpedia offers to help Filipino businesses, including MSMEs, meet the SEC’s new mandate and lower barriers to sustainability and bridge the resource and expertise gap.

Its services are designed to be affordable and scalable for businesses of all sizes, Soh says.

He adds, “ESGpedia supports small businesses across their sustainability journey. We understand many of them are at the early stages of ESG readiness.”

Our platform helps small businesses gather key data, calculate GHG (greenhouse gas) emissions, streamline reporting and align with global standards.”

ESGpedia offers guidance and dedicated plans for MSMEs to make ESG adoption affordable and practical for them, Soh says.

Soh reports that transparency among Filipino businesses is growing. SEC estimates that 95 percent of listed companies are already disclosing ESG initiatives, although much of it is still under a flexible “comply or explain” framework.

With ESG reporting becoming mandatory in 2026, the Philippines’ sustainability report card is expected to improve significantly.